Finding affordable car insurance is tough for high-risk drivers. But it’s not impossible.

High-risk drivers often face hefty premiums due to past accidents, speeding tickets, or DUI convictions. This makes securing affordable coverage a daunting task. Yet, there are options tailored specifically for such drivers, providing competitive rates and potential savings. This blog will guide you to the cheapest insurance options for high-risk drivers.

We’ll explore various insurance providers, compare rates, and offer tips for reducing your premiums. By the end, you’ll have the knowledge to find cheapest Insurance for high risk drivers for your needs. Keep reading to discover how you can save money without compromising on coverage.

Credit: www.valuepenguin.com

Table of Contents

ToggleIntroduction To High Risk Driver Insurance

High risk driver insurance offers affordable coverage for those with a challenging driving history. These drivers often face higher premiums due to past infractions. This type of insurance is essential for maintaining legal driving status.

Understanding High Risk Driver Classification

Insurance companies classify drivers as high risk based on several factors. Common reasons include:

- At-fault accidents: Drivers involved in accidents where they were deemed responsible.

- Speeding tickets: Multiple tickets indicate a pattern of risky behavior.

- DUI convictions: Driving under the influence is a serious offense.

- Young drivers: Typically those under 25 due to inexperience.

- Lapses in coverage: Periods without insurance coverage signal unreliability.

Why High Risk Drivers Face Higher Premiums

High risk drivers face higher premiums due to the increased likelihood of claims. Insurance companies consider them more likely to be involved in accidents. To offset this risk, they charge higher rates.

Here’s a comparison of average annual rates for high-risk drivers:

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Plymouth Rock | $411 | $1,353 |

| Auto-Owners | $420 | $1,639 |

| USAA | $434 | $1,695 |

| Geico | $459 | $1,741 |

| Erie | $557 | $1,693 |

Choosing the right provider can help mitigate costs. Customized quotes based on individual driving history offer the best options.

To learn more, visit the Bankrate article.

Credit: www.youtube.com

Key Features Of Insurance Policies For High Risk Drivers

High-risk drivers often struggle with finding affordable insurance. Fortunately, some policies cater to their needs. These policies offer specific features that help manage higher premiums and provide comprehensive coverage.

Coverage Options Tailored For High Risk Drivers

Insurance providers offer customized coverage options for high-risk drivers. These options ensure that even with a checkered driving history, you receive adequate protection.

- Coverage from top-rated insurance companies

- Customized quotes based on individual driving history

- Rates comparison for various high-risk scenarios

These tailored options help you find the best fit for your specific situation, whether it involves at-fault accidents, speeding tickets, or DUI convictions.

Discounts And Incentives To Lower Premiums

High-risk drivers can still find ways to save on insurance premiums. Many companies offer discounts and incentives to help lower costs.

- Take defensive driving courses

- Maintain safe speeds

- Consider accident forgiveness add-ons

Insurance providers such as Plymouth Rock and Erie may also offer incentives for maintaining a clean driving record.

Telematics And Usage-based Insurance Plans

Telematics and usage-based insurance plans are becoming popular among high-risk drivers. These plans use technology to monitor driving habits.

- Track driving patterns and behaviors

- Adjust premiums based on actual usage

- Encourage safer driving habits

This technology can lead to significant savings, especially for those who drive less or follow safe driving practices.

Accident Forgiveness And Safe Driving Programs

Accident forgiveness and safe driving programs are crucial for high-risk drivers. These programs can help prevent your premium from increasing after an accident.

- Accident forgiveness add-ons

- Safe driving rewards

- Potential to lower long-term costs

Participation in these programs can help you maintain affordable insurance rates even after a mishap.

For more information on affordable insurance options for high-risk drivers, visit Bankrate.com.

Pricing And Affordability Breakdown

Finding affordable auto insurance as a high-risk driver can be challenging. Rates often vary based on several factors. This section breaks down pricing and affordability aspects for high-risk drivers. We will explore the factors influencing costs, compare premiums across different insurers, and provide tips to lower your insurance premiums.

Factors Influencing Insurance Costs For High Risk Drivers

Several factors affect the insurance costs for high-risk drivers. These include:

- Driving history: Past accidents, speeding tickets, and DUI convictions.

- Age: Younger drivers typically face higher premiums.

- Credit score: Lower credit scores can lead to higher rates.

- Location: Urban areas often have higher insurance costs.

- Coverage level: Full coverage is more expensive than minimum coverage.

Comparing Premiums Across Different Insurers

It’s crucial to compare premiums from various insurers to find the best rates. Here’s a breakdown of average annual rates for high-risk drivers:

| Insurance Company | Minimum Coverage ($) | Full Coverage ($) |

|---|---|---|

| Plymouth Rock | 411 | 1,353 |

| Auto-Owners | 420 | 1,639 |

| USAA | 434 | 1,695 |

| Geico | 459 | 1,741 |

| Erie | 557 | 1,693 |

Tips To Lower Your Insurance Premium As A High Risk Driver

High-risk drivers can take several steps to reduce their insurance premiums:

- Take a defensive driving course to improve your driving skills.

- Maintain safe speeds and avoid traffic violations.

- Consider accident forgiveness add-ons to protect your rates.

- Keep older cars to avoid high collision coverage costs.

- Improve your credit score to potentially lower your premiums.

By following these tips, high-risk drivers can find more affordable insurance options.

Pros And Cons Of High Risk Driver Insurance

High risk driver insurance can provide essential coverage for drivers with past infractions. While it offers several benefits, it also has certain limitations. Understanding both sides can help you make informed decisions.

Advantages Of Specialized High Risk Policies

Specialized high risk policies offer coverage from top-rated insurance companies. These policies cater to individuals with accidents, speeding tickets, or DUI convictions. They provide customized quotes based on your driving history.

- Competitive rates: High risk policies often offer more competitive rates than standard policies.

- Access to reputable providers: You can choose from multiple reputable insurance providers.

- Potential savings: Comparing different quotes can lead to significant savings on premiums.

- Options for various scenarios: Policies available for drivers with at-fault accidents, speeding tickets, DUIs, young drivers, and lapses in coverage.

Some of the top providers include Plymouth Rock, Auto-Owners, and USAA. For example, Plymouth Rock offers rates as low as $411 for minimum coverage and $1,353 for full coverage.

Drawbacks And Limitations To Consider

Despite the benefits, high risk driver insurance also has some drawbacks. It’s essential to be aware of these limitations.

- Higher premiums: High risk policies usually come with higher premiums compared to standard policies.

- Limited availability: Not all insurance companies offer high risk policies.

- Strict terms: Policies may have stricter terms and conditions.

- Potentially fewer discounts: High risk drivers might not qualify for as many discounts as low-risk drivers.

For example, while Geico offers high risk policies, their rates can go up to $1,741 for full coverage.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Plymouth Rock | $411 | $1,353 |

| Auto-Owners | $420 | $1,639 |

| USAA | $434 | $1,695 |

| Geico | $459 | $1,741 |

| Erie | $557 | $1,693 |

Choosing the right policy requires careful consideration of both the advantages and limitations. Ensure you compare multiple quotes and read the terms carefully.

Specific Recommendations For High Risk Drivers

High-risk drivers often face challenges in finding affordable insurance options. Specific recommendations can help navigate this landscape. Below are some tailored suggestions for those classified as high-risk drivers.

Best Insurance Providers For High Risk Drivers

Finding the right insurance provider is crucial. Here are some of the best options:

| Insurance Company | Minimum Coverage (Annual) | Full Coverage (Annual) |

|---|---|---|

| Plymouth Rock | $411 | $1,353 |

| Auto-Owners | $420 | $1,639 |

| USAA | $434 | $1,695 |

| Geico | $459 | $1,741 |

| Erie | $557 | $1,693 |

Ideal Scenarios For Choosing Specific Policies

Different scenarios call for different insurance policies. Here are some ideal scenarios:

- Drivers with at-fault accidents: Plymouth Rock, Erie, and Auto-Owners offer competitive rates.

- Drivers with speeding tickets: Plymouth Rock and Erie provide the best options.

- Drivers with DUI convictions: American National is a top choice.

- Young drivers (18-year-olds): American National, EMC, and Erie are ideal providers.

Steps To Take After Being Classified As A High Risk Driver

Being classified as a high-risk driver can be daunting. Here are some steps to consider:

- Compare Rates: Use comparison tools to find the best rates from reputable providers.

- Consider Defensive Driving Courses: These courses can help reduce premiums.

- Maintain Safe Driving Habits: Avoid speeding and other infractions to improve your status over time.

- Explore Accident Forgiveness: Some insurers offer add-ons that can prevent premium hikes after an accident.

- Improve Your Credit Score: A better credit score can lead to lower insurance rates.

For more detailed information, visit Bankrate.com.

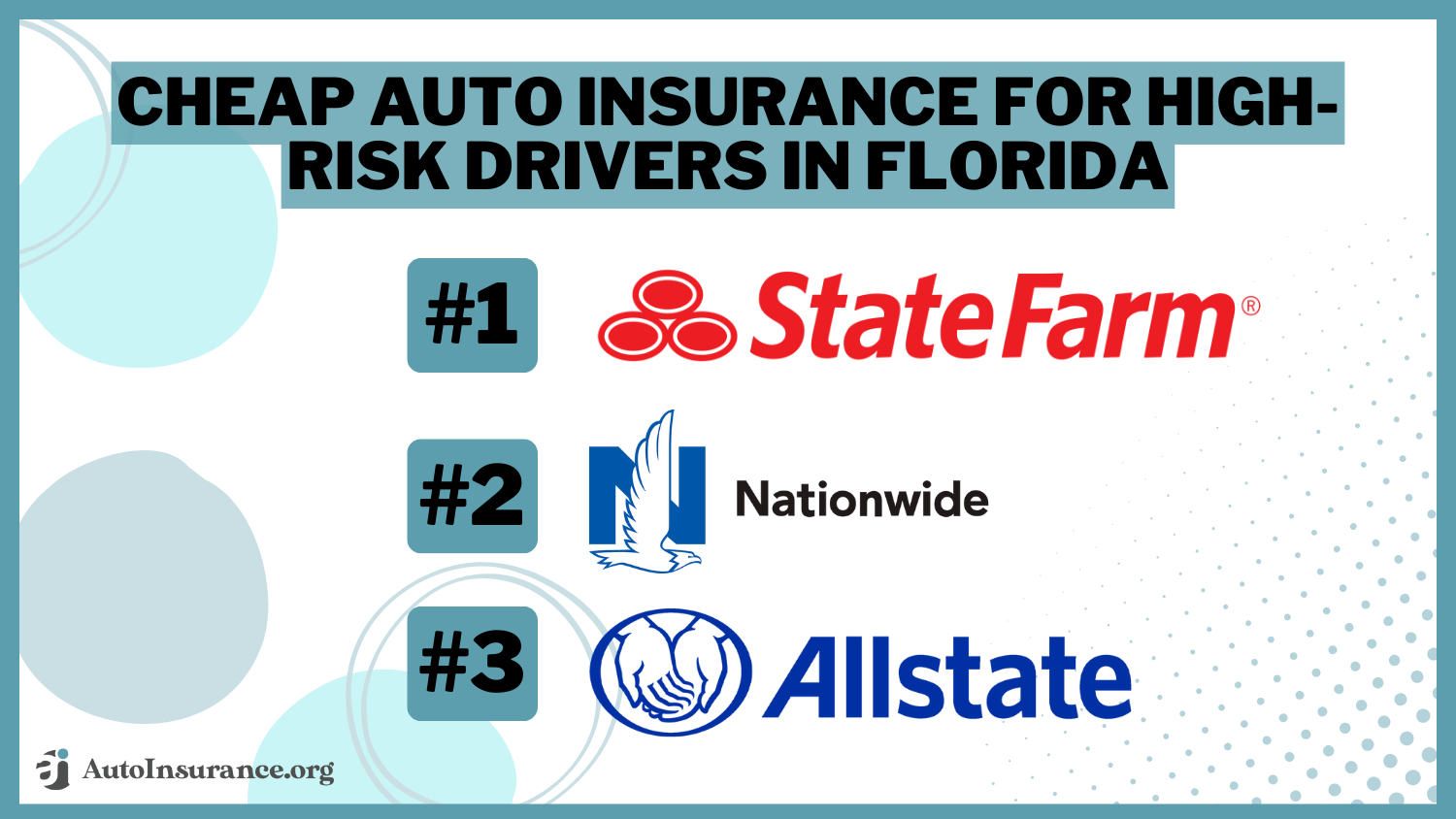

Credit: www.autoinsurance.org

Frequently Asked Questions

What Is High-risk Driver Insurance?

High-risk driver insurance is coverage for drivers with a history of violations, accidents, or poor credit. It typically costs more.

How Can High-risk Drivers Lower Their Insurance?

High-risk drivers can lower insurance by maintaining a clean driving record, taking defensive driving courses, and comparing quotes from multiple providers.

Why Is Insurance Expensive For High-risk Drivers?

Insurance is expensive for high-risk drivers because they are more likely to file claims. Insurers charge higher premiums to offset this risk.

Can High-risk Drivers Get Discounts?

Yes, high-risk drivers can get discounts by bundling policies, installing safety devices, and maintaining good grades if they are students.

Conclusion

Finding affordable insurance for high-risk drivers can be challenging. By comparing rates from top-rated companies, high-risk drivers can find coverage that fits their budget. Use defensive driving courses and maintain safe driving habits to keep premiums low. Visit [Bankrate. com](https://www.

bankrate. com/insurance/car/cheap-auto-insurance-high-risk-drivers/) for more details. Remember, smart choices today can lead to significant savings on your auto insurance.