Finding car insurance for a 17 year old can be tough. Costs are high because they haven’t driven much.

It is important to understand the best options, costs, and ways to save for families unwanted expenses. As a parent, making sure your teen has the right car insurance is very important. Teen drivers pay more for insurance because they are new drivers and have a higher chance of accidents.

But don’t worry, there are ways to manage these costs. This guide will look at the best car insurance options for 17-year-olds, explain how much it might cost, and give tips to save money. Whether you want full coverage or are looking for discounts, read on to find the best solutions for your teen driver.

Table of Contents

ToggleIntroduction to Car Insurance for a 17-Year-Old

Car insurance is very important for any new driver, especially for a 17-year-old. Young drivers usually have higher insurance costs because they have less driving experience. Knowing the basics of car insurance can help teens and their families make smart choices.

Why Car Insurance Is Essential for Young Drivers

Car insurance gives financial protection in case of accidents or damage. For young drivers, this protection is even more important because they are seen as higher risk. Here are some key reasons why car insurance is essential:

Financial Security

Car insurance covers the costs from accidents, like repairs and medical bills. This helps reduce the financial stress on families if something happens.

Legal Requirement

Most states require drivers to have at least basic liability insurance. Without it, your teen could face fines, legal problems, and might lose their driving privileges.

Peace of Mind

Knowing that your teen is insured gives parents peace of mind. It ensures that both the driver and other people on the road are protected in case of an accident.

Challenges 17-Year-Olds Face in Getting Car Insurance

Getting car insurance for a 17-year-old has several challenges. These challenges often lead to higher premiums and fewer options. Here are the main problems:

High Premiums

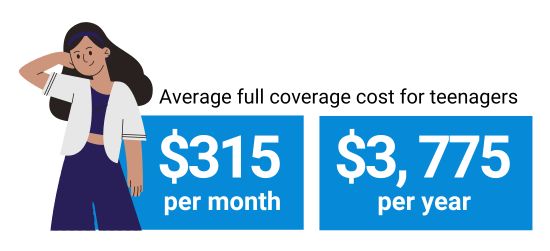

The average cost for full coverage is about $4,842 per year for a family with a 17-year-old driver. Premiums can be much higher depending on different factors.

State Regulations

Insurance rates vary a lot by state. For example, in Washington state and New Jersey, insurance rules are different, which can make insurance more expensive.

Risk Profile

Young drivers are seen as high-risk because they have less experience and are more likely to drive recklessly, like speeding or using a phone while driving.

Limited Discounts

While some discounts are available, they might not lower the costs enough for some families.

Common Queries

How Much Is Car Insurance for a 17-Year-Old?

Car insurance for a 17-year-old can cost a lot. On average, it ranges from $2,000 to $5,000 per year. The exact cost depends on where you live, the type of car, and the coverage you choose.

How Much Is Car Insurance for a 17-Year-Old in Washington State?

In Washington state, car insurance for a 17-year-old usually costs between $3,500 and $5,500 per year. Rates are affected by the state’s rules, how busy the roads are, and the types of cars driven.

How Much Is Car Insurance for a 17-Year-Old in NJ?

In New Jersey, the average annual premium for a 17-year-old driver is about $4,800. Insurance is more expensive here because of strict insurance laws and higher accident rates.

How Much Is Car Insurance for a 17-Year-Old Monthly?

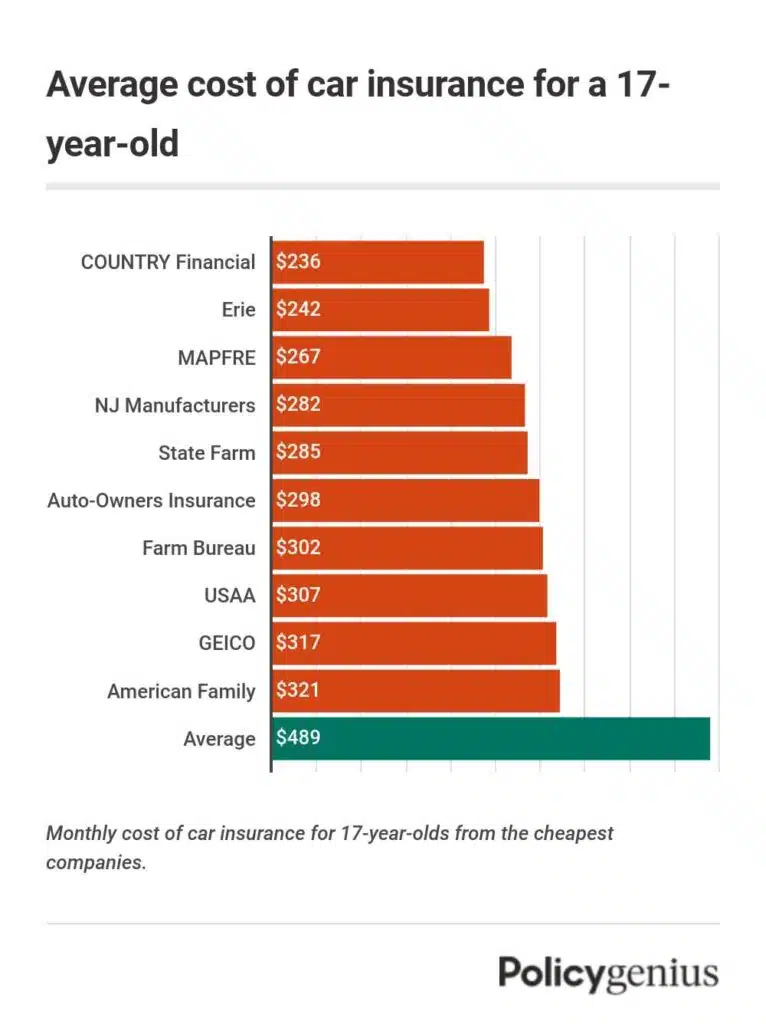

Monthly premiums for a 17-year-old can range from $200 to $400. Choosing a higher deductible can help lower these monthly costs. A deductible is the amount you pay out of pocket before insurance covers the rest.

Car Insurance for a 17-Year-Old Male vs. Female

Insurance premiums can be different based on gender. Here’s how:

Car Insurance for a 17-Year-Old Male

A 17-year-old male usually pays around $2,900 per year for car insurance. Males are seen as higher risk because they are more likely to drive fast or use their phones while driving.

Car Insurance for a 17-Year-Old Female

A 17-year-old female typically pays about $2,500 per year. Females generally have fewer accidents, which makes their insurance cheaper compared to males.

Car Insurance for a 17-Year-Old Boy vs. Girl

Both boys and girls pay a lot for car insurance, but boys often pay a bit more because they have higher accident rates.

Best Car Insurance Companies for a 17-Year-Old

When looking for car insurance for a 17-year-old, it’s important to compare quotes from different companies to find the best deal. Here are some top insurers that offer good rates and discounts for teen drivers:

Allstate

- Average Annual Premium: $5,126

- Key Features: Accident forgiveness, safe driving programs.

Auto-Owners

- Average Annual Premium: $3,458

- Key Features: Good student discounts, driver education discounts.

Erie

- Average Annual Premium: $4,399

- Key Features: Customizable coverage, usage-based insurance programs.

Geico

- Average Annual Premium: $4,164

- Key Features: Affordable premiums, good student discounts.

- How Much Is Geico Car Insurance for a 17-Year-Old? Geico offers competitive rates for 17-year-olds, averaging around $4,164 per year. They have various discounts that can help lower this cost further.

Nationwide

- Average Annual Premium: $3,479

- Key Features: Accident forgiveness, safe driving programs.

Comparison of Policies

Each company has different benefits for young drivers. For example:

- Allstate: Includes accident forgiveness to keep premiums stable after the first accident.

- Auto-Owners: Focuses on good student and driver education discounts to lower costs.

- Erie: Offers customizable coverage and usage-based insurance to reward safe driving.

- Geico: Known for affordable rates and multiple discount options, including for good students.

- Nationwide: Provides digital tools and flexible coverage options, along with safe driving programs.

Cheapest Car Insurance for a 17-Year-Old

Finding affordable car insurance is a top priority for many parents. Here are some tips to help you find the cheapest car insurance for a 17-year-old:

Cheapest States for Teen Car Insurance

Insurance rates can vary a lot by state. Here are some of the most affordable states for insuring a 17-year-old:

- Idaho

- Iowa

- Indiana

- North Carolina

- Ohio

Why These States?

- Lower Accident Rates: Fewer accidents reduce the risk for insurers.

- Affordable Repair Costs: Cheaper repairs help keep premiums low.

- State Regulations: Favorable insurance laws and lower minimum coverage needs make insurance cheaper.

Cheapest Vehicles to Insure for 17-Year-Olds

The type of car your teen drives can greatly affect insurance costs. Here are some affordable options:

- Mazda MX-5 Miata

- Subaru Outback

- Volkswagen Golf GTI

- Mini Countryman

- Honda Odyssey

Why These Vehicles?

- Safety Ratings: High safety ratings reduce the risk of serious accidents.

- Low Repair Costs: Cheaper repairs and replacements keep premiums lower.

- Non-Performance Cars: Avoiding sports or luxury cars, which are usually more expensive to insure.

Key Features of Car Insurance Plans for 17-Year-Olds

Knowing the key features of car insurance plans can help you make a smart choice. Here are some important coverage options and benefits to think about:

Coverage Options: What to Look For

- Liability Coverage: Protects against claims from others if your teen is at fault.

- Collision Coverage: Covers damage to your teen’s car from an accident.

- Comprehensive Coverage: Covers non-accident damages like theft or weather.

- Uninsured/Underinsured Motorist Coverage: Protects if the other driver doesn’t have enough insurance.

Additional Features:

- Accident Forgiveness: Stops your premium from going up after the first accident.

- Usage-Based Insurance: Rewards safe driving with lower rates by tracking driving habits.

Customization: Tailoring Policies for Young Drivers

Customization lets you adjust the policy to fit your teen’s needs. Here are some options:

- Good Student Discount: Rewards teens with good grades.

- Driver Education Discount: Available if your teen completes a driver’s education course.

- Safe Driving Programs: Monitors driving behavior and offers discounts for safe driving.

Additional Benefits: Roadside Assistance and Rental Coverage

Many car insurance plans for 17-year-olds offer extra benefits that can be helpful, such as:

- Roadside Assistance: Helps with flat tires, dead batteries, and lockouts.

- Rental Coverage: Pays for a rental car if your teen’s car is being fixed.

How to Save on Car Insurance for a 17-Year-Old

Even though insurance is expensive, there are ways to make it cheaper. Here are some practical tips:

Shop Around

Compare quotes from different insurance companies to find the best price. Different insurers have different rates and discounts, so shopping around can save you money.

Encourage Safe Driving Habits

Promote responsible driving. Avoiding risky actions like speeding or using a phone while driving can help lower premiums over time.

Reduce Mileage

Lowering the number of miles your teen drives each year can qualify for low-mileage discounts. If your teen doesn’t drive much, consider choosing a low-mileage discount.

Look for Discounts

Explore different discounts such as:

- Good Student Discounts: For maintaining high grades.

- Defensive Driving Course Discounts: For completing a driver’s education course.

- Bundling Policies: Combining auto insurance with other types of insurance for discounts.

- Telematics Programs: Some insurers offer programs that track driving habits and reward safe driving with lower rates.

Opt for Higher Deductibles

Choosing a higher deductible means you’ll pay more out of pocket if there’s an accident, but it can lower your monthly premium. Just make sure you have enough money saved to cover the deductible if needed.

Drive a Safe Vehicle

Pick a safer, low-performance car to reduce insurance costs. Avoid luxury cars, sports cars, or vehicles that are expensive to repair.

Cost Breakdown of Car Insurance for 17-Year-Olds

Understanding how the costs are calculated can help families manage these expenses better. Here are the main factors that influence car insurance costs for 17-year-olds:

Factors Influencing Insurance Costs for Young Drivers

- Driving Experience: Less experience means higher risk.

- Vehicle Type: Sports cars cost more to insure.

- Location: Living in a busy city usually means higher rates.

- Driving Record: Any traffic violations can increase premiums.

- Coverage Level: Full coverage is more expensive than just liability insurance.

Average Premiums: What to Expect

Here are some average annual premiums from top insurance companies:

| Insurance Company | Average Annual Premium |

|---|---|

| Allstate | $5,126 |

| Auto-Owners | $3,458 |

| Erie | $4,399 |

| Geico | $4,164 |

| Nationwide | $3,479 |

Credit: CreditKarma

Pros and Cons of Car Insurance for 17-Year-Olds

Car insurance is important for 17-year-olds. It has both benefits and challenges. Knowing these can help parents make smart choices.

Pros: Peace of Mind and Financial Protection

- Financial Protection: Covers costs from accidents, reducing financial stress.

- Encourages Safe Driving: Programs monitor driving habits and promote safe behavior.

- Discount Opportunities: Good student and safe driving discounts can lower premiums.

- Comprehensive Coverage: Policies often include collision and comprehensive insurance.

- Customized Options: Families can choose extra coverage like roadside assistance.

Cons: High Premiums and Limited Options

- High Premiums: Adding a 17-year-old can increase premiums by up to 128%.

- Gender-Based Rates: Premiums can be much different for males and females.

- State Variations: Insurance rules and costs change by state.

- Financial Burden: Higher rates can put a strain on family budgets.

- Limited Options: Fewer companies offer good rates for young drivers because they are high-risk.

Credit: www.insure.com

Best Car Insurance Options for 17-Year-Olds

Finding the best car insurance for a 17-year-old can be hard. Here are some top insurance providers and what makes them good:

Top Insurance Providers: Who Offers the Best Plans

- Allstate: $5,126 annually. Offers accident forgiveness and safe driving programs.

- Auto-Owners: $3,458 annually. Provides good student and driver education discounts.

- Erie: $4,399 annually. Features customizable coverage and usage-based insurance programs.

- Geico: $4,164 annually. Known for affordable premiums and good student discounts.

- Nationwide: $3,479 annually. Offers accident forgiveness and safe driving programs.

Comparison of Policies: What Sets Them Apart

Each company has different benefits for young drivers. For example:

- Allstate: Includes accident forgiveness to keep premiums stable after the first accident.

- Auto-Owners: Focuses on good student and driver education discounts to lower costs.

- Erie: Offers customizable coverage and usage-based insurance to reward safe driving.

- Geico: Known for affordable rates and multiple discount options, including for good students.

- Nationwide: Provides digital tools and flexible coverage options, along with safe driving programs.

Credit: www.progressive.com

Tips For Saving On Car Insurance For 17-year-olds

Insuring a 17-year-old driver can be costly. With an average annual premium of $4,842, finding ways to save is crucial. Several strategies can help reduce these expenses.

Good Student Discounts: How Academic Performance Can Help

Many insurers offer good student discounts to high school or college students who maintain good grades. Typically, a GPA of 3.0 or higher can qualify for this discount.

Encourage your teen to excel academically. This can result in significant savings on car insurance premiums. Good grades show responsibility, which insurers reward.

Safe Driving Programs: Rewards For Responsible Driving

Insurers often provide safe driving programs for young drivers. These programs monitor driving behavior and reward safe habits with discounts.

Enroll your teen in a driver education course. These courses teach essential skills and can reduce insurance costs. Some insurers also offer discounts for completing defensive driving courses.

Bundling Policies: Combining Insurance For Additional Savings

Consider bundling policies to save on car insurance. Combining auto insurance with other types of insurance, like home or renters, can lead to discounts.

Many insurance companies offer multi-policy discounts. This can lower the overall cost of insurance for your family.

| Insurance Company | Average Annual Premium |

|---|---|

| Allstate | $5,126 |

| Auto-Owners | $3,458 |

| Erie | $4,399 |

| Geico | $4,164 |

| Nationwide | $3,479 |

Utilizing these tips can help reduce the cost of car insurance for a 17-year-old. Comparing rates, looking for discounts, and promoting safe driving habits are essential steps.

Recommendations for Ideal Users and Scenarios

Car insurance for a 17-year-old can be very expensive. But finding the right coverage is important. Different families and situations may need different options. Here are some recommendations for ideal users and scenarios to help you make the best choice.

Best for Budget-Conscious Families

For families on a tight budget, finding affordable car insurance is key. Here are some strategies:

- Compare Quotes: Shop around and compare quotes from multiple insurers. This helps you find the best rate.

- Good Student Discounts: If your teen has high grades, you may get a discount.

- Driver Education: Enroll your teen in a driver education course to lower premiums.

Recommended Companies: Geico and Auto-Owners offer good rates for budget-conscious families, with average annual premiums of $4,164 and $3,458 respectively.

Ideal for Young Drivers with High Academic Performance

Teen drivers with good grades can get special discounts. Insurers often reward good students with lower rates.

- Good Grades: A GPA of 3.0 or higher can lead to significant savings.

- Safe Driving Programs: Joining safe driving programs can further reduce premiums.

Recommended Companies: Erie and Nationwide are great options for high-achieving students, offering average annual premiums of $4,399 and $3,479 respectively.

Scenarios Where Additional Coverage Is Beneficial

In some cases, having extra coverage can be helpful. Consider these scenarios:

- Accident Forgiveness: Prevents your premium from going up after an accident.

- Usage-Based Insurance: If your teen doesn’t drive often, this can save you money.

Recommended Company: Allstate offers comprehensive coverage options, including accident forgiveness, with an average annual premium of $5,126.

Frequently Asked Questions

How Much Is Car Insurance For A 17-year-old?

Car insurance for a 17-year-old can be expensive, often ranging from $2,000 to $5,000 annually. Rates vary by location, vehicle type, and insurer.

What Factors Affect Car Insurance Costs For Teens?

Factors include driving record, type of car, location, and whether the teen is on a parent’s policy. Good grades and safe driving courses can help lower rates.

How Can A 17-year-old Save On Car Insurance?

Teens can save by maintaining good grades, taking driver’s education courses, and driving a safe, low-risk vehicle. Staying on a parent’s policy also reduces costs.

Are There Discounts Available For Teen Drivers?

Yes, many insurers offer discounts for good student grades, completing driver safety courses, and having a car with safety features. Check with your insurer for available discounts.

Conclusion

Finding the best car insurance for a 17-year-old can be hard. Premium costs change a lot by state and insurer. Discounts can help lower costs, so look for options like good student discounts. Encourage safe driving habits to reduce risk. Shop around and compare quotes to get the best deal. Choose coverage that fits your family’s needs and budget. With careful planning, you can find affordable car insurance that protects your teen driver.

For more details and personalized quotes, visit trusted insurance comparison websites or contact insurance providers directly.