Looking for honest Assurant Renters Insurance reviews? Let’s keep it simple. Renters insurance matters because it protects your stuff—like your laptop, clothes, or furniture—if something goes wrong (think theft, fire, or leaks). Assurant offers plans with different coverage options, but is it right for you? You need to know three things: what it costs, what it covers, and where it might fall short.

In this Assurant Renters Insurance review, we’ll break down the basics. Is Assurant cheap? Yes—plans start around $15/month. Does it cover enough? For most renters, maybe. But there’s a catch: some customers say filing claims is frustrating, and high-value items (like jewelry) need extra coverage. We’ll share real pros and cons, plus stories from people who’ve used Assurant.

Whether you’re a student, a family, or living solo, this review will help you decide. Want peace of mind without overpaying? Let’s see if Assurant’s the answer—or if you should keep looking.

Credit: joywallet.com

Table of Contents

ToggleIntroduction To Assurant Renters Insurance

Renters insurance is essential for protecting your belongings. Assurant Renters Insurance offers peace of mind. It covers loss, damage, and more.

Overview of Renters Insurance

Renters insurance safeguards your personal items. It helps replace or repair belongings. It covers theft, fire, and other risks. Many overlook its value. Yet, it’s crucial for financial security.

- Covers personal property loss.

- Provides liability protection.

- Offers peace of mind.

Assurant As An Insurance Provider

Assurant stands out in the renters insurance market. It has a strong reputation. Known for reliable coverage and customer service. Assurant makes insurance easy. It offers flexible plans. Tailored to meet diverse needs.

| Features | Benefits |

|---|---|

| Flexible coverage options | Meets individual needs |

| Reliable customer service | Support when you need it |

| Easy claims process | Quick and hassle-free |

Coverage Options Under Assurant Renters Insurance

Tenants seeking protection for their belongings find Assurant Renters Insurance a reliable choice. Let’s explore the coverage options Assurant provides.

Standard Policy Inclusions

Assurant’s standard renters policy includes:

- Personal property coverage: Protects your belongings.

- Liability protection: Covers injury or property damage claims.

- Loss of use: Pays for additional living expenses if your rental is uninhabitable.

- Medical payments coverage: Handles medical costs for guests injured at your place.

Optional Coverage Add-ons

For extra security, consider these add-ons:

- Identity theft protection: Safeguards against fraud.

- Replacement cost coverage: Pays full value for lost items without depreciation.

- Pet damage protection: Covers damages caused by pets.

Understanding Limits And Deductibles

Selecting the right limits and deductibles is key:

- Coverage limits: The max amount paid out for a claim.

- Deductibles: What you pay before insurance kicks in.

Choose a balance that fits your budget and coverage needs.

Unique Features Of Assurant Renters Insurance

Renters seeking insurance often look for standout features that offer more than just basic coverage. Assurant Renters Insurance provides several unique benefits that cater to the modern renter’s needs. These features not only enhance the security of one’s belongings but also offer peace of mind in various situations. Let’s discuss some of the unique features that Assurant offers.

Identity Theft Protection

Assurant includes identity theft protection in their renters insurance policies. This feature stands out as it helps policyholders recover after their personal information is stolen. It covers expenses related to restoring your identity, such as legal fees and lost wages.

Replacement Cost Coverage

With replacement cost coverage, items lost or damaged are replaced without factoring in depreciation. This means policyholders can receive the full cost to replace their belongings, ensuring they can fully recover from loss.

Earthquake And Flood Coverage

Most standard renters insurance policies exclude natural disaster coverage. Assurant sets itself apart by offering earthquake and flood coverage. This inclusion provides added protection in areas prone to such disasters, helping renters safeguard against unpredictable events.

The Cost Factor: Analyzing Assurant’s Pricing

Understanding the cost of Assurant Renters Insurance is key. Let’s dive into their pricing, how it stands against competitors, and ways to save.

Pricing Structure Breakdown

Assurant offers various plans. Each plan’s price depends on coverage needs. Prices vary by location and personal property value.

- Basic coverage starts at a low monthly rate.

- Higher coverage options increase the price.

- Customizable add-ons available for extra protection.

Comparing Affordability With Competitors

When comparing, Assurant stands out. Their basic plan often costs less than others. Yet, for higher coverage, prices are competitive. Always compare:

- Monthly premiums

- Deductibles

- Coverage limits

Discounts And Savings Opportunities

Assurant provides ways to save. Pay attention to these:

- Bundling policies can lower costs.

- Security features in your home may qualify for discounts.

- Paying annually instead of monthly can save money.

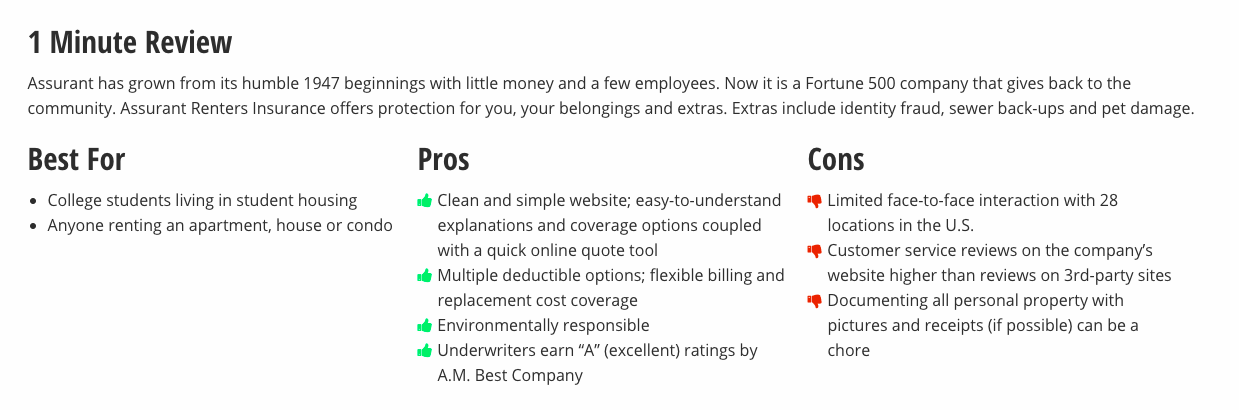

Real-world Benefits: Pros And Cons

Understanding the real-world benefits of Assurant Renters Insurance helps make informed decisions. Let’s explore the pros and cons.

Advantages Of Choosing Assurant

- Quick Claims: Fast and easy claim process.

- Flexible Coverage: Options to fit different needs.

- Additional Benefits: Offers extras like pet damage coverage.

Drawbacks To Consider

- Cost Variability: Prices can vary widely.

- Limited Discounts: Fewer ways to lower costs.

- Customer Reviews: Mixed feedback on service quality.

Customer Satisfaction And Service Experience

Customer experiences with Assurant show a mix of satisfaction and frustration. Positive remarks often highlight the ease of claim filing. Negative reviews frequently mention service delays and communication issues. Choosing Assurant requires weighing these factors carefully.

Claims Process And Support

Understanding the claims process is crucial when choosing renters insurance. Let’s explore how Assurant handles claims from start to finish.

Filing A Claim With Assurant

To file a claim, policyholders must notify Assurant promptly. Online and phone reporting options are available. Customers provide details of the incident and any proof of loss. This may include photos or a list of damaged items.

Support Channels And Assistance

- 24/7 customer service ensures help is always at hand.

- Policyholders can access online portals for updates.

- Email and phone support are available for inquiries.

Resolution And Reimbursement Timelines

Assurant aims for a quick resolution. Simple claims can be resolved in a few days. More complex cases may take longer. Reimbursement follows soon after claim approval, subject to the policy’s terms.

Assurant Renters Insurance For Different Scenarios

Renters face unique challenges based on their location and lifestyle. Assurant Renters Insurance offers solutions tailored to diverse needs. Let’s explore how Assurant fits into various living scenarios.

Best For Urban Renters

City dwellers often contend with higher theft rates and housing density risks. Assurant’s policies cater to these concerns with features like theft coverage and additional living expenses. This makes it a strong choice for renters in bustling cities.

Suitability For High-value Item Owners

For those with expensive electronics or jewelry, Assurant provides coverage options that protect these assets. Policyholders can get peace of mind knowing their high-value items are insured against loss or damage.

When To Look Elsewhere: Scenarios Not Covered

Certain situations fall outside Assurant’s coverage. Natural disasters like floods or earthquakes may require separate policies. Renters facing these risks should consider other insurance providers.

)

Credit: insurify.com

Expert And Consumer Reviews: A Balanced View

Assurant Renters Insurance stands out in the market. Experts and customers share their insights. This helps you make an informed decision.

Industry Expert Opinions

Industry experts often highlight Assurant’s reliable coverage and customer service. They note the flexibility in policy options. Many praise the simple claims process. Some experts point out that Assurant’s premiums may be higher than average.

Real Consumer Testimonials

Real users value the ease of signing up for Assurant Renters Insurance. They appreciate the fast response to claims. Yet, a few customers have had issues with claim denials or customer support. It’s important to read these reviews to get a true sense of customer satisfaction.

Review Aggregator Insights

Review aggregators provide a broad view. They compile ratings from various sources. This gives a consolidated rating that reflects the general opinion. Assurant Renters Insurance often scores well for ease of use and coverage options. Some aggregators mention a mix of reviews on customer service experiences.

Final Thoughts: Is Assurant Right For You?

Choosing the right renters insurance is crucial for peace of mind. Assurant offers various options that might fit your needs. Let’s delve into what makes Assurant stand out and if it’s the right choice for your insurance requirements.

Assessing Your Individual Insurance Needs

Every renter has unique needs. Assurant provides customizable plans. Consider your valuables and the level of coverage you require. Do you own expensive electronics or jewelry? Are you in a flood-prone area? Answering these questions will help you decide.

Comparing With Personal Risk Profile

Your lifestyle affects your risk profile. If you travel often, you may need more coverage. Assurant offers theft protection and travel coverage. Match your risk profile with Assurant’s offerings to see if they align.

How To Get Started With Assurant

Starting with Assurant is simple. Visit their website or call directly. You can get a quote quickly. Gather personal information and details about your rental. Assurant’s agents can guide you through the process and help tailor a policy for you.

Credit: studenomics.com

Frequently Asked Questions

What Does Assurant Renters Insurance Cover?

Assurant Renters Insurance provides coverage for personal property, liability, and additional living expenses. It protects against theft, fire, and certain natural disasters. The policy can include optional coverages like pet damage protection and identity theft restoration, making it a comprehensive choice for renters seeking security.

How Much Does Assurant Renters Insurance Cost?

The cost of Assurant Renters Insurance varies depending on the coverage limits, deductible chosen, and the location of the rental property. On average, premiums can range from $15 to $30 per month, offering an affordable option for renters looking to protect their personal belongings and liability.

What Are The Benefits Of Choosing Assurant For Renters Insurance?

Choosing Assurant for Renters Insurance offers benefits like easy online policy management, 24/7 claims support, and flexible coverage options. Policyholders can also access discounts for multi-policy bundles and enjoy the convenience of quick, efficient service.

Are There Any Drawbacks To Assurant Renters Insurance?

While Assurant provides comprehensive coverage and convenience, some policyholders may find the premiums slightly higher than other insurers for comparable coverage. Additionally, certain natural disasters like earthquakes and floods may require separate policies, which could be a drawback for renters in prone areas.

Conclusion

Choosing the right renters insurance is crucial. Assurant offers a solid option. With clear coverage details and pricing, it’s a viable choice for many. Yet, every renter’s needs differ. Balancing benefits against potential drawbacks is key. Always read the fine print before deciding.

Assurant could be your match for peace of mind at home. Remember, smart choices today safeguard your space tomorrow.