Finding the best car insurance in Alabama can be daunting. Many companies offer various coverage options and prices.

Alabama drivers need reliable car insurance to protect themselves on the road. With so many choices, it’s crucial to know which companies stand out for their service, affordability, and coverage options. Whether you’re a new driver or looking to switch providers, understanding the top contenders can save you time and money.

In this guide, we explore the best car insurance companies in Alabama. We’ll consider customer satisfaction, financial strength, and coverage features. This way, you can make an informed decision and find the right insurance for your needs. Let’s dive in and discover which companies are the best for Alabama drivers.

Table of Contents

ToggleTop Car Insurers

Finding the right car insurance in Alabama can be a daunting task. With many providers to choose from, it’s crucial to know which companies stand out. Below, we explore the top car insurers in Alabama, focusing on their market presence and what makes them the leaders in the industry.

Leading Companies

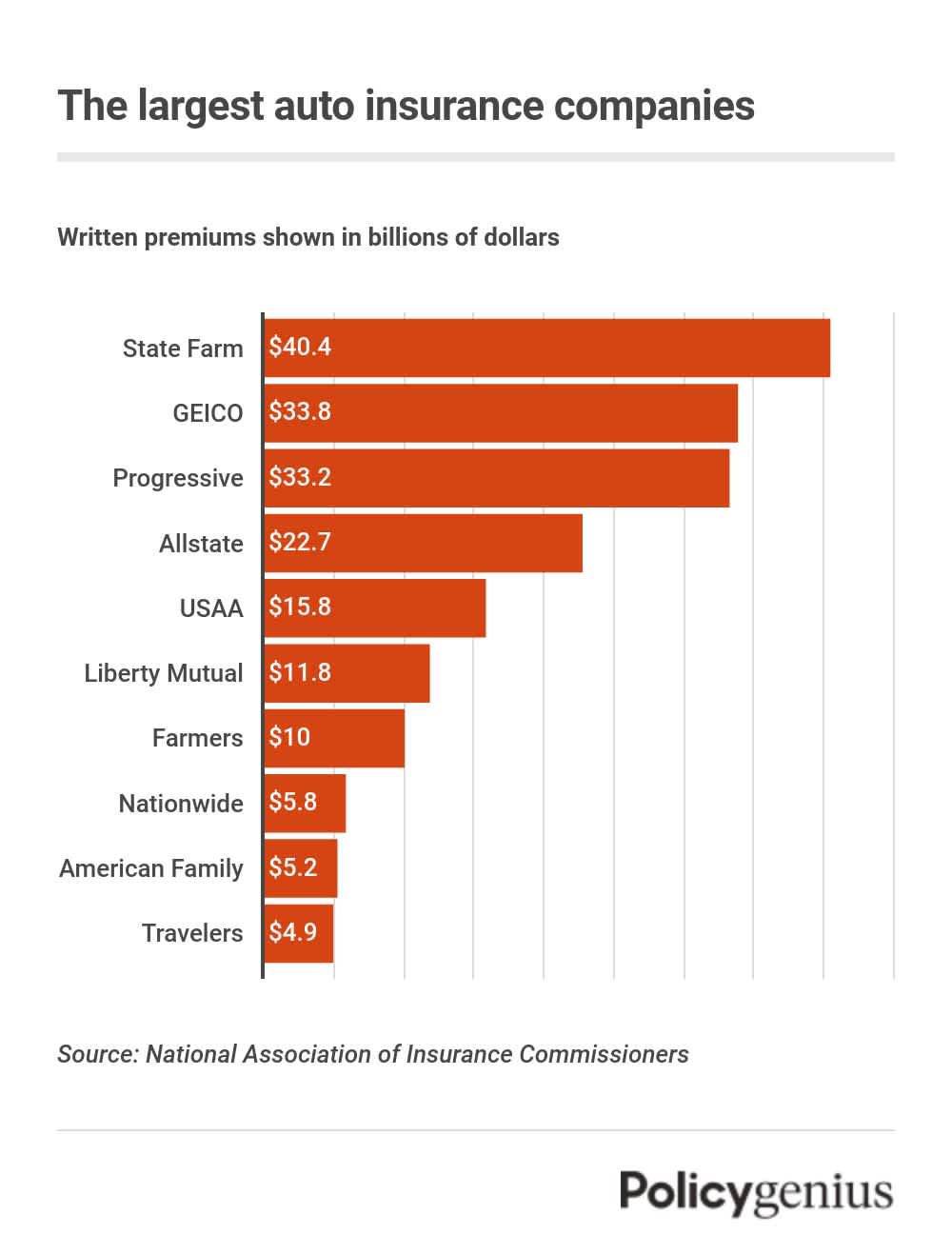

Several companies dominate the car insurance market in Alabama. These providers offer comprehensive coverage, competitive rates, and excellent customer service. Here are some of the leading car insurers in Alabama:

- State Farm: Known for its extensive network of agents and customer-centric approach. State Farm offers a variety of discounts and coverage options.

- Geico: Famous for its low rates and efficient online services. Geico is a popular choice for budget-conscious drivers.

- Allstate: Offers robust coverage options and several discounts for safe drivers. Allstate is known for its reliable claims process.

- Progressive: Provides innovative tools like the Name Your Price tool and Snapshot program to help drivers find the best rates.

- USAA: A top choice for military members and their families. USAA is known for its exceptional customer satisfaction ratings.

Market Share Insights

Understanding the market share of car insurance companies in Alabama helps highlight their dominance and customer preferences. Here’s a breakdown of the market share insights:

| Company | Market Share (%) |

|---|---|

| State Farm | 24.5 |

| Geico | 16.8 |

| Allstate | 11.2 |

| Progressive | 10.1 |

| USAA | 7.4 |

State Farm holds the largest market share, emphasizing its strong presence and trust among Alabama drivers. Geico follows, attracting many with its competitive pricing. Allstate and Progressive also capture significant portions of the market, each offering unique benefits and coverage options. USAA, while catering to a niche market of military members, still secures a notable share due to its high customer satisfaction.

These insights help understand which companies are leading and why they are preferred by many drivers in Alabama. Choosing the right car insurance involves considering these factors to find the best fit for your needs.

Coverage Options

Finding the best car insurance companies in Alabama can be challenging. Understanding the coverage options available helps you make an informed decision. This section explores the essential coverage options like liability coverage and comprehensive plans.

Liability Coverage

Liability coverage is crucial for all drivers in Alabama. This coverage protects you financially if you are at fault in an accident. It covers the costs of injuries and damages to other parties.

Here are the key points about liability coverage:

- State Minimum Coverage: Alabama requires a minimum amount of liability coverage. This includes bodily injury and property damage liability.

- Insurance Premiums in Alabama: The cost of liability insurance varies. Factors like driving history and the type of vehicle affect premiums.

- Liability Insurance Options: Many top insurance providers offer various liability insurance options. You can choose higher limits for better protection.

A table showing the minimum requirements in Alabama:

| Coverage Type | Minimum Requirement |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $25,000 per accident |

Choosing the right liability coverage is essential for financial security. Review the options and select what fits your needs and budget.

Comprehensive Plans

Comprehensive plans offer extensive coverage for various risks. These plans protect against damages not caused by a collision.

Here are the main aspects of comprehensive car insurance:

- Coverage Scope: Comprehensive plans cover theft, vandalism, natural disasters, and other non-collision damages.

- Affordable Auto Insurance: Some providers offer affordable comprehensive plans. It’s essential to compare rates to find the best insurance quotes.

- Top Insurance Providers: Leading companies in Alabama offer comprehensive plans with high customer service ratings.

A list of potential covered events:

- Fire

- Theft

- Vandalism

- Natural Disasters (e.g., hail, floods)

- Falling Objects

Comprehensive plans ensure your vehicle is protected from various risks. Evaluating the coverage options helps in selecting the right plan for your needs.

Alabama auto coverage varies across providers. It’s crucial to compare car insurance rates and understand the coverage details. This will help you find the best insurance quotes and ensure complete protection.

Customer Satisfaction

Introduction paragraph about Best Car Insurance Companies in Alabama and Customer Satisfaction…

Ratings Overview

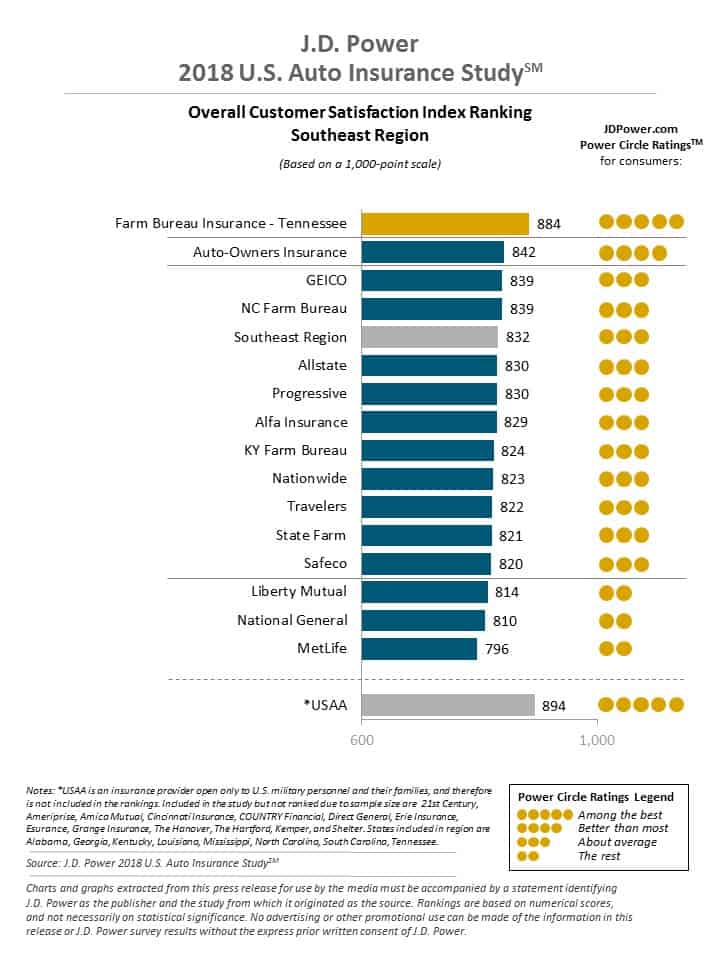

Customer satisfaction is key when choosing car insurance. In Alabama, several companies stand out. They have high ratings and positive feedback from customers. This section will cover some of the top-rated companies.

Here are some of the top-rated car insurance companies in Alabama:

- State Farm: Known for excellent customer service and competitive rates.

- Geico: Offers affordable premiums and a user-friendly mobile app.

- Allstate: Provides a range of discounts and a strong financial rating.

These companies have been rated based on customer feedback, claims handling, and overall satisfaction. The table below summarizes their ratings:

| Company | Customer Service Rating | Claims Handling Rating | Overall Satisfaction Rating |

|---|---|---|---|

| State Farm | 4.7/5 | 4.5/5 | 4.6/5 |

| Geico | 4.6/5 | 4.4/5 | 4.5/5 |

| Allstate | 4.5/5 | 4.3/5 | 4.4/5 |

These ratings show how well each company meets customer expectations. High ratings in customer service and claims handling are vital. They ensure a smooth experience during stressful times.

Customer Reviews

Customer reviews give insight into real experiences. They highlight strengths and weaknesses of car insurance companies in Alabama. Below are some snippets from customer reviews:

- State Farm: “State Farm made my claims process simple and stress-free. Their agents are always helpful.”

- Geico: “Geico’s app is fantastic. It makes managing my policy so easy. Plus, their rates are unbeatable.”

- Allstate: “Allstate offers great discounts. I saved a lot on my premium. Their customer service is also top-notch.”

These reviews highlight common themes. Customers appreciate ease of use, helpful agents, and savings. Here are some detailed reviews:

| Company | Review |

|---|---|

| State Farm | “I had an accident last year. State Farm handled everything quickly. No hassles at all.” |

| Geico | “Geico’s customer support is always available. They answered all my questions patiently.” |

| Allstate | “Allstate’s roadside assistance saved me. They arrived fast and fixed my car on the spot.” |

Customer reviews are a valuable resource. They help potential customers make informed decisions. Positive reviews build trust and confidence in the company.

Credit: www.insurantly.com

Cost Factors

Choosing the best car insurance company in Alabama can be a challenging task. One of the critical aspects to consider is the cost. The cost of car insurance depends on several factors. Understanding these factors can help you find the best insurance at the right price.

Premium Comparisons

Insurance premiums vary widely among companies. Several elements influence these premiums, such as your driving history, age, and vehicle type. It’s essential to compare premiums from different companies to find the best deal.

Here’s a table comparing average annual premiums from some top car insurance companies in Alabama:

| Insurance Company | Average Annual Premium |

|---|---|

| State Farm | $1,200 |

| Geico | $950 |

| Allstate | $1,300 |

| Progressive | $1,100 |

These figures are averages. Your actual premium may differ based on specific factors. Here are some key factors that affect premiums:

- Driving Record: A clean driving record typically results in lower premiums.

- Age: Younger drivers often face higher premiums due to perceived risk.

- Vehicle Type: Luxury cars usually cost more to insure than standard models.

Discount Opportunities

Many insurance companies offer discounts to help reduce your premiums. Knowing about these discounts can save you money.

Here are some common discount opportunities:

- Good Driver Discount: Available if you have a clean driving record for a certain number of years.

- Multi-Policy Discount: Offered if you bundle your car insurance with other types of insurance, like home or renters insurance.

- Good Student Discount: Available for young drivers who maintain a good GPA.

- Safety Features Discount: If your car has advanced safety features, you may qualify for a discount.

Below is a table showcasing potential discounts from top car insurance companies in Alabama:

| Insurance Company | Discount Type | Discount Amount |

|---|---|---|

| State Farm | Good Driver | Up to 15% |

| Geico | Multi-Policy | Up to 25% |

| Allstate | Good Student | Up to 20% |

| Progressive | Safety Features | Up to 10% |

It’s crucial to ask your insurance agent about all possible discounts. Sometimes, combining discounts can lead to significant savings on your car insurance.

Claims Process

Finding the best car insurance companies in Alabama is crucial for your peace of mind. The claims process is a key factor in this decision. A smooth claims process ensures you get back on the road quickly after an accident. Let’s explore how to file claims and understand claim settlement times with top car insurance companies in Alabama.

Filing Claims

Filing a claim with the best auto insurance discounts in Alabama should be straightforward and stress-free. Top car insurance companies offer multiple ways to file a claim:

- Online: Most companies have user-friendly websites where you can file a claim quickly.

- Mobile App: Many insurers provide mobile apps for easy and fast claim filing.

- Phone: A quick call to customer service can start your claim process.

- In-person: Visit your local agent for personal assistance.

Before filing a claim, gather necessary information:

- Policy number

- Details of the accident

- Police report (if applicable)

- Photos of damage

- Contact information of other parties involved

Affordable car insurance in Alabama ensures a smooth claims process. It’s important to compare car insurance quotes in Alabama to find a provider with excellent customer service. Look for companies with positive Alabama car insurance reviews to ensure a good experience.

Claim Settlement Times

Claim settlement times vary among auto insurance providers in Alabama. It’s essential to choose a company known for quick settlements. Here’s what affects settlement times:

- Complexity of the claim

- Availability of required documents

- Cooperation from all parties involved

- Efficiency of the insurance company’s claims department

Here’s a table comparing average settlement times for top car insurance companies in Alabama:

| Insurance Company | Average Settlement Time |

|---|---|

| Company A | 7-10 days |

| Company B | 10-14 days |

| Company C | 14-21 days |

Quick settlements are often a sign of good customer service in car insurance Alabama. When comparing auto insurance providers in Alabama, consider the claim settlement times. Fast settlements ensure you get back on the road without long delays.

Insurance claim process Alabama varies, so it’s important to review car insurance coverage options. Choosing the right coverage can speed up claim settlements. Affordable car insurance Alabama with good reviews typically offers efficient claim processes.

Credit: www.policygenius.com

Regional Considerations

Choosing the best car insurance companies in Alabama involves understanding regional considerations. Different areas in Alabama face unique challenges that can affect insurance rates and coverage. Knowing these factors helps you make informed decisions about the best car insurance for your needs.

Local Risks

Alabama has several local risks that can impact car insurance rates. These risks vary by region and can include factors like traffic density, crime rates, and accident frequency. For instance, urban areas like Birmingham or Montgomery might have higher traffic congestion, leading to a greater likelihood of accidents.

Here are some local risks to consider:

- Traffic congestion: Higher in urban areas, increasing the risk of accidents.

- Crime rates: Vehicle theft and vandalism are more common in certain cities.

- Rural roads: Less maintained, leading to a higher chance of accidents.

- Wildlife: Rural areas may have more wildlife collisions.

Insurers take these risks into account when determining your premium. For example, living in a high-crime area may result in higher rates due to the increased likelihood of theft or damage. Similarly, frequent accidents in congested areas might lead to higher premiums.

Considering these local risks can help you choose an insurance company that offers the best coverage and rates for your specific area in Alabama.

Weather Impacts

Weather plays a significant role in car insurance rates in Alabama. The state experiences a range of weather conditions that can affect driving safety and vehicle damage. Understanding these weather impacts can help you select the right insurance policy.

Key weather-related risks include:

- Hurricanes and tropical storms: Common in coastal regions, causing flooding and damage.

- Tornadoes: Frequent in certain parts of Alabama, leading to significant vehicle damage.

- Heavy rainfall: Can cause flooding and slippery roads, increasing accident risks.

- Hailstorms: Can cause substantial damage to vehicles.

Insurance companies consider these weather impacts when setting premiums. For instance, areas prone to hurricanes or flooding may have higher rates due to the increased risk of vehicle damage. Similarly, regions with frequent tornadoes might see higher premiums as insurers account for potential damage.

Choosing a car insurance policy that covers weather-related risks is crucial. Look for companies that offer comprehensive coverage, including protection against natural disasters. This ensures your vehicle is protected no matter the weather conditions in Alabama.

Policy Types

Choosing the right car insurance policy can make a big difference. Whether you need extensive protection or just the basics, the best car insurance companies in Alabama offer various policy types to fit your needs. Understanding these options can help you make an informed decision and ensure you get the best coverage for your vehicle.

Full Coverage

Full coverage is ideal if you want extensive protection for your car. It includes several types of insurance, such as liability insurance, collision coverage, and comprehensive coverage. Here’s what you can expect:

- Liability Insurance: Covers damages if you are at fault in an accident.

- Collision Coverage: Pays for repairs to your car after an accident, regardless of fault.

- Comprehensive Coverage: Protects against non-collision events like theft, vandalism, and natural disasters.

Many top insurance providers offer full coverage policies with additional benefits. These can include roadside assistance, rental car reimbursement, and gap insurance. Full coverage is more expensive but provides peace of mind. You can compare car insurance rates online to find the best deal. Look for car insurance discounts to lower your premiums.

Here is a quick comparison of what full coverage might include:

| Type | Coverage | Benefits |

|---|---|---|

| Liability Insurance | Damage to others | Protects assets |

| Collision Coverage | Accident damages | Repairs your car |

| Comprehensive Coverage | Non-accident events | Wide protection |

Minimum Coverage

Minimum coverage is the least amount of insurance required by Alabama state law. It’s the most affordable car insurance option. Here’s what it typically includes:

- Bodily Injury Liability: Covers medical expenses for injuries you cause to others.

- Property Damage Liability: Pays for damage to other people’s property.

Minimum coverage meets the state minimum requirements but offers limited protection. It’s suitable for older cars or if you’re on a tight budget. Alabama auto insurance laws require at least:

| Coverage Type | Minimum Limit |

|---|---|

| Bodily Injury Liability | $25,000 per person |

| Bodily Injury Liability | $50,000 per accident |

| Property Damage Liability | $25,000 per accident |

While minimum coverage is cheaper, it might not cover all costs in a serious accident. Use online car insurance comparisons to find affordable car insurance that meets your needs. Always request insurance quotes from multiple providers. This ensures you get the best rate and adequate protection.

Future Trends

Car insurance is essential for every driver in Alabama. With many options available, choosing the right one can be challenging. Understanding future trends in car insurance can help you make an informed decision. Let’s explore some of the emerging trends in the car insurance industry in Alabama.

Telematics Usage

Telematics car insurance is becoming more popular among Alabama auto insurance providers. Telematics uses a device to track your driving habits. This data is then used to determine your car insurance rates.

Some key benefits of telematics car insurance include:

- Insurance Discounts: Safe drivers can earn discounts based on their driving behavior.

- Usage-Based Insurance: Pay premiums based on how much and how well you drive.

- Personalized Insurance Policies: Get coverage tailored to your specific driving habits.

Many auto insurance providers in Alabama offer telematics programs. Below is a table highlighting some popular providers and their telematics offerings:

| Provider | Telematics Program | Key Features |

|---|---|---|

| Provider A | Drive Safe | Offers discounts for safe driving |

| Provider B | Smart Ride | Usage-based premiums |

| Provider C | Snapshot | Personalized policies |

By opting for telematics, Alabama drivers can enjoy competitive car insurance rates and more personalized insurance coverage options.

Emerging Technologies

Emerging technologies are also shaping the future of car insurance in Alabama. These technologies offer new ways to enhance insurance coverage and improve customer experience.

Some notable emerging technologies include:

- Artificial Intelligence (AI): AI helps in processing claims faster and detecting fraud.

- Blockchain: Blockchain technology ensures secure and transparent transactions.

- Internet of Things (IoT): IoT devices provide real-time data on vehicle health and driving conditions.

These technologies enable auto insurance providers to offer more competitive car insurance policies. For instance, AI can quickly analyze accident reports and determine fault. Blockchain ensures that all transactions are secure and tamper-proof. IoT devices help monitor vehicle health and provide data that can be used to offer better insurance coverage options.

Here is a summary of how these technologies benefit Alabama auto insurance:

| Technology | Benefit |

|---|---|

| AI | Faster claims processing |

| Blockchain | Secure transactions |

| IoT | Real-time vehicle monitoring |

Technology in insurance is advancing rapidly. Alabama drivers should stay informed about these trends to make the best decisions for their car insurance needs.

:max_bytes(150000):strip_icc()/how-car-insurance-companies-value-cars.asp-final-e3fe7d12f1fc4cb9bef0d86ca31d28c4.jpg)

Credit: www.investopedia.com

Frequently Asked Questions

What Are The Top Car Insurance Companies In Alabama?

The top car insurance companies in Alabama include State Farm, GEICO, and Allstate. These companies offer competitive rates and strong customer service. They are well-known for their reliable coverage options.

Which Car Insurance Has The Best Rates In Alabama?

GEICO is known for offering some of the best rates in Alabama. Their policies are affordable and comprehensive. Many customers appreciate their competitive pricing and discounts.

How Do I Choose Car Insurance In Alabama?

To choose car insurance in Alabama, compare rates, coverage options, and customer reviews. Consider your budget and specific needs. Make sure to check for available discounts.

Is Car Insurance Mandatory In Alabama?

Yes, car insurance is mandatory in Alabama. Drivers must have liability insurance to legally operate a vehicle. This law ensures financial responsibility in case of accidents.

Conclusion

Choosing the best car insurance in Alabama doesn’t have to be hard. Compare different providers. Check their coverage options and rates. Read customer reviews for insights. Each company offers unique benefits. Consider your needs and budget. This way, you can find the right fit.

Remember, good coverage brings peace of mind. Stay safe and protected on the road. Your perfect car insurance is out there. Happy driving!