Driving on Alaska’s snowy roads demands more than just reliable tires—it also means securing the best car insurance in Alaska. With the state’s challenging terrain and ever-changing weather, having the right coverage is essential for peace of mind.

Let’s explore what makes a car insurance plan not just good, but the best for Alaskan drivers as we approach 2025. With the frosty landscapes of Alaska as a backdrop, drivers must choose their car insurance wisely. It’s not just about the cost, but also about finding a provider that understands the unique challenges of driving in the Last Frontier.

From Geico’s budget-friendly options to USAA’s military-oriented policies, every driver has different needs. Progressive’s Name Your Price Tool stands out for those on a budget, while State Farm caters to those who value local agents and a robust digital experience. With an average full coverage policy costing around $2,401 a year and the minimum at $497, the right insurance isn’t a luxury; it’s a necessity.

Drivers can enjoy discounts, tailored coverage, and excellent online tools for managing their policies. While individual rates vary, these insurance leaders offer a starting point for Alaskans to find their best match in car insurance for 2025. Remember, policies can change, so it’s vital to get the latest, personalized quotes for the most accurate pricing.

Table of Contents

ToggleIntroduction To Car Insurance In Alaska

Alaska’s unique landscape demands special attention to car insurance. With its vast wilderness, driving conditions can be challenging. Best Car Insurance in Alaska for 2025 evaluates top providers like Geico, USAA, Progressive, and State Farm. These companies stand out for their coverage options, rates, and digital tools.

Understanding The Alaskan Insurance Landscape

Insurance in Alaska varies by provider and coverage. The average full coverage policy costs $2,401/year, while minimum coverage averages at $497/year. Factors influencing these rates include driving conditions and personal rating factors. It’s essential to compare personalized quotes for accurate pricing.

- Progressive offers a unique tool for setting your price.

- Geico shines with discounts and digital tools.

- USAA focuses on military families with exceptional service.

- State Farm provides local agent support and a top-rated app.

Why Adequate Car Insurance Is Crucial In Alaska

Alaska’s harsh weather and remote areas make adequate insurance vital. Tailored coverage ensures protection against unpredictable conditions. Discounts and online tools add value, making policy management easier. Especially for military families, providers like USAA offer dedicated support.

| Provider | Annual Rate | Monthly Rate |

|---|---|---|

| Progressive | $1,614 | $135 |

| Geico | $1,462 | $122 |

| USAA | $1,588 | $132 |

| State Farm | $2,554 | $213 |

Evaluating The Best Car Insurance Providers For 2025

Alaska’s car insurance landscape is set to evolve in 2025. With premiums and coverage options changing, it’s crucial to know the top providers. Let’s dive into the criteria for selecting the best and an overview of the leading companies.

Criteria For Selection

Choosing the right car insurance involves several factors. We consider average rates, coverage diversity, discount availability, and digital experience. These elements ensure the best value for Alaskan drivers.

- Average rates determine affordability.

- Coverage options offer tailored protection.

- Discounts reduce premiums for eligible customers.

- Digital tools simplify policy management.

Overview Of Top Car Insurance Companies

The front-runners for 2025 include Geico, USAA, Progressive, and State Farm. Each offers unique features and benefits.

| Company | Average Full Coverage | Average Minimum Coverage | Notable Features | Monthly Cost (Approx.) |

|---|---|---|---|---|

| Progressive | $1,614/year | Varies | Name Your Price Tool | $135/month |

| Geico | $1,462/year | Varies | Extensive discounts | $122/month |

| USAA | $1,588/year | Varies | Military focus | $132/month |

| State Farm | $2,554/year | Varies | Local agent support | $213/month |

Each company’s rates vary based on personal factors. Always compare personalized quotes for the most accurate pricing.

Comprehensive Coverage Plans

Alaska’s rugged terrain calls for unique insurance needs. Comprehensive coverage plans are vital for drivers in the state. They protect against non-collision events like theft, vandalism, and natural disasters. In 2025, choosing the best car insurance with a solid comprehensive plan in Alaska is crucial.

Importance Of Comprehensive Coverage In Alaska

Alaska’s weather and wildlife pose risks to vehicles. Comprehensive coverage is not just an option; it’s a necessity. It covers damages from events beyond traffic accidents. This includes moose collisions, which are common in Alaska, and protection from severe weather conditions.

- Protection from wildlife collisions

- Cover for weather-related damage

- Peace of mind for vehicle owners

Comparing Plans: What To Look For

When comparing car insurance plans, focus on coverage details and cost. Look for plans that balance affordability with extensive coverage. Discounts and digital tools can add value.

| Insurance Company | Average Full Coverage | Unique Features |

|---|---|---|

| Progressive | $1,614/year | Name Your Price Tool |

| Geico | $1,462/year | Discounts and digital tools |

| USAA | $1,588/year | Military-focused service |

| State Farm | $2,554/year | Local agent support |

Choose a plan that suits your budget and needs. Always check for the latest rates and personalized quotes to get accurate pricing.

Affordability And Pricing

Choosing the right car insurance is crucial. Price matters. In Alaska, finding affordable car insurance that also offers great coverage can be a challenge. Let’s explore how to balance cost and coverage effectively.

Average Insurance Costs In Alaska

Car insurance prices vary in Alaska. On average, full coverage costs $2,401 per year. For minimum coverage, it’s $497 per year. These numbers help set a baseline for what Alaskans might expect to pay.

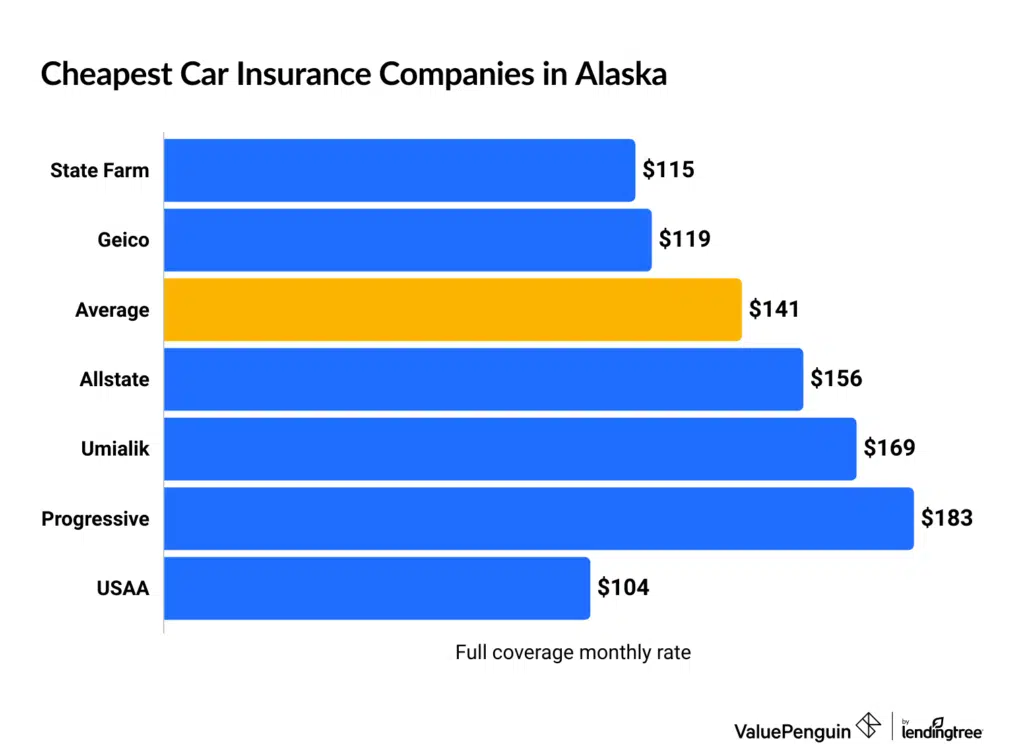

Finding Cheapest Car Insurance In Alaska: Balancing Cost And Coverage

Finding the best value involves looking at both cost and coverage. Don’t just look for the cheapest option. Consider what you get for your money.

- Progressive offers a Name Your Price Tool. It costs $1,614/year. This lets you control your budget.

- Geico is known for low rates and discounts. Their average is $1,462/year.

- USAA serves military families. They provide excellent service for $1,588/year.

- State Farm gives local agent support. Their rate is $2,554/year.

Remember, the best insurance offers good coverage at a fair price. Compare what each company offers. Think about discounts, digital tools, and support. Choose what fits your needs and budget best.

Discounts And Savings Opportunities

Finding the best car insurance in Alaska for 2025 means not just looking at coverage but also how you can save money. Discounts play a huge role in reducing your premiums. Let’s explore the common discounts Alaskan insurers offer and share tips to maximize your savings.

Common Discounts Offered By Alaskan Insurers

Several discounts can lower your car insurance costs. Key discounts include:

- Safe driver discounts for those with clean driving records.

- Military discounts offered by companies like USAA, catering specifically to service members.

- Multi-policy discounts when you bundle car insurance with other policies like home insurance.

- Government employee discounts, particularly notable with Geico.

Tips For Maximizing Savings On Premiums

Reducing your insurance premiums is possible with the right strategies. Consider these tips:

- Compare quotes from leading providers like Geico, USAA, Progressive, and State Farm to find the best rates.

- Use digital tools to manage your policy and track safe driving habits, potentially lowering your rates.

- Bundle different types of insurance for multi-policy discounts.

- Ask about additional discounts that may apply to your situation.

Remember, always check for the latest information as rates can fluctuate. For the most accurate pricing, compare personalized quotes.

Credit: www.caranddriver.com

Unique Features Of Alaskan Car Insurance

Alaska’s car insurance market stands out in 2025. With harsh weather conditions and remote areas, insurers tailor policies to meet these unique challenges. Leading providers have responded with custom features, ensuring Alaskans receive optimal coverage and support.

Coverage For Harsh Weather Conditions

Alaskan insurers recognize the impact of severe weather on vehicles. Comprehensive policies in 2025 are designed to protect against these risks. From ice damage to collision with wildlife, the right coverage is critical. Below are key coverage options:

- Ice and snow damage: Repairs for weather-related harm.

- Wildlife collisions: Coverage for accidents involving animals.

- Flood damage: Protection against sudden water ingress.

Roadside Assistance And Additional Perks

Alaskan car insurance goes beyond typical coverage. In 2025, policies often include roadside assistance to help with unexpected breakdowns, especially in remote areas. Here are some additional perks:

| Insurance Provider | Roadside Assistance | Additional Perks |

|---|---|---|

| Progressive | Included in full coverage | Name Your Price Tool |

| Geico | Optional add-on | Digital tools for easy management |

| USAA | Standard for military | Discounts for military families |

| State Farm | Available for all policies | Local agent support |

Customer Service And Claims Processing

Finding the best car insurance in Alaska means looking beyond the price. Customer service and the ease of claims processing are crucial. They can turn a stressful event into a manageable one. Let’s dive into what makes a provider stand out in these areas.

Evaluating Insurer Responsiveness And Support

The right insurer offers more than good rates. They provide support when you need it most. A quick response can make all the difference.

- Geico and USAA lead with digital tools for fast help.

- State Farm’s local agents offer personalized support.

- Progressive’s Name Your Price Tool gives control over policy costs.

With rates starting at $497/year for minimum and $2,401/year for full coverage, insurers balance affordability with quality service.

Real User Experiences With Claims In Alaska

Personal stories from Alaskans highlight the real-world performance of insurers.

| Insurer | Annual Rate | User Feedback |

|---|---|---|

| Progressive | $1,614 | Positive reviews for ease of use and claim support. |

| Geico | $1,462 | Known for quick claim resolution and discounts. |

| USAA | $1,588 | High praise from military families for tailored support. |

| State Farm | $2,554 | Appreciation for local agent help and a useful app. |

These experiences show the value of excellent service in claim situations. Remember, rates can change. Always compare current quotes.

Technology And User Experience

Exploring car insurance in Alaska for 2025 reveals a tech-driven landscape. Digital innovation enhances user experience. Insurers now offer tools for easy policy management. Expect seamless online services from top insurers like Geico, USAA, Progressive, and State Farm.

Digital Tools For Insurance Management

The best car insurance providers in Alaska for 2025 emphasize digital efficiency. Policyholders manage accounts effortlessly. Features include online bill pay, claim filing, and policy updates. Real-time data ensures informed coverage decisions.

- Geico and Progressive lead with user-friendly interfaces.

- USAA offers tools tailored for military families.

- State Farm combines digital convenience with local agent support.

Mobile Apps And Online Resources

Insurers in Alaska stay ahead with mobile apps. These apps provide on-the-go policy access. Users view ID cards, file claims, and more from their phones. Online resources offer insurance education and support.

| Provider | App Features |

|---|---|

| Progressive | Name Your Price tool, rate comparison |

| Geico | Discounts, digital tools, budget management |

| USAA | Customer service, military-specific resources |

| State Farm | Agent interaction, digital app efficiency |

Pros And Cons Of Top Picks

Choosing the best car insurance in Alaska for 2025 requires understanding each provider’s strengths and weaknesses. Insurers like Geico, USAA, Progressive, and State Farm lead the pack. Yet, they offer different experiences to Alaskan drivers. Let’s delve into what makes each insurer stand out and what could be better.

Strengths And Weaknesses Of Leading Insurers

- Progressive: Known for its Name Your Price Tool, Progressive allows drivers to customize premiums to their budgets. Its rate comparison feature helps you find competitive prices.

- Geico: Geico excels in providing budget-friendly policies with a range of discounts. Its digital tools make policy management straightforward.

- USAA: Exclusively serving military personnel, USAA focuses on exceptional customer service and tailored military benefits.

- State Farm: With a strong network of local agents and a highly-rated app, State Farm is great for personalized service.

Each insurer has its drawbacks. Progressive and State Farm may have higher rates, while USAA’s services are limited to the military community. Geico, while affordable, might not offer the same level of personal agent support as State Farm.

Balancing Coverage And Cost: A Closer Look

| Insurer | Average Full Coverage | Average Minimum Coverage | Monthly Cost |

|---|---|---|---|

| Progressive | $1,614/year | $497/year | $135/month |

| Geico | $1,462/year | $497/year | $122/month |

| USAA | $1,588/year | $497/year | $132/month |

| State Farm | $2,554/year | $497/year | $213/month |

Finding the right balance between coverage and cost is key. Progressive and Geico often offer the best rates. However, don’t overlook USAA and State Farm, especially if you value specialized services or local support. Remember, rates can change, so always seek the latest quotes for an accurate comparison.

Credit: www.carinsurance.org

Recommendations For Specific Drivers In Alaska

Finding the right car insurance in Alaska requires consideration of individual needs. Whether you’re a new driver, facing high risks, or managing a family fleet, the market has options to suit. Let’s explore insurance choices tailored for specific Alaskan drivers in 2025.

Best Options For New Drivers

Geico stands out for new drivers, offering competitive rates and a user-friendly experience. With an average annual premium of $1,462, new drivers can benefit from Geico’s range of discounts and digital tools, making it an affordable and convenient option.

Top Insurance For High-risk Drivers

High-risk drivers might prefer Progressive for their innovative tools. Progressive’s Name Your Price Tool helps those with a tight budget, while their competitor rate comparisons ensure you’re getting a good deal at an average of $1,614 per year.

Optimal Choices For Families And Multiple-car Owners

State Farm offers the best mix for families and multi-car owners. Despite a higher average rate of $2,554 yearly, the local agent support and a high-rated digital app can simplify managing multiple policies. USAA is also a top pick for military families, with tailored services at $1,588 yearly.

| Provider | Average Annual Premium | Notable Feature |

|---|---|---|

| Geico | $1,462 | Budget-friendly, Great for New Drivers |

| Progressive | $1,614 | Name Your Price Tool, For High-Risk Drivers |

| State Farm | $2,554 | Local Agent Support, Ideal for Families |

| USAA | $1,588 | Military-Specific Needs, Family-Friendly |

Conclusion: Making An Informed Choice

Finding the right car insurance in Alaska requires careful consideration. This summary will help you make an informed decision for your needs in 2025.

Recap Of Top Car Insurance Picks For 2025

- Geico: Known for its budget-friendly rates and discounts.

- USAA: Best for military families, noted for service and support.

- Progressive: Offers unique tools like the Name Your Price Tool.

- State Farm: Combines digital convenience with local agent support.

These providers stand out in the Alaskan insurance market, each with unique benefits.

Next Steps: How To Secure The Best Insurance For Your Needs

- Review your driving habits and coverage needs.

- Consider budget constraints and desired coverage level.

- Compare updated quotes from top providers.

- Check for discounts you may qualify for.

- Contact insurers for any questions on policies or refunds.

Start with these steps to secure a policy that fits your situation.

Frequently Asked Questions

What Determines Car Insurance Rates In Alaska?

Insurance rates in Alaska depend on multiple factors. These include the driver’s age, driving record, type of vehicle, and coverage level. Location within Alaska also affects rates due to varying risk of accidents or theft. Insurers assess these to calculate premiums accurately.

How To Find Cheap Car Insurance In Alaska?

To find affordable car insurance in Alaska, start by comparing quotes from several providers. Additionally, consider increasing your deductible, maintaining a clean driving record, and applying for any available discounts. Bundling policies can also lead to savings. Always shop around for the best deal.

What Coverage Is Mandatory For Alaskan Drivers?

Alaskan law requires drivers to have liability insurance. This includes both bodily injury and property damage coverage. Specifically, the minimums are $50,000 for bodily injury per person, $100,000 for bodily injury per accident, and $25,000 for property damage. It’s essential for compliance and financial protection.

Can Weather Affect My Car Insurance Rates In Alaska?

Yes, weather can impact car insurance rates in Alaska. Harsh winter conditions increase the risk of accidents, leading insurers to possibly adjust premiums. Drivers in areas prone to severe weather might face higher rates due to the increased risk of claims.

Conclusion

Choosing the right car insurance in Alaska for 2025 need not be tough. Geico, USAA, Progressive, and State Farm stand out with excellent offerings. Each company brings unique features, from budget-friendly rates to military-specific support. Remember, average costs like $2,401 for full coverage give a starting point, but your quote might differ.

Discounts can help save money, and digital tools make managing your policy simple. Local agents and online support ensure you’re covered, no matter your preference. For the best deal, compare quotes tailored to you. Get the insurance that fits your life in Alaska.

Don’t wait; start exploring these top options today.