Finding affordable and Cheap Home Insurance Companies for Seniors in Florida can be a challenge, especially for seniors in Florida. As costs rise, seniors need reliable options that fit their budget.

For seniors living in Florida, securing affordable home insurance is essential. With fixed incomes and unique needs, finding a policy that offers both affordability and comprehensive coverage can be difficult. Home insurance provides financial security against unforeseen events, such as natural disasters or accidents.

Seniors, often on retirement income, must balance costs with the need for sufficient protection. Understanding the factors that influence insurance rates and knowing where to look can make this process easier. This blog post will guide you through the key aspects of choosing affordable home insurance and highlight some of the best companies offering budget-friendly options for seniors in Florida.

Credit: www.worthinsurance.com

Table of Contents

ToggleIntroduction: Why Seniors In Florida Need Affordable Home Insurance

Seniors in Florida face unique challenges. Affordable home insurance helps protect their homes and budgets. Discover the best options today.

Retirement in Florida often means sunshine, beautiful beaches, and a relaxed lifestyle. But alongside these joys, seniors must also consider their home insurance needs. Affordable home insurance is crucial for seniors living on a fixed income. Let’s explore why cheap home insurance is essential for seniors in Florida.

The Financial Constraints Of Seniors

Many seniors live on a fixed income. It’s vital to manage expenses carefully. Here are key points to consider:

- Limited Retirement Savings: Many seniors rely on fixed pensions or social security.

- Rising Living Costs: Expenses like healthcare and daily needs can increase over time.

- Unexpected Home Repairs: Older homes may need more maintenance, adding to costs.

The Impact Of Florida’s Weather

Florida’s weather can be unpredictable. This makes home insurance even more important. Key weather-related factors include:

- Hurricanes: Florida is prone to hurricanes, causing significant damage.

- Flooding: Heavy rains and storms can lead to flooding.

- High Humidity: This can cause mold and mildew issues in homes.

The Importance Of Security

Home insurance provides peace of mind. It ensures that seniors’ homes are protected. Here’s why security is crucial:

- Protection Against Theft: Insurance covers losses due to burglary.

- Liability Coverage: It helps if someone gets injured on the property.

- Coverage for Natural Disasters: Insurance can cover damages from events like storms.

Choosing The Right Insurance

Selecting the best insurance requires careful consideration. Here are some tips:

- Compare Quotes: Get quotes from multiple providers to find the best deal.

- Check for Discounts: Some companies offer discounts for seniors.

- Read Reviews: Look at customer reviews to gauge the reliability of the insurer.

Final Thoughts On Affordable Home Insurance

Affordable home insurance is essential for seniors in Florida. It protects against financial strains and weather-related damages. By understanding the needs and options, seniors can make informed decisions about their home insurance.

Why Seniors In Florida Struggle With Home Insurance

Seniors in Florida face high home insurance costs due to increased hurricane risks. Finding affordable insurance companies can be challenging.

As seniors in Florida search for affordable home insurance, they often face unique challenges. Understanding these obstacles can help in finding better solutions.

High Risk Of Natural Disasters

Florida’s weather conditions can be severe. This affects insurance rates:

- Hurricanes: Increase the risk of property damage.

- Flooding: Leads to higher premiums.

- Storm Surge: Adds additional costs to coverage.

Fixed Incomes

Many seniors live on limited budgets. This impacts their ability to afford insurance:

- Retirement Income: Often lower than working wages.

- Medical Expenses: Can limit available funds for other needs.

- Rising Costs: Insurance premiums can outpace fixed incomes.

Older Homes

Older properties can be harder to insure. This is due to several factors:

- Outdated Systems: Older plumbing and electrical systems increase risk.

- Maintenance Issues: Older homes may need more repairs.

- Building Codes: Older homes might not meet current standards.

Limited Coverage Options

Seniors may find fewer insurance choices. This limits their ability to find affordable rates:

- Specialized Policies: Not all insurers offer policies tailored for seniors.

- High-Risk Areas: Insurance companies may avoid areas prone to disasters.

- Market Availability: Fewer options can lead to higher prices.

Understanding these struggles helps in navigating the complexities of home insurance for seniors in Florida. By being informed, seniors can better manage their insurance needs.

Key Factors For Choosing Affordable Senior Home Insurance

Finding affordable senior home insurance in Florida involves comparing rates, checking coverage options, and reading customer reviews. Choose companies known for their reliability and good customer service.

Affordable home insurance can be crucial for seniors in Florida. With the right plan, they can save money while ensuring their homes are protected. Here are key factors to consider.

Coverage Options

Different insurers offer varied coverage. It’s essential to understand what each plan includes.

- Dwelling coverage: Protects the structure of the home.

- Personal property coverage: Covers belongings inside the house.

- Liability protection: Offers coverage if someone is injured on your property.

- Additional living expenses: Helps with costs if the home is uninhabitable.

Deductibles

Deductibles impact premiums. Knowing how they work can save money.

- Higher deductibles: Often result in lower premiums.

- Lower deductibles: Usually mean higher premiums but less out-of-pocket costs during a claim.

- Balance: Find a deductible that suits your financial situation.

Discounts And Savings

Insurers often provide discounts. These can significantly reduce costs.

- Bundling: Combine home and auto insurance for a discount.

- Safety features: Homes with security systems may get lower rates.

- Senior discounts: Some companies offer reduced rates for seniors.

Customer Service And Support

Good customer service is vital. It ensures smooth claim processes and support.

- Read reviews: Check other seniors’ experiences with the insurer.

- Accessibility: Ensure the insurer offers easy contact methods.

- Claims process: A quick and efficient process is essential.

Financial Stability

Choose an insurer with strong financial health. This ensures they can pay claims.

- Ratings: Look for ratings from agencies like A.M. Best or Moody’s.

- Longevity: Established companies often have better financial stability.

- Reputation: Consider the insurer’s history and customer satisfaction.

Policy Customization

Every senior has unique needs. Customizable policies can be more beneficial.

- Add-ons: Options like flood or earthquake coverage.

- Limits: Adjust coverage limits to match your needs.

- Flexibility: Ensure the policy can adapt to life changes.

Making informed choices helps seniors find the best insurance. By considering these factors, they can secure affordable, comprehensive coverage.

Top 10 Cheap Home Insurance Companies For Seniors In Florida

Here is a list of top 10 affordable home insurance options for seniors in Florida. These top 10 companies provide reliable coverage at budget-friendly rates. Protect your home without breaking the bank.

Finding affordable home insurance can be tough, especially for seniors. Florida’s unique weather conditions make it even more challenging. But don’t worry, we’ve got you covered. Here are the top 10 cheap home insurance companies for seniors in Florida.

1. State Farm

State Farm offers reliability and affordable rates. They provide comprehensive coverage options tailored for seniors.

- Customizable policies: Choose what suits your needs.

- Discounts available: Save more with bundling and safety features.

- Strong financial stability: Trusted by many for their claims process.

2. Allstate

Allstate is known for its excellent customer service. They have various discount options making it budget-friendly for seniors.

- Easy claim process: Hassle-free and quick.

- Multiple coverage options: Pick the best for your home.

- Senior discounts: Special rates for older adults.

3. Liberty Mutual

Liberty Mutual offers personalized service and competitive pricing. Their policies cater to the specific needs of seniors.

Liberty Mutual offers personalized service and competitive pricing. Their policies cater to the specific needs of seniors.

4. Usaa

USAA is ideal for veterans and their families. They provide affordable rates and excellent customer service.

- Exclusive to military: Tailored policies for veterans.

- Affordable premiums: Keeps costs low for seniors.

- Top-notch service: High satisfaction rates.

5. Farmers Insurance

Farmers Insurance provides various coverage options with affordable rates. They are known for their excellent customer support.

Farmers Insurance provides various coverage options with affordable rates. They are known for their excellent customer support.

6. Nationwide

Nationwide offers a wide range of discounts and flexible policy options. It is known for its reliable service.

- Bundling discounts: Save by combining policies.

- Flexible coverage: Customize your plan.

- Great customer service: Always ready to help.

7. American Family Insurance

American Family Insurance is known for its personalized approach. They offer various discounts to keep premiums low for seniors.

American Family Insurance is known for its personalized approach. They offer various discounts to keep premiums low for seniors.

8. Progressive

Progressive provides competitive pricing and numerous discount options. They are a popular choice among seniors.

- Competitive rates: Affordable for seniors.

- Multiple discounts: Save more on premiums.

- Easy online tools: Manage your policy online.

9. Aaa

AAA offers reliable coverage options and excellent customer service. They also provide various discounts for seniors.

AAA offers reliable coverage options and excellent customer service. They also provide various discounts for seniors.

10. Chubb

Chubb is known for its high-quality coverage and excellent claims process. They provide tailored options for seniors.

- High-quality coverage: Comprehensive plans.

- Excellent claims process: Easy and efficient.

- Tailored policies: Meet seniors’ specific needs.

How Seniors Can Save On Florida Home Insurance

Seniors in Florida can find cheap home insurance by exploring companies offering senior discounts. These insurers often provide lower rates and special deals.

Finding affordable home insurance in Florida can be challenging, especially for seniors. Here are some strategies to help seniors save on their home insurance premiums.

Shop Around For Quotes

Comparing multiple quotes can lead to big savings. Different companies offer different rates:

- Request quotes from various insurers: This helps compare prices.

- Use insurance comparison websites: These tools simplify the process.

- Consider local agents: They may have insights into regional discounts.

Increase Your Deductible

Opting for a higher deductible can lower your premiums. This means paying more out of pocket for claims:

- Choose a higher deductible: This reduces monthly premium costs.

- Evaluate risk: Ensure you can afford the deductible if a claim arises.

Bundle Insurance Policies

Combining home and auto insurance can lead to discounts. Many insurers offer bundled packages:

- Bundle home and auto insurance: This often results in lower premiums.

- Check for additional bundling options: Some companies offer multi-policy discounts.

Improve Home Security

Enhancing your home’s security can reduce insurance costs. Insurers favor homes with advanced safety features:

- Install security systems: Alarm systems deter theft and lower premiums.

- Upgrade locks and windows: Reinforced locks and secure windows add protection.

Maintain A Good Credit Score

A strong credit score can influence insurance rates. Insurers view good credit as a sign of responsibility:

- Pay bills on time: This helps maintain a good credit score.

- Monitor credit reports: Regular checks ensure accuracy and help catch errors.

Take Advantage Of Senior Discounts

Many insurers offer discounts specifically for seniors. These can provide significant savings:

- Inquire about senior discounts: Ask if the insurer offers special rates for seniors.

- Join senior organizations: Membership can sometimes lead to insurance discounts.

By following these tips, seniors can find affordable home insurance in Florida. Saving on premiums is possible with a little effort and research.

Common Mistakes Seniors Make (and How To Avoid Them)

Many seniors in Florida overlook the importance of comparing home insurance options. This can lead to higher costs. Researching cheap home insurance companies can save money and provide better coverage.

Finding affordable home insurance as a senior in Florida can be tricky. Many seniors make costly mistakes. Here’s how to avoid them.

Overlooking Discounts

Many seniors miss out on discounts:

- Age-related discounts: Some insurers offer lower rates for seniors.

- Bundling policies: Combining home and auto insurance can save money.

- Home safety upgrades: Adding alarms or storm shutters might reduce premiums.

Not Comparing Enough Quotes

Choosing the first quote may not be wise. Here’s why comparing is crucial:

- Different rates: Insurers have varied pricing for the same coverage.

- Policy features: Some companies offer better perks.

- Customer service: Reviews can reveal which insurers are reliable.

Underinsuring The Home

Some seniors opt for minimal coverage to cut costs. This can be risky.

- Full replacement cost: Ensure the policy covers the home’s total rebuild cost.

- Personal belongings: High-value items should be adequately insured.

- Liability coverage: Protects against lawsuits from accidents on your property.

Ignoring Policy Exclusions

Policies often have exclusions. Being unaware can lead to surprises.

- Natural disasters: Check if hurricanes and floods are covered.

- Maintenance issues: Regular home upkeep might not be insured.

- Personal property limits: Some items, like jewelry, may need additional coverage.

Forgetting To Update Policies

Life changes can affect insurance needs. Regular updates are necessary.

- Home renovations: Inform the insurer of any major upgrades.

- Changes in occupancy: Let the insurer know if you have new tenants.

- Value increases: Ensure coverage reflects the current home value.

Not Reading The Fine Print

Many skip over the details in their policies:

- Deductibles: Know what you’ll pay out-of-pocket before coverage kicks in.

- Coverage limits: Understand the maximum amount the insurer will pay.

- Terms and conditions: Be clear on what is and isn’t covered.

Relying Solely On Price

Choosing the cheapest option can be tempting. But it’s not always best.

- Quality of service: Some insurers offer better customer support.

- Claims process: Check if the insurer has a smooth claims procedure.

- Coverage comprehensiveness: Ensure all your needs are met.

Conclusion: Secure Affordable Coverage Without Sacrificing Protection

Find cheap home insurance companies for seniors in Florida. Get affordable coverage without sacrificing protection for your home. Choose wisely and save money.

Finding affordable home insurance in Florida is crucial for seniors. It’s about securing your property without breaking the bank. It’s possible to achieve this balance, ensuring peace of mind and financial stability.

Understand Your Coverage Needs

Identify what you need from your home insurance. Here’s a quick list to consider:

- Home Structure: Protection against damage to your house.

- Personal Belongings: Coverage for your possessions.

- Liability Protection: In case someone gets hurt on your property.

- Additional Living Expenses: Covers costs if you must live elsewhere temporarily.

Shop Around For Quotes

Comparing quotes from different insurers is vital. It helps you find the best deal.

- Use Online Tools: Many websites offer comparison tools.

- Speak to Agents: Sometimes, a conversation can reveal discounts.

- Read Reviews: Look for feedback from other seniors.

Look For Senior Discounts

Many insurance companies offer discounts for seniors. Here’s what to look for:

- Age-Based Discounts: Reduced rates for older adults.

- Loyalty Discounts: Savings for long-term customers.

- Bundling Discounts: Lower rates if you bundle home and auto insurance.

Consider Higher Deductibles

Raising your deductible can lower your premium. This means paying more out-of-pocket if you file a claim, but enjoying lower monthly costs. Evaluate your financial situation to decide if this is a good option for you.

Maintain A Good Credit Score

Your credit score can affect your insurance rates.

- Pay Bills on Time: Ensure timely payments.

- Check Credit Reports: Look for errors and correct them.

- Reduce Debt: Lowering your debt can improve your score.

Seek Professional Advice

Sometimes, expert advice can make a difference. Consider speaking with:

- Insurance Brokers: They can offer personalized recommendations.

- Financial Advisors: They can help you understand the financial impact.

- Trusted Friends: Recommendations from peers can be valuable.

Review Your Policy Annually

Your needs and circumstances can change. Reviewing your policy every year ensures it still fits your needs. Adjust coverages as necessary, and look for new discounts or better rates. This proactive approach can save money and keep you protected.

Credit: www.youtube.com

Frequently Asked Questions

Do Seniors Get A Discount On Homeowners Insurance In Florida?

Yes, some insurance companies in Florida offer discounts to seniors on homeowners insurance. Check with your insurer for details.

Who Has The Cheapest Home Insurance For Seniors?

Allstate, State Farm, and Liberty Mutual often offer affordable home insurance for seniors. Compare quotes to find the best rate.

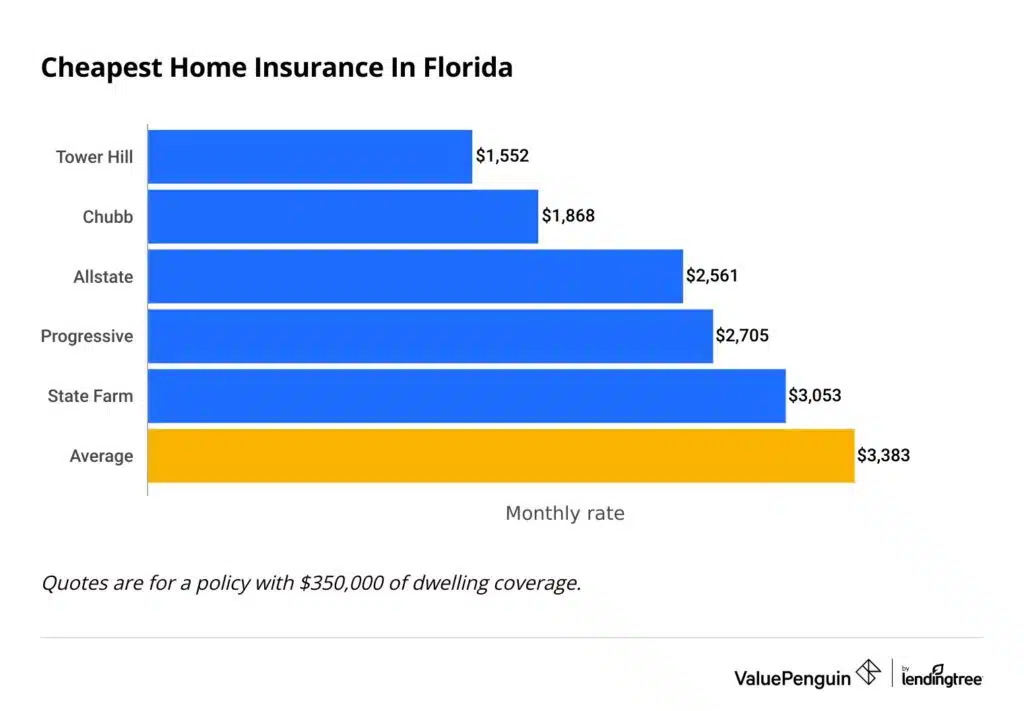

Who Offers The Cheapest Homeowners Insurance In Florida?

State Farm offers some of the cheapest homeowners insurance rates in Florida. Compare quotes for the best deal.

Is There A Senior Discount For Homeowners Insurance?

Yes, some insurance companies offer senior discounts for homeowners insurance. Check with your provider for eligibility and savings.

Conclusion

Finding affordable home insurance in Florida can be challenging for seniors. It’s essential to compare options and understand key factors. Look at top companies and save smartly. Avoid common mistakes to secure coverage without compromising protection. Stay informed and choose wisely for your peace of mind.