As a pet owner, unexpected vet bills can be a big worry. The ASPCA says caring for a pet costs over $1,400 a year. Without insurance, you might face huge bills from vet visits, costing from $374 to over $1,285.

But, the right pet insurance can help. It offers affordable plans and reliable coverage for pets. You can get discounts for more than one pet. This way, you can give your pets the care they need without spending too much and this guide will help you to find best pet insurance USA for your loving pets.

Table of Contents

ToggleKey Takeaways

- The average yearly cost of pet ownership includes medical expenses, food, and care.

- Pet insurance ensures your pet receives uninterrupted medical care.

- Affordable plans including discounts and reimbursement options exist.

- Choosing the best pet insurance requires understanding your pet’s unique needs.

- Emergency vet bills can lead to financial strain without proper coverage.

Basics of Pet Insurance

Pet insurance is like a safety net for your pet’s vet bills. It helps you financially when unexpected vet costs come up. Knowing how pet insurance works is key to making good choices.

It’s a deal between you and an insurance company. They help pay for vet bills from accidents or illnesses. With vet costs going up, insurance can help ease the financial stress.

What is Pet Insurance?

Pet insurance is a policy for vet care costs from accidents or illnesses. It covers things like vet visits, tests, surgeries, and meds. Policies vary, but most are accident-illness plans.

These plans are very common, making up almost all insurance plans. But, it doesn’t cover pre-existing conditions. Some providers might cover certain conditions after a wait without symptoms.

How Does Pet Insurance Work?

To understand how pet insurance works, you need to know how to buy and claim. First, you pay a premium based on your pet’s details and coverage. Then, when you go to the vet, you pay and claim later.

Claims are usually paid back in 5 to 9 days. Coverage varies, with some plans paying 80% to 100% of vet bills after a deductible. Remember, there are extra costs like co-insurance and waiting periods.

Why Pet Insurance is Essential for Pet Owners

Caring for a pet is a big job. It includes making sure they are healthy and happy. Pet insurance is key for financial security. It helps cover the high costs of vet care.

Financial Security Against Unexpected Vet Bills

Vet bills can be very high. They can go over $1,500 easily. Pet insurance covers 80-90% of these costs. This gives pet owners peace of mind.

Getting pet insurance early is smart. It helps avoid big bills later. More pets are insured now, showing it’s a good idea.

Ensuring Regular Veterinary Care

Regular vet visits are important for pets. Pet insurance helps with these visits and ongoing care. It makes it easier to keep pets healthy.

Insurance encourages early check-ups. This can catch health problems early. It also helps with costs of dental care and surgeries.

| Type of Expense | Average Cost | Insurance Coverage |

|---|---|---|

| Emergency Vet Bill | $1,500+ | 80-90% |

| Routine Check-up | $50-$300 | Varies |

| Dental Care | $300-$1,000 | Possible Add-on |

| Unexpected Surgery | $2,000+ | 80-90% |

Pet insurance is a big help. It keeps pets healthy and owners financially secure. It’s a smart investment for a happy pet.

Best Pet Insurance USA: Top Providers Overview

Choosing the right pet insurance provider is important. There are many options in the market. Each provider offers different plans, features, and prices. This helps pet owners find the best policy for their pets.

Let’s look at some of the top providers in the United States. We’ll see what makes them stand out.

Comparative Analysis of Leading Insurers

| Provider | Rating | Annual Coverage | Reimbursement Rates | Sample Monthly Rates for Dogs (Age 2 vs. Age 8) |

|---|---|---|---|---|

| ASPCA | 5/5 | Unlimited | 70%, 80%, 90% | $31 (Age 2) / $73 (Age 8) |

| Embrace | 5/5 | Unlimited | 70%, 80%, 90% | $44 (Age 2) / $80 (Age 8) |

| Hartville | 5/5 | Unlimited | 70%, 80%, 90% | $32 (Age 2) / $77 (Age 8) |

| MetLife | 5/5 | Unlimited | 50% – 90% | $42 (Age 2) / $78 (Age 8) |

Highlights of Each Provider’s Offerings

- ASPCA: Known for its comprehensive offering with unlimited annual maximum coverage and flexible reimbursement rates.

- Embrace: Offers similar unlimited coverage and allows pet owners to choose reimbursement percentages based on their needs.

- Hartville: Matches competitors with unlimited coverage, competitive pricing, and variety in reimbursement options.

- MetLife: Stands out for its robust customer satisfaction, along with reasonable premiums and flexible coverage options.

Coverage Types Offered by Pet Insurance Plans

When looking at pet insurance, it’s key to know the different coverage types. These plans aim to meet various needs, helping pet owners find the perfect match for their pets. We’ll look at accident and illness coverage, and also wellness and preventive care options.

Accident and Illness Coverage

Accident and illness coverage is very detailed. It covers a wide range of issues, from small injuries to big illnesses like cancer. In 2022, the average monthly cost for this coverage was $53.34 for dogs and $32.25 for cats.

It’s important to know about annual limits, which can be from $2,500 to unlimited. This helps in picking the right policy.

Wellness and Preventive Care Options

Wellness care is a great add-on to basic coverage. It includes things like vaccinations, spaying/neutering, and dental cleanings. Pet owners can choose this at an extra monthly cost.

This coverage is a smart choice because it helps prevent bigger health problems. The average cost for routine care is about $225 for dogs and $160 for cats. It’s a good investment for your pet’s health.

| Coverage Type | Details | Average Monthly Premium |

|---|---|---|

| Accident and Illness Coverage | Covers unexpected medical costs from accidents and illnesses. | $53.34 (Dogs), $32.25 (Cats) |

| Accident-Only Coverage | For treatment of injuries only; excludes illnesses. | $16.70 (Dogs), $10.18 (Cats) |

| Wellness Care | Routine care including check-ups and preventative treatments. | Varies based on additional plan choices |

Top Pet Insurance Providers in the USA

I looked for the best pet insurance and found several top companies. They offer different coverage levels and special benefits for pets. Here are some of the leading options.

ASPCA: Broad Coverage Options

ASPCA pet insurance has many coverage options. It covers accidents, illnesses, and hereditary conditions. There’s no age limit for signing up.

Their mobile app makes it easy to file claims. ASPCA also covers alternative therapies and behavioral issues. This gives pets a full health care approach.

Embrace: Flexible Wellness Plans

Embrace offers customizable wellness plans. You can choose from 70%, 80%, or 90% reimbursement rates. This lets you pick a plan that fits your budget.

Embrace also has coverage limits from $5,000 to $30,000. This flexibility meets different needs.

Hartville: Straightforward Waiting Periods

Hartville is known for clear waiting periods. Their policy is easy to understand. This makes choosing insurance for pets simpler.

MetLife: Discounts and Customization

MetLife offers customizable plans and discounts for certain jobs. Coverage limits range from $1,000 to $25,000. This lets you tailor insurance to your needs.

Reimbursement rates are flexible too. You can choose a rate that works for your budget.

Affordable Pet Insurance Plans Available

As a pet owner, finding affordable pet insurance USA options is key. It ensures your furry friend gets the best care without financial stress. Many providers offer budget-friendly plans for different needs and budgets. It’s important to understand the costs to make a good choice.

Budget-Friendly Options for Pet Parents

Many pet owners look for affordable pet insurance. They want good coverage without high costs. Here are some notable options:

- ASPCA – Monthly costs range from $20 to $35 for dogs and $13 to $19 for cats, making it one of the cheapest options available.

- Lemonade Pet Insurance – With average monthly premiums of $28 for dogs and $14 for cats, this provider offers substantial annual coverage from $5,000 to $100,000.

- Pets Best Pet Insurance – Average monthly costs sit at $20 for dogs and $12 for cats while offering deductible options from $50 to $1,000.

- Figo Pet Insurance – Monthly rates are $26 for dogs and $14 for cats, with comprehensive policy options.

Comparison of Monthly Costs Across Providers

Looking at monthly costs from different insurers helps a lot. Here’s a comparison of average costs and annual coverage:

| Insurance Provider | Average Monthly Cost (Dogs) | Average Monthly Cost (Cats) | Annual Coverage Options |

|---|---|---|---|

| ASPCA | $20 – $35 | $13 – $19 | Varies |

| Lemonade | $28 | $14 | $5,000 – $100,000 |

| Pets Best | $20 | $12 | $5,000 – Unlimited |

| Figo | $26 | $14 | $5,000 – Unlimited |

| AKC | $45 | – | $2,500 – $10,000 |

| Nationwide | $35 | $14 | Regular Coverage |

Looking at these affordable pet insurance USA options helps me find the right plan. It fits my budget and ensures my pet gets the care they need. With the right coverage, I can rest easy knowing my pet is protected from unexpected health issues.

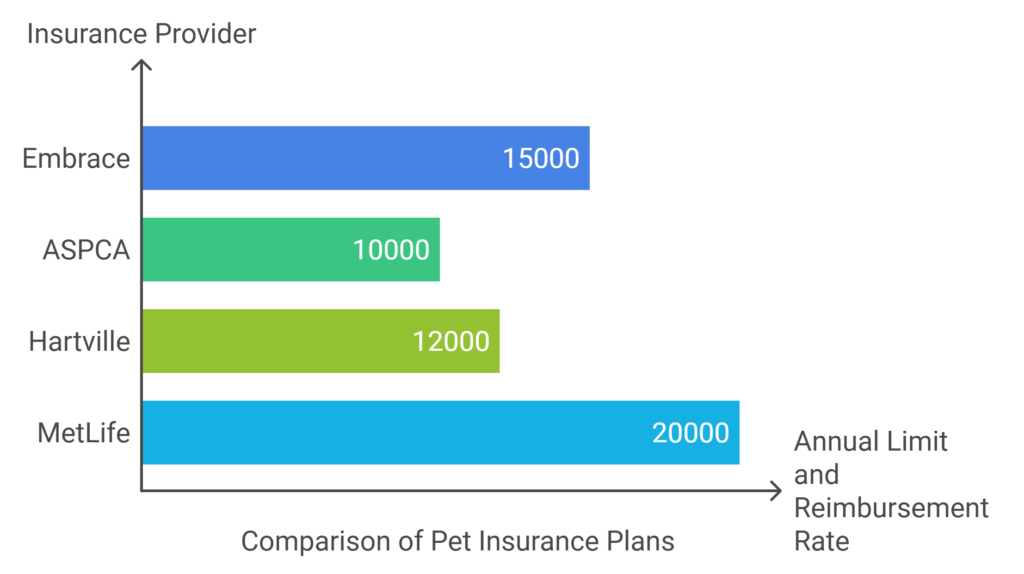

How to Compare Pet Insurance Quotes

Choosing the right pet insurance is key. I look at the annual limit and reimbursement rates to compare quotes. This helps me pick a plan that fits my pet’s needs.

Understanding Annual Limits and Reimbursement Rates

Annual limits show the most an insurer will pay in a year. Different plans have different limits, which affect costs. Reimbursement rates tell us how much of the vet bill is covered after deductibles.

Key Factors to Consider While Comparing Plans

Several things matter when I look at pet insurance quotes:

- Coverage Types: Plans range from basic to comprehensive, covering everything from accidents to routine care.

- Age of Pet: Younger pets usually cost less to insure.

- Location: Where you live can change the cost of vet care, which affects insurance quotes.

- Specific Breed Risks: Some breeds face more health problems, which can raise insurance costs.

| Provider | Annual Limit | Reimbursement Rate | Average Premium |

|---|---|---|---|

| Embrace | $15,000 | 93% | $49.99 |

| ASPCA | $10,000 | 80% | $42.50 |

| Hartville | $12,000 | 85% | $38.00 |

| MetLife | $20,000 | 90% | $61.00 |

By considering these factors, I can find the best pet insurance. This ensures my pet gets the care they need without breaking the bank.

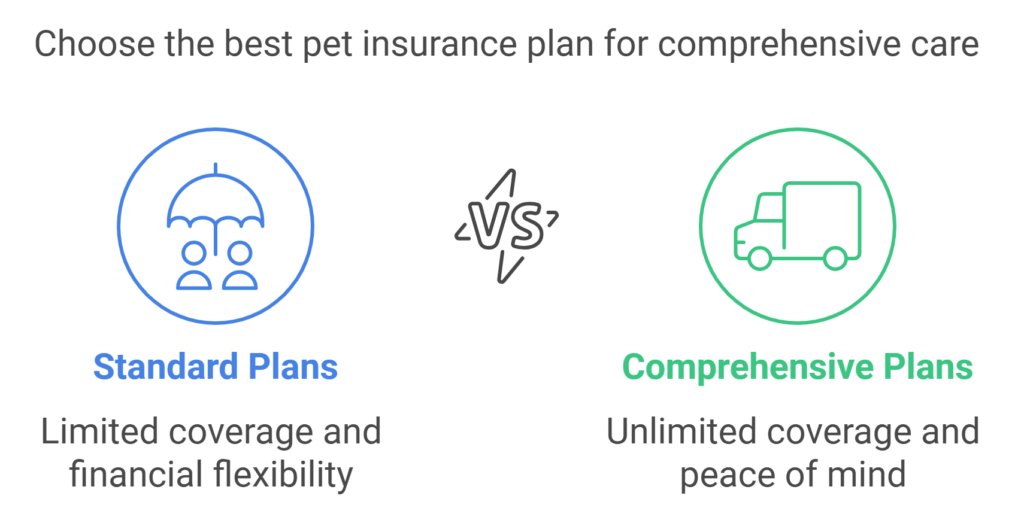

The Importance of Comprehensive Coverage

Pet insurance often goes beyond basic coverage. It includes comprehensive coverage. This is key for pet owners, offering unlimited payouts and covering breed-specific conditions.

Benefits of Unlimited Payout Options

Unlimited payout options are a big plus. They let pet owners get any treatment needed without worrying about costs. This means they can choose the best care for their pets, without money worries.

With no limits, pet owners can focus on their pets’ health, not money. This is a huge relief.

Covers Specifically Breed-Related Conditions

Comprehensive plans also cover breed-related conditions. This is vital for pets with specific health issues. It helps keep pets healthy and gives owners peace of mind.

| Coverage Feature | Standard Plans | Comprehensive Plans |

|---|---|---|

| Payout Limitations | Annual limits apply | No limits, fully funded care |

| Breed-Specific Coverage | Not typically included | Covered for specific breeds |

| Peace of Mind | Moderate | High, with extensive coverage |

| Financial Flexibility | Limited options | Unlimited treatment choices |

Pet Health Insurance Options for Different Pets

Choosing the right pet health insurance is key to keeping your pets healthy. Each pet, like dogs, cats, or exotic animals, has its own health risks. Knowing these helps owners pick the best insurance for their pets.

Best Insurance for Dogs and Cats

For dogs and cats, many insurance plans cover accidents, illnesses, and dental care. These plans help with unexpected vet bills for non-existing conditions. The cost of insurance depends on breed, age, and where you live. It’s smart to ask for a quote that fits your pet’s needs.

Coverage for Exotic Pets

Exotic pets need special insurance. Some plans are made just for them. They cover everything from regular visits to emergency care. Owners of exotic pets should look closely at their options to find the right fit.

| Type of Pet | Typical Coverage | Average Premiums |

|---|---|---|

| Dogs | Accidents, illnesses, dental issues | $143/month |

| Cats | Accidents, illnesses, hereditary conditions | $143/month |

| Exotic Pets | Emergency care, regular check-ups | Varies widely |

Pet Insurance Costs Explained

It’s important for pet owners to understand pet insurance costs. This includes monthly premiums and annual deductibles. Knowing these costs helps me choose a policy that fits my budget and protects my pet.

Annual Deductibles and Monthly Premiums

Pet insurance plans have an annual deductible, which can be $100 to $1,000. This is what I pay before my insurance starts. Monthly premiums vary a lot, based on my pet and the coverage I choose.

Dog insurance can cost $30 to $101 monthly for $5,000 coverage. Cat insurance is cheaper, from $10 to $62 monthly. This depends on the type of plan I pick.

Estimating Average Costs Based on Pet’s Breed and Age

The cost of pet insurance depends on my pet’s age and breed. For dogs, accident-only coverage can be as low as $17 monthly. Comprehensive plans can cost up to $56.

Cat insurance costs range from $10 to $32 monthly. This also depends on the coverage level. Age and health can increase costs. It’s key for pet owners to understand these factors when choosing insurance.

Pet Insurance with the Best Customer Service

Choosing pet insurance means looking at customer service too. Good support is key when emergencies happen. Many providers offer 24/7 help and quick claims, making pet owners feel secure.

24/7 Support and Fast Claims Processing

Pet owners need help fast, especially for sudden health issues. Companies like Healthy Paws and Embrace offer 24/7 support. Healthy Paws is top-rated, with a 4.6 out of 5 score on PetInsuranceReview.com.

Quick claims processing is also important. Healthy Paws usually handles claims in two days. Embrace is known for fast claims too, making it easy for pet owners.

How Customer Experience Affects Your Choice

Customer service greatly influences your choice of pet insurance. Happy customers talk about easy claims and good communication. Matty and Annie’s stories show how good service builds trust.

Sharing these experiences shows the value of reliable service. It strengthens the bond between insurers and pet owners. Choosing companies with great service and fast claims makes for a better experience.

Conclusion

Looking into the best pet insurance in the USA shows it’s key to know your pet’s needs and your budget. Options range from State Farm’s low price of $55 to Progressive’s full plans. This means pet owners can find the right coverage for their situation.

Choosing a plan that covers well and makes pet owners happy is crucial. With rising vet costs, good insurance brings peace of mind. Each company, like Nationwide and ASPCA, has its own strengths. These might include coverage types or how much they pay back.

When looking for pet insurance, it’s smart to research and compare plans. The best insurance isn’t always the most expensive. It’s about finding a good balance between cost and coverage for your pets.