Are you worried about protecting your biggest asset? Finding the right homeowners insurance can be tough. It’s hard to choose between good coverage and affordable prices.

Many providers offer low prices but lack quality service and reliable policies. State Farm homeowners insurance stands out. They offer great customer service and strong protection plans.

State Farm makes sure your home and things are safe. In this article, I’ll explain why State Farm homeowners insurance coverage is a top choice for many.

Table of Contents

ToggleKey Takeaways

- State Farm offers a range of comprehensive coverage options.

- The company has a high customer satisfaction rate.

- Discounts are available through bundling with other policies.

- Homeowners insurance from State Farm provides solid liability coverage.

- Policies can be customized to meet individual needs.

- State Farm boasts A+ ratings from the BBB and A.M. Best.

Why you choose State Farm Homeowners Insurance?

State Farm is known for its reliable homeowners insurance across the U.S. They have nearly a century of experience. Their policies protect my home and personal belongings.

They also offer liability coverage for accidents. This shows their commitment to keeping customers safe and happy.

State Farm has many coverage options. Their policies include coverage for my home, personal items, and more. I can tailor my policy to fit my needs.

They also have options for different homes, like single-family homes and farms. This makes it easy to find the right coverage for me.

State Farm has high customer satisfaction ratings. They scored 829 from JD Power. They also have a top financial strength rating from AM Best.

This makes me trust State Farm for my homeowners insurance. They offer comprehensive and reliable protection.

Comprehensive Dwelling Coverage

My homeowners insurance with State Farm has a key part called comprehensive dwelling coverage. It protects my home’s structure, including garages and other buildings on my land. This coverage helps me if damage happens from a covered event, offering help for repairs or new builds.

Knowing about this coverage is key to protecting my biggest asset.

Understanding Dwelling Coverage

This coverage guards against many dangers like wind, hail, fire, and theft. It also covers up to 10% of other structures, like fences and detached garages. State Farm updates policies yearly to match rising building costs.

It’s important to keep coverage at 80% of rebuilding costs for full replacement cost coverage. This way, I can handle unexpected damage costs without big financial hits.

Importance of Repair and Replacement

Having enough dwelling coverage is crucial. With costs going up and markets changing, I must not overlook the need for enough coverage. If I need to file a claim, knowing how dwelling coverage helps is key.

Many things affect State Farm homeowners insurance rates, like where I live, my credit score, and my claims history. State Farm’s flexible and all-encompassing approach gives me peace of mind, no matter what happens.

Robust Personal Property Coverage

State Farm’s homeowners insurance offers strong protection for my belongings. It covers theft, fire, and accidental damage. Knowing what’s covered is key to keeping my stuff safe.

What is Covered?

State Farm covers many personal items. You can expect protection for:

- Furniture and appliances

- Clothing and personal items

- Electronics and devices

- Collectibles, like comics and sports cards

- Sports equipment, for skiing or fishing

Valuable items like jewelry or fine art get extra coverage. This includes *replacement cost coverage* without depreciation.

Protection Against Theft and Damage

Having personal property coverage gives me peace of mind. If something is stolen or damaged, State Farm helps. It covers theft and damage, helping me get back what I lost.

Adding options like Broad Pair and Set coverage can help more. It’s good for unique collections or sets. Choosing the right options makes me feel safer about my valuables.

| Item Type | Standard Coverage | Optional Coverage |

|---|---|---|

| Jewelry | Limited coverage under homeowners policy | Personal articles policy for full coverage |

| Collectibles | Varies based on policy | Broad Pair and Set coverage |

| Sports Equipment | Included in personal property coverage | Specialized personal articles policy |

Reliable Liability Coverage

Liability coverage is key in the State Farm homeowners policy. It helps if someone gets hurt on my property. It covers medical costs and legal fees from disputes.

Knowing about liability coverage shows its value. It protects my assets from legal problems.

What is Liability Coverage?

This coverage has three main parts:

- Personal Liability: Covers injuries or damages to others.

- Medical Payments to Others: Pays for medical bills of guests hurt on my property.

- Additional Coverages: Covers extra costs for injuries or damage, adding to my legal protection.

Protection Against Legal Claims

The State Farm policy explains liability coverage well. It covers many things, like:

| Type of Coverage | What is Covered |

|---|---|

| Personal Liability | Injuries to guests, property damage from my mistake. |

| Medical Payments | Medical bills for hurt guests, no matter who’s at fault. |

| Umbrella Coverage | Extra liability for big claims that go over my policy limits. |

Liability coverage is in most homeowners policies. It protects against many legal issues. Knowing this coverage helps me choose the right home insurance.

Exceptional Customer Service and Claims Process

State Farm is known for its wide range of coverage options and great customer service. Many customers are very happy with their service, as shown in state farm insurance reviews. They say the support they get when filing a claim is top-notch.

High Customer Satisfaction Rates

State Farm is a big name in the market, known for quality service. People often say good things about their agents in state farm insurance reviews. They find the agents helpful and clear in explaining things.

I feel good knowing a team is ready to help when I need it most.

Streamlined Claims Handling

State Farm makes filing claims easy. You can do it online or with a local agent. This makes the process smooth.

Every day, they handle over 36,000 claims. This shows they can handle a lot and respond quickly. It makes me feel safe, even when things get tough.

| Feature | Description |

|---|---|

| Claims Handling | Online and local agent support for ease of access. |

| Customer Support | Agents are trained to provide timely and friendly assistance. |

| Daily Claims Processed | Over 36,000 claims handled daily, ensuring quick responses. |

| Satisfaction Ratings | High ratings in customer reviews for service quality. |

Customizable Coverage Options

Choosing State Farm homeowners insurance has big perks. I can make a policy that fits me perfectly. This means I get the right protection for my home.

I can pick extra coverage for emergencies, personal items, and more. If my home can’t be lived in, I have help with living expenses.

Choosing the Right Coverage for Your Needs

I can pick from many state farm options. I like that I can add inflation coverage. This keeps my insurance up to date with market values.

Replacement cost claim settlement is also a big plus. It pays for the full cost of fixing or replacing damaged items. This gives me a lot of peace of mind.

Additional Living Expenses and Emergency Coverage

Having coverage for extra living costs is a big relief. It helps when my home isn’t safe to live in. By customizing my coverage, I make sure it fits my life and budget.

| Coverage Type | Description | Benefit |

|---|---|---|

| Emergency Coverage | Protection for unforeseen expenses. | Ensures financial support during emergencies. |

| Personal Articles Coverage | Coverage for specific higher-value items. | Offers peace of mind for valuable possessions. |

| Additional Living Expenses | Covers temporary housing costs. | Reduces stress during home repairs or rebuilding. |

State Farm offers many coverage options. This makes it a top choice for homeowners. They can tailor their insurance to fit their needs well.

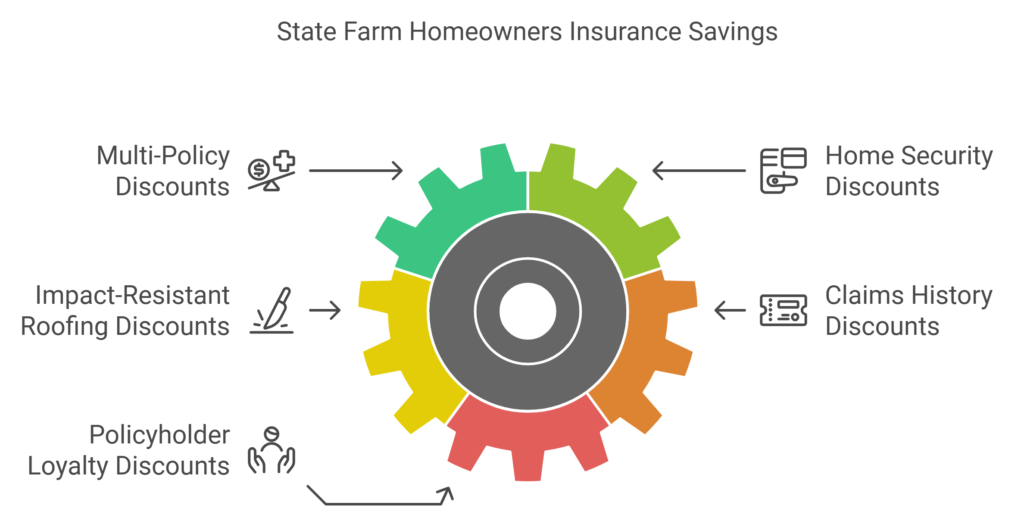

State Farm Homeowners Insurance Coverage Discounts

State Farm offers many discounts to lower my homeowners insurance costs. It’s important to know about these state farm home insurance discounts to save money. Here are some discounts I can get:

- Multi-Policy Discounts: Saving money by combining homeowners and auto insurance.

- Home Security Discounts: Getting lower rates with fire, smoke, or burglar alarms.

- Impact-Resistant Roofing Discounts: Saving more with hail-resistant shingles or class 4 shingles.

- Claims History Discounts: Lower rates if I haven’t filed a claim in three to five years.

- Policyholder Loyalty Discounts: Saving more if I’ve been a customer for a long time.

I can use the state farm home insurance premium calculator to see how much I can save. This tool shows how different discounts can help me.

When I get a homeowners insurance quote state farm offers, I ask about all discounts. I make sure I meet the requirements. Improving my home’s safety can also save me money.

Knowing about these discounts helps me get the best insurance deal. With State Farm’s help, I can have great coverage without spending too much.

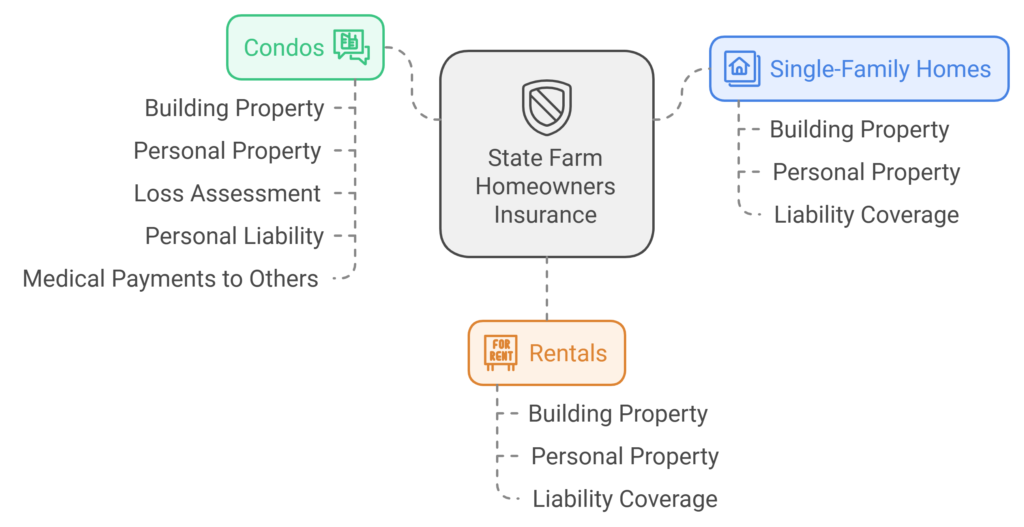

State Farm Homeowners Insurance Coverage Options

I like the many state farm homeowners insurance options. They fit different homes, like single-family homes, condos, or rentals. State Farm offers plans that meet many homeowner needs.

Home Insurance for Various Types of Properties

State farm has many insurance plans for homeowners. They cover different types of homes well. For example, condo insurance includes:

- Building property

- Personal property

- Loss assessment

- Personal liability

- Medical payments to others

Loss assessment coverage is key. It helps with costs from the condo association for shared property losses. This ensures I’m covered more than usual.

Flexible Policy Structures

It’s important to know about homeowners insurance state farm rates. I want to stay within my budget but still have good coverage. I can pick my policy limits and add extra coverage. This lets me customize for my needs.

- Options for replacement cost or depreciated loss settlement

- Customization for identity theft protection

- Earthquake coverage extensions

State Farm offers many options, but not flood insurance. That’s through the National Flood Insurance Program (NFIP). For my manufactured home, I can get direct physical loss coverage. This keeps me safe no matter what.

I can also get discounts by making my home safer. Every change I make fits state farm’s coverage options. This makes my policy personal and valuable.

Adequate Coverage for Natural Disasters

Natural disasters are big challenges for homeowners. It’s key to have good coverage. State Farm offers strong options for these risks. Knowing what’s covered and what’s not is important for your protection.

Many people don’t know that standard policies don’t cover floods and earthquakes. This can leave you at risk unless you take extra steps.

Understanding Policy Exceptions

It’s important to know what your insurance doesn’t cover. State Farm policies usually don’t cover floods or earthquakes. This means you might need extra insurance for these risks.

State Farm offers special endorsements for these risks. You can add flood or earthquake insurance to protect your home. This way, you can feel safe against unexpected events.

Flood and Earthquake Coverage Options

In places like California, natural disasters like floods and earthquakes are common. But, many people don’t have enough coverage. For example, only 13% of Californians have earthquake insurance.

Flood insurance is usually a separate policy. But knowing your home is protected is worth it. It gives you peace of mind.

| Type of Coverage | Typical Deductible Range | Availability |

|---|---|---|

| Flood Insurance | $1,000 or 1-2% of insured value | Separate policy |

| Earthquake Insurance | 2% – 20% of replacement value | Endorsement to homeowners policy |

Premiums for insurance vary by state. It’s important to look at what’s available in your area. Knowing your options helps you make smart choices about your insurance. This way, you can protect your property well.

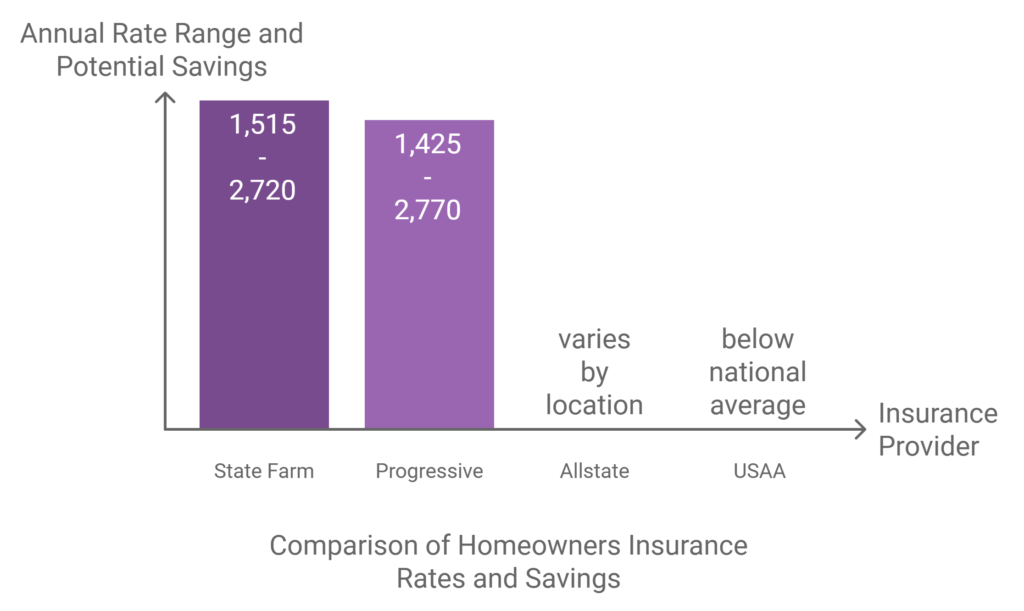

Competitive Pricing Among Major Insurers

State Farm offers great homeowners coverage. But, some might find their rates higher than others. A recent study showed big rate hikes, like a 30% jump for homeowners’ policies. This makes us look closer at State Farm’s pricing compared to others.

Studies by NerdWallet show State Farm’s rates for dwelling coverage range from $1,515 to $2,720 a year. These rates might seem high at first. But, the quality of service and coverage is important to consider. Pricing can change a lot based on your situation.

Getting a homeowners insurance quote from State Farm can help. Bundling home and auto insurance can save up to $1,273. These savings make State Farm’s insurance more affordable.

It’s also smart to compare quotes from different insurers. I suggest getting quotes from at least three companies. Rates change based on many things, like where you live and how much coverage you want. This way, you can make a better choice.

| Provider | Average Annual Rate | Potential Savings (Bundling) |

|---|---|---|

| State Farm | $1,515 – $2,720 | $1,273 |

| Progressive | $1,425 – $2,770 | Up to 25% |

| Allstate | Varies by location | Up to 25% |

| USAA | Below national average | Varies |

In summary, State Farm’s rates might seem high at first. But, looking at the value of coverage, discounts, and comparing other insurers helps. With the right approach, you can find competitive pricing.

Highly Rated Financial Stability

When looking at home insurance, financial stability is key. State Farm is a top pick, thanks to high ratings from A.M. Best. These ratings show they can handle money issues and keep customers’ trust, especially when dealing with state farm homeowners insurance claims process.

State Farm’s Financial Strength Ratings

State Farm is the biggest home insurance company in the U.S. They have a solid financial stability record. Their A++ (Superior) rating from A.M. Best means they can pay claims and keep running smoothly. With over 18,000 agents, State Farm is all about reliability and customer service.

Impact on Peace of Mind

Having State Farm as my insurer makes me feel secure. It lets me relax, knowing my home is covered. State Farm offers many state farm coverage options, like dwelling and personal property coverage. This makes me ready for anything.

Conclusion

Choosing homeowners insurance from State Farm gives me many benefits. It offers strong protections and peace of mind. State Farm’s insurance covers my home well and my belongings too.

State Farm is known for great customer service and easy claims. This makes me trust them more.

State Farm lets me pick a policy that fits my home’s needs. Being the biggest insurance company in the U.S., they have lots of experience. They are rated 4.5 stars out of 5 by NerdWallet.

State Farm covers what’s important without extra costs. Their average yearly cost is $1,935. This makes them a top choice for homeowners insurance.

I’m confident in protecting my most valuable asset with State Farm.