Many young drivers face high car insurance costs. Those under 25 often pay 41% more than 25-year-olds. This is because they are new to driving and have more accidents.

But there’s good news! Young drivers can find cheaper insurance. They can do this by knowing what affects prices, looking at different coverage, and using discounts. This article will help young drivers find affordable insurance. They can drive safely without spending too much.

Table of Contents

ToggleKey Takeaways

- Young drivers face significantly higher insurance premiums due to inexperience.

- Comparing quotes is vital for finding the best rates.

- Utilizing discounts can greatly reduce overall costs.

- Understanding coverage types is crucial for informed decisions.

- Seasoned drivers tend to pay lower premiums compared to their younger peers.

Introduction to Car Insurance for Young Drivers

Car insurance is key for young drivers. It keeps them legal and safe financially. It covers them in accidents, liability, and damages to others.

Many states need proof of insurance to register and drive a car. Young drivers must get good coverage.

Brief explanation of the importance of car insurance for young drivers

Insurance is a big help for young drivers. It lets them drive without worry. It also protects them from big costs from accidents.

With insurance, new drivers can learn to drive better. They don’t have to worry about money problems from accidents.

Why young drivers generally face higher premiums

Young drivers pay a lot more for insurance. They might pay up to 41% more than drivers aged 25 and up. This is because they are seen as riskier.

Insurance companies think young drivers are more likely to have accidents. Gender also matters, as boys have more accidents than girls. So, young drivers need to find cheap insurance that still protects them well.

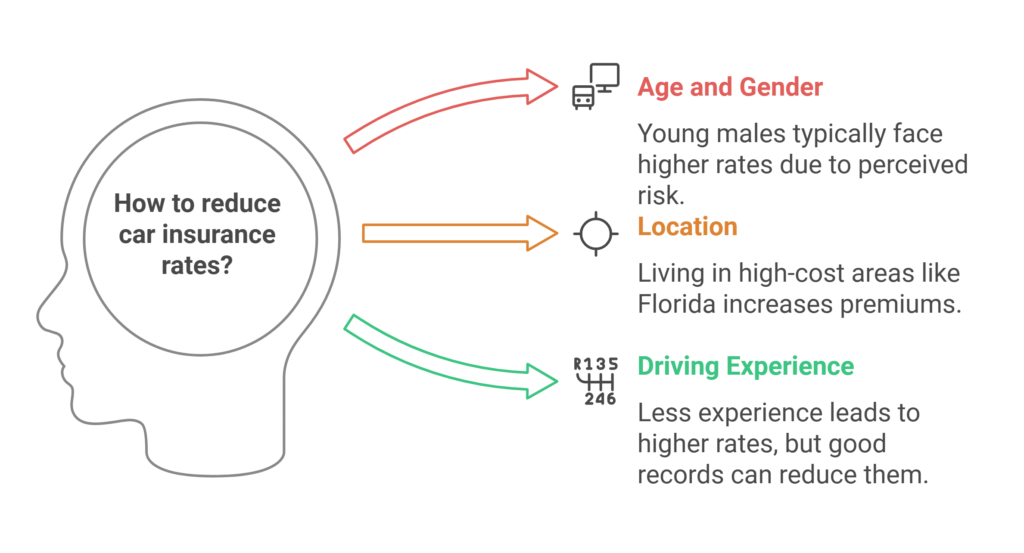

Factors Affecting Car Insurance Rates for Young Drivers

Knowing what affects car insurance rates helps young drivers find good deals. Many things influence how much you pay for insurance, especially if you’re 16 to 19.

Age and Gender: How age and gender influence premiums

Age and gender are key in setting insurance rates. Young male drivers usually pay more than young females. This is because insurers see them as riskier. Teenagers, in particular, face the highest rates because they are seen as the most risky group.

Location: Impact of geographic location on premiums

Where you live also affects your insurance costs. For example, Florida has the highest average insurance cost at $3,945 a year. Vermont has the lowest at $1,353. Places with lots of traffic or crime tend to have higher rates. This shows why where you live matters a lot when looking for cheap insurance for teens.

Driving Experience: How lack of experience affects rates

Not having much driving experience means higher insurance rates for young drivers. Insurers think new drivers are more likely to have accidents. But, as you drive more, your rates might go down. This shows that a good driving record can save you money in the long run.

Type of Car: How the make/model of the car impacts insurance rates

The car you drive can also change your insurance costs. Cars with good safety ratings usually cost less to insure. Young drivers should pick cars that are safe and affordable. This can help lower their insurance costs.

| Factor | Impact on Premiums |

|---|---|

| Age & Gender | Higher rates for young males; discounts may apply for females in certain states |

| Location | Premiums vary widely; urban areas often charge more |

| Driving Experience | Lack of experience leads to higher perceived risk and rates |

| Type of Car | Vehicles with safety features can lower insurance rates |

Common Types of Car Insurance Coverage for Young Drivers

Young drivers need to know about different car insurance coverages. Each type offers financial protection and affects costs. With more affordable options, finding the right insurance is easier. Knowing about these coverages helps meet legal needs and gives peace of mind.

Liability Insurance: What it covers and why it’s important

Liability insurance is a must in most states. It covers injuries and damages to others in accidents. Young drivers need it to avoid big penalties. Adding a teen to a policy can cost around $3,824 a year, making it crucial to consider.

Collision Coverage: What it covers and when it’s necessary

Collision coverage pays for damages to your car in accidents. It’s key for newer cars with high repair costs. For first-time drivers, it helps avoid huge repair bills.

Comprehensive Coverage: Protection against non-collision-related events

Comprehensive coverage protects against theft, vandalism, and natural disasters. It’s important for young drivers at risk of these incidents. While it raises premiums, it’s worth it for valuable cars.

Uninsured/Underinsured Motorist Coverage: Why it’s essential for young drivers

Uninsured or underinsured motorist coverage is vital for young drivers. It helps if hit by someone without enough insurance. It’s a must for teen drivers to avoid financial disaster. Knowing about insurance helps make smart choices for safety and affordability.

| Coverage Type | Key Benefits | Importance for Young Drivers |

|---|---|---|

| Liability Insurance | Mandatory coverage, protects against injuries and damages to others. | Essential for compliance and financial protection. |

| Collision Coverage | Covers repair costs from accidents. | Helps manage repair expenses for new drivers. |

| Comprehensive Coverage | Protects against theft and natural disasters. | Provides security for valuable vehicles. |

| Uninsured/Underinsured Motorist Coverage | Financial assistance for accidents with uninsured drivers. | Crucial for protection against uninsured motorists’ risks. |

Top 10 Cheapest Car Insurance for Young Drivers in the USA

Finding cheap auto insurance for young adults is tough. But, some companies offer great rates for young drivers. Knowing your options helps get the best deals and enough coverage.

Overview of the top insurance companies

Some top insurance providers for affordable rates are:

- Nationwide – Often the most affordable for 16 and 17-year-olds.

- GEICO – Offers low average rates and a variety of discounts.

- State Farm – Known for high customer satisfaction, it provides individual and family policies.

- USAA – Highly rated for customer satisfaction and available to military families.

- Travelers – The sixth largest insurer, offers affordability and various discounts.

- Auto-Owners – Known for low premiums and customer satisfaction.

- Progressive – Low rates for college students and options for bundling.

- Allstate – Affordable for 18-year-olds in multiple states.

Comparison of Premiums

A comparison of average annual premiums for different age groups shows the cost differences:

| Age Group | Average Annual Cost (Individual Policy) | Average Annual Cost (Family Policy) |

|---|---|---|

| 16-Year-Old | $4,874 | $3,048 |

| 17-Year-Old | $3,048 (Nationwide) | $3,048 |

| 18-Year-Old Male | $3,048 | $2,686 (Female) |

| 19-Year-Old | $2,531 (State Farm) | $2,431 (GEICO for 18-Year-Old) |

Additional Factors to Consider

When looking for cheap car insurance for young drivers, consider more than just rates. Look at customer service, claims process, and financial stability. A good insurance company offers great rates and support when you need it.

- Customer service ratings

- Ease of filing a claim

- Financial strength and stability

How to Obtain Car Insurance Quotes for Young Drivers

Finding the right car insurance can be tough for young drivers. You can use online tools or talk to insurance agents. Both ways can help you save money on car insurance.

Online Comparison Tools

Online comparison sites are great for young drivers. They let you see many insurance quotes at once. You can filter these to find the best deal for you.

Make sure to enter your car type, coverage, and driving history correctly. This helps get quotes that match your situation.

Working with an Agent

Talking to an insurance agent is a good idea. They can give you advice and help with tricky situations. They make sure you get the right coverage for you.

Agents also know about discounts that might not be online. This can make your car insurance cheaper.

Providing Accurate Information

To get the best quotes, give all the details. Tell them about your driving history, car, and personal info. This helps lower your insurance costs.

Even though young drivers often pay more, accurate info can help find cheaper insurance.

| Insurance Provider | Average Monthly Rate | Discounts Offered | Notes |

|---|---|---|---|

| NJM | $190 | Defensive driving, Good Student | Cheapest for 16-year-olds |

| GEICO | $175 | Good Student, Multi-Car | Best rates for young adults |

| USAA | $165 | Military affiliation discounts | Excellent customer reviews |

| Progressive | $98 | Safety features discounts | Among the cheapest for 21-year-olds |

| Liberty Mutual | $7,396 Annual | Good Student, New Teen Driver | Great for drivers away at school |

Discounts Available for Young Drivers

Finding affordable insurance for new drivers means looking for discounts. Young drivers can find special deals that help a lot. These discounts not only save money but also encourage safe driving.

Good Student Discounts

Good grades can save a lot on insurance. Companies like Progressive give 10% off for high GPAs. This helps young drivers save money and do well in school.

Safe Driver Discounts

Safe driving courses can get you discounts. These discounts can cut premiums by 5%. Programs like Progressive’s Snapshot® reward safe driving, helping you save more.

Bundling Policies

Combining auto and home insurance can save a lot. It’s easier to manage and often cheaper. Many companies offer discounts for bundling policies.

Low-Mileage Discounts

Driving less can save you money. Companies give discounts for those who drive less. It’s a great way for young drivers to save while driving less.

| Type of Discount | Potential Savings | Key Providers |

|---|---|---|

| Good Student Discount | Up to 10% | Progressive, Geico |

| Safe Driver Discount | Around 5% | Progressive, Travelers |

| Bundling Policies | Varies; often significant | Auto-Owners, Geico |

| Low-Mileage Discount | Varies by provider | Multiple Providers |

Maximizing Discount Opportunities

Young drivers can cut their car insurance costs by taking action. They can improve their driving record and choose smart insurance options. This way, they get cheap coverage for teen drivers and stay financially responsible.

Improving Driving Record

Keeping a clean driving record is key for young drivers. Insurers give lower rates for safe driving. Avoiding accidents and tickets means big savings over time.

Having a record of safe driving helps young drivers get cheaper insurance. This is especially true for new drivers under 21.

Telematics Insurance Programs

Telematics insurance is popular with young drivers. These plans track driving habits and reward safe driving with discounts. This way, young drivers can show they’re careful and get even lower rates.

Paying Upfront

Paying insurance upfront can save a lot of money. Some companies give big discounts for upfront payments. This is a smart move for families looking to save on insurance for new drivers.

| Insurance Strategy | Potential Savings | Additional Benefits |

|---|---|---|

| Clean Driving Record | Up to 25% | Eligibility for good driver discounts |

| Telematics Program | Depending on driving habits | Ongoing rewards for safe driving |

| Paying Premiums Upfront | Up to 10% | Improved cash flow management |

Young drivers can tackle insurance costs better by using these strategies. They can find affordable options that meet their needs.

Tips for Finding the Best Car Insurance Rates for Young Drivers

Finding the right car insurance can be tough for young drivers. But, with the right steps, you can save a lot. These tips help you find cheap insurance and make sure you’re covered.

Start Early: The importance of shopping for insurance before you need it

Start looking for auto insurance insurance early. Shopping early gives you more options and often better rates. Young drivers can find great deals if they start early.

Use Multiple Sources for Quotes: Why it’s important to compare quotes from various providers

Getting quotes from many insurance companies helps you see the best prices. Each company has different prices. Look at quotes from GEICO, Progressive, and State Farm to get a full picture.

Consider the Coverage: Balancing affordability with adequate coverage

It’s important to find a balance between low prices and enough coverage. Many young drivers try to save money by getting less coverage. But, this can leave you without enough protection. Your insurance should offer good coverage without breaking the bank.

Review Your Policy Regularly: How to reassess your policy as you gain experience

Check your insurance policy often as you get more driving experience. This lets you update your coverage to fit your current needs. You might get discounts for better driving or a new car. If you’re on your parents’ policy, it might be time to get your own.

| Insurance Provider | Discount Opportunities | Average Premium for Young Drivers |

|---|---|---|

| GEICO | Good Student, Away-at-School Status | $3,500 |

| Progressive | Snapshot Program | $3,450 |

| State Farm | Steer Clear Program | $3,600 |

| Nationwide | Nationwide SmartRide Program | $3,550 |

The Impact of Driving Records on Insurance Rates

The driving record is key in setting car insurance rates for new drivers under 21. Young drivers often pay more because they lack experience. Violations like speeding tickets, accidents, or DUIs can raise rates a lot. It’s important for young drivers to know how these infractions affect their insurance costs.

Traffic Violations: How speeding tickets, accidents, and DUI offenses affect premiums

Traffic violations can really increase insurance rates. A speeding ticket can raise rates by 26%. DUIs can increase rates by 50%. These infractions show insurers that you’re a higher risk, leading to higher monthly premiums.

For example, drivers with DUIs pay about $203 a month. Those with clean records pay around $135.

Accidents and Claims: The effect of making claims on your premiums

Accidents can also raise premium costs. Being at fault for an accident can increase rates by 34%. These records stay on file for three to five years, making you a higher-risk driver.

Drivers with recent at-fault accidents may pay up to $108 a month on average.

Avoiding Traffic Violations: Tips for young drivers to maintain a clean record

Keeping a clean driving record can help avoid higher insurance costs. Here are some tips:

- Always follow speed limits.

- Stay focused and avoid distractions while driving.

- Take defensive driving courses to improve skills and lower points.

- Check your driving record for errors regularly.

- Avoid aggressive driving.

By following these tips, young drivers can keep their premiums low and find more affordable insurance options.

| Driving Record State | Average Monthly Premium | Rate Increase (%) |

|---|---|---|

| Clean Record | $85 (State Farm) | 0% |

| One Ticket | $171 | 27% |

| Any Infraction | $99 (GEICO) | 26% |

| Recent Accident | $108 (GEICO) | 34% |

| Recent DUI | $132 (State Farm) | 50% |

Final Thought

Car insurance for young drivers has its ups and downs. Age, location, and driving record affect costs a lot. For example, drivers aged 16 to 21 pay about $2,012 a year on average.

USAA is known for offering cheap insurance to the young. Making smart choices and using discounts can help lower costs. This makes it easier for young drivers to manage their expenses.

Recap of Key Points

As young drivers get more experience, their insurance costs often go down. This shows how important it is to drive safely. By comparing prices from companies like USAA, GEICO, and Farm Bureau, drivers can find the best deals.

It’s key to keep checking your insurance policy. This ensures you get the best deal and coverage that fits your needs.

Long-Term Considerations

Premiums usually drop as drivers get older, especially in their mid-20s. Even without a specific age for lower rates, safe driving and experience help get better deals. Young drivers should always keep an eye on their insurance to catch any changes or discounts.

Encouragement to Shop Around

It’s vital to keep comparing insurance rates. Knowing about market changes and local prices helps find the right insurance. Finding the best car insurance is not just a one-time task. It’s an ongoing effort to be financially smart.