Finding the right car insurance can be a challenge. Arkansas drivers have several good options.

If you able to find the best car insurance companies in Arkansas can save you time and money. Selecting the right car insurance involves more than just comparing prices. It’s about finding a balance between coverage, customer service, and available discounts. In Arkansas, companies like Geico, State Farm, Auto-Owners, USAA, and Shelter stand out.

Each offers unique features tailored to different needs. Whether you seek affordable premiums, excellent customer satisfaction, or advanced digital tools, knowing your options is key. This guide will help you navigate the top car insurance companies in Arkansas for 2024, providing insights into what makes each one a strong choice. Stay informed to make the best decision for your car insurance needs.

Table of Contents

ToggleIntroduction To Car Insurance In Arkansas

Finding the best car insurance in Arkansas can be challenging. But the right coverage ensures peace of mind and financial security. This guide helps you understand the essentials of car insurance in Arkansas.

The Importance Of Car Insurance

Car insurance protects you from unexpected expenses. It covers damages, medical bills, and legal fees. Without insurance, you risk paying out of pocket for accidents or theft.

- Financial Protection: Covers repair costs and medical bills.

- Legal Requirement: Driving without insurance is illegal in Arkansas.

- Peace of Mind: Ensures you are covered in accidents or emergencies.

Overview Of Arkansas Car Insurance Requirements

Arkansas law mandates minimum car insurance coverage. Drivers must have both liability and uninsured motorist coverage.

| Coverage Type | Minimum Requirement |

|---|---|

| Bodily Injury Liability | $25,000 per person, $50,000 per accident |

| Property Damage Liability | $25,000 per accident |

| Uninsured Motorist Bodily Injury | $25,000 per person, $50,000 per accident |

Having the minimum required coverage helps you avoid fines and legal issues. But, consider additional coverage for better protection.

Top Car Insurance Companies In Arkansas

Choosing the right car insurance can be challenging. To help, we’ve reviewed the best car insurance companies in Arkansas for 2024. These companies offer competitive rates, excellent customer service, and a range of discounts. Let’s dive into the details.

Criteria For Selecting Top Insurance Companies

We selected the top car insurance companies based on several criteria:

- Coverage Options: Availability of comprehensive and customizable coverage.

- Discounts: Various discounts including military, student, and multi-line policies.

- Customer Service: Scores from the 2023 J.D. Power Auto Insurance Study.

- Digital Tools: Advanced digital tools for managing policies.

- Financial Strength: Stability and reliability of the insurance provider.

List Of Top-rated Car Insurance Providers

| Company | Bankrate Score | Average Full Coverage Rate | Average Minimum Coverage Rate |

|---|---|---|---|

| Geico | 4.5 | $1,869/year | $356/year |

| State Farm | 4.3 | $2,144/year | $445/year |

| Auto-Owners | 4.2 | $1,886/year | $466/year |

| USAA | 4.8 | $1,580/year | $359/year |

| Shelter | 4.0 | $2,120/year | $508/year |

These companies stand out for their competitive premiums and high customer satisfaction. USAA offers exceptional service, especially for military families. Geico and State Farm are known for their extensive coverage options and discounts.

Using advanced digital tools, these companies make policy management easy and convenient. Many offer bundling options, providing further savings.

Whether you need full coverage or minimum coverage, these top-rated providers have options tailored to your needs. Compare their rates and benefits to find the best fit for you.

Key Features Of The Best Car Insurance Companies

Understanding the key features of the best car insurance companies in Arkansas can help you make an informed decision. Here we break down the critical aspects that set these companies apart.

Comprehensive Coverage Options

The top car insurance companies in Arkansas offer a wide range of coverage options. These include:

- Liability Coverage

- Collision Coverage

- Comprehensive Coverage

- Uninsured/Underinsured Motorist Coverage

- Personal Injury Protection (PIP)

These options ensure that you are protected from various risks and can customize your policy to suit your needs. For instance, Geico and State Farm provide robust coverage options that cater to both standard and high-risk drivers.

Customer Service And Support

Exceptional customer service is a hallmark of the best car insurance companies. Companies like USAA and State Farm excel in customer satisfaction, as evidenced by their high scores in the 2023 J.D. Power Auto Insurance Study. Key features include:

- 24/7 Customer Support

- Local Agents for Personalized Service

- Easy-to-Navigate Websites and Mobile Apps

High customer satisfaction ensures that your queries and claims are handled efficiently, providing peace of mind.

Discounts And Savings Opportunities

Saving on premiums is a significant advantage. The best car insurance companies offer various discounts, such as:

- Military Service Discounts (e.g., USAA)

- Professional Affiliation Discounts

- Good Student Discounts

- Multi-Line Policies

For example, Geico offers an average full coverage rate of $1,869/year, and discounts can significantly reduce this cost. These savings make quality coverage more affordable.

Claims Process And Support

The ease and efficiency of the claims process are crucial. Top companies like Auto-Owners and Shelter provide:

- Simple Online Claims Submission

- Quick Processing Times

- Dedicated Claims Support Teams

These features ensure that you can quickly recover and get back on the road after an accident. Digital tools also enhance this process, making it more convenient for policyholders.

For more detailed reviews and premium rates, visit Bankrate’s Best Car Insurance in Arkansas for 2024.

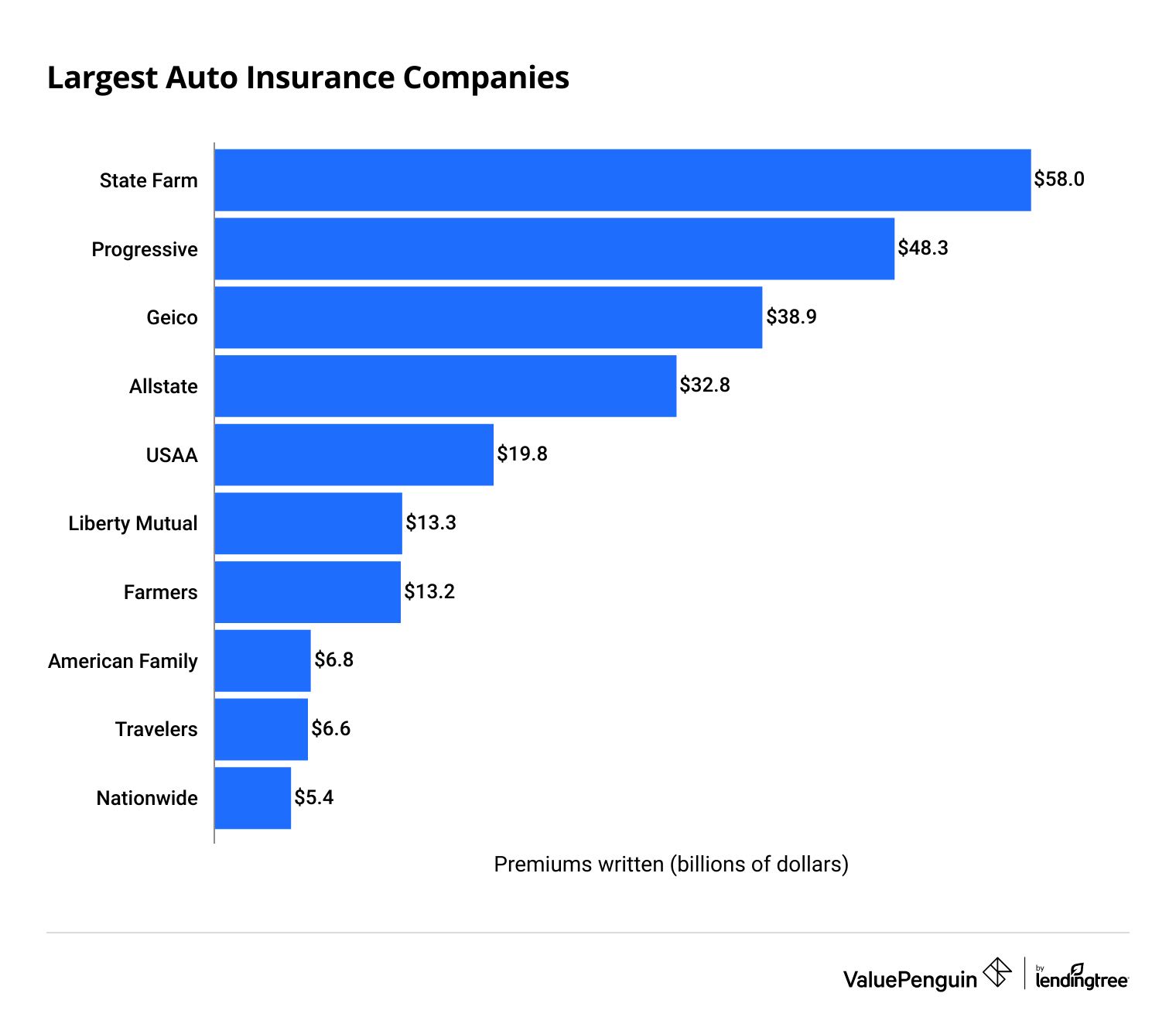

Credit: www.valuepenguin.com

Detailed Review Of Each Top Car Insurance Provider

Choosing the right car insurance in Arkansas can be challenging. To help, we have reviewed the top car insurance providers. Below are detailed reviews of the leading companies based on their unique features and benefits.

Company A: Unique Features And Benefits

Geico stands out for its competitive pricing and comprehensive coverage options.

| Feature | Details |

|---|---|

| Average Full Coverage Rate | $1,869/year |

| Average Minimum Coverage Rate | $356/year |

| Discounts | Military service, student discounts, multi-line policies |

| Customer Satisfaction | High scores from J.D. Power Auto Insurance Study |

| Digital Tools | Advanced digital tools for easy policy management |

Geico offers several discounts, including those for military members and students. Their digital tools make managing your policy convenient and straightforward.

Company B: Unique Features And Benefits

State Farm is known for its strong local agent network and excellent customer service.

| Feature | Details |

|---|---|

| Average Full Coverage Rate | $2,144/year |

| Average Minimum Coverage Rate | $445/year |

| Discounts | Professional affiliation, bundling options |

| Customer Satisfaction | High scores from J.D. Power Auto Insurance Study |

| Digital Tools | Comprehensive online tools for policy management |

State Farm offers a range of discounts and customization options. Their local agents provide personalized service, enhancing overall customer satisfaction.

Company C: Unique Features And Benefits

Auto-Owners provides competitive rates and is known for its customer-centric approach.

| Feature | Details |

|---|---|

| Average Full Coverage Rate | $1,886/year |

| Average Minimum Coverage Rate | $466/year |

| Discounts | Bundling options, high-risk driver coverage |

| Customer Satisfaction | Strong scores from J.D. Power Auto Insurance Study |

| Digital Tools | Effective online tools for policy management |

Auto-Owners offers various discounts, including options for high-risk drivers. Their focus on customer satisfaction and strong digital tools make them a reliable choice.

Pricing And Affordability

Finding the right car insurance in Arkansas means balancing cost and coverage. It’s crucial to understand the pricing and affordability of different insurance companies. Here, we provide a detailed look into the costs associated with the top car insurance providers in Arkansas for 2024.

Comparative Pricing Analysis

Comparing prices helps you find the most affordable car insurance. Below is a table that summarizes the average premiums for full coverage and minimum coverage from the top companies:

| Insurance Company | Average Full Coverage Rate (per year) | Average Minimum Coverage Rate (per year) |

|---|---|---|

| Geico | $1,869 | $356 |

| State Farm | $2,144 | $445 |

| Auto-Owners | $1,886 | $466 |

| USAA (Military Only) | $1,580 | $359 |

| Shelter | $2,120 | $508 |

Factors Influencing Insurance Costs

Several factors impact car insurance costs in Arkansas. Understanding these can help you manage premiums better:

- Driving Record: Clean records usually get lower rates.

- Location: Urban areas might have higher rates due to traffic and accidents.

- Vehicle Type: Expensive or high-performance cars cost more to insure.

- Coverage Levels: Full coverage is pricier than minimum coverage.

- Discounts: Discounts for military service, student drivers, and bundling policies can reduce costs.

Tips For Finding Affordable Car Insurance

Here are some tips to help you find affordable car insurance in Arkansas:

- Compare Quotes: Get quotes from multiple companies to find the best rate.

- Ask for Discounts: Check for eligibility for discounts like multi-line policies or safe driver discounts.

- Choose Higher Deductibles: A higher deductible can lower your premium.

- Maintain a Good Credit Score: Insurance companies often consider your credit score when determining rates.

- Bundle Policies: Bundling car insurance with other policies, like home insurance, often leads to discounts.

By understanding these factors and tips, you can make an informed decision and find the best car insurance that fits your budget and needs.

Pros And Cons Of Each Car Insurance Company

Choosing the best car insurance company in Arkansas involves weighing the pros and cons. Here, we provide an in-depth look at the advantages and disadvantages of the top companies: Geico, State Farm, Auto-Owners, USAA, and Shelter. This will help you make an informed decision tailored to your needs.

Company A: Pros And Cons

| Pros | Cons |

|---|---|

|

|

Company B: Pros And Cons

| Pros | Cons |

|---|---|

|

|

Company C: Pros And Cons

| Pros | Cons |

|---|---|

|

|

By reviewing the pros and cons of each car insurance company, you can better understand what each provider offers and decide which one suits your needs best.

Recommendations For Ideal Users

Finding the right car insurance in Arkansas depends on your specific needs. Whether you’re budget-conscious, a high-risk driver, or looking for comprehensive coverage, there are options tailored just for you. Below, we break down the best car insurance companies in Arkansas for different types of drivers.

Best For Budget-conscious Drivers

For those who prioritize saving money, Geico and USAA are top choices. They offer some of the lowest average premiums in Arkansas.

| Company | Average Full Coverage Rate | Average Minimum Coverage Rate |

|---|---|---|

| Geico | $1,869/year | $356/year |

| USAA | $1,580/year | $359/year |

Both companies also offer various discounts, such as military service and student discounts, making them great for budget-conscious drivers.

Best For High-risk Drivers

High-risk drivers in Arkansas may find suitable coverage with State Farm and Shelter. These companies provide options specifically for drivers with less-than-perfect records.

- State Farm: Known for its high customer satisfaction and reliable customer service.

- Shelter: Offers local agent availability for personalized service and support.

Both companies are committed to helping high-risk drivers find the necessary coverage, ensuring they stay protected on the road.

Best For Comprehensive Coverage Seekers

If you seek extensive coverage options, Auto-Owners and USAA stand out. They offer a range of customizable policies to fit your unique needs.

- Auto-Owners: Provides average full coverage rates at $1,886/year with various bundling options.

- USAA: Offers high customer satisfaction and coverage tailored for military members and families.

With their advanced digital tools and customizable policies, both companies provide comprehensive coverage to ensure peace of mind.

Credit: www.valuepenguin.com

Conclusion: Choosing The Right Car Insurance In Arkansas

Choosing the right car insurance in Arkansas involves evaluating various factors. The goal is to find a policy that offers good coverage at a fair price. Key factors include customer satisfaction, discounts, and digital tools.

Summarizing Key Points

- Top Companies: Geico, State Farm, Auto-Owners, USAA, Shelter.

- Bankrate Score: Rated from 0.0 to 5.0 based on coverage, discounts, tools, service, and financial strength.

- Average Premiums: Detailed rates for full and minimum coverage.

- Customer Satisfaction: Scores from the 2023 J.D. Power Auto Insurance Study.

- Discounts: Military, professional, student, and multi-line discounts.

- Digital Tools: Advanced tools for easy policy management.

Final Recommendations

Consider these points when choosing your car insurance:

- Geico: Average full coverage rate of $1,869/year, minimum coverage at $356/year. Known for good digital tools.

- State Farm: Offers full coverage at $2,144/year and minimum at $445/year. High customer satisfaction.

- Auto-Owners: Average full coverage rate of $1,886/year, minimum at $466/year. Good for personalized service.

- USAA: Best for military members with full coverage at $1,580/year and minimum at $359/year.

- Shelter: Provides full coverage at $2,120/year, minimum at $508/year. Local agent availability.

Evaluate your specific needs and select a company that aligns with your priorities. Each company offers unique benefits, ensuring you find the best coverage for your situation.

Credit: www.rateforce.com

Frequently Asked Questions

What Are The Top Car Insurance Companies In Arkansas?

The top car insurance companies in Arkansas include State Farm, GEICO, Progressive, and Allstate. They offer competitive rates, excellent customer service, and comprehensive coverage options.

How Much Does Car Insurance Cost In Arkansas?

Car insurance in Arkansas costs around $1,450 annually on average. Rates can vary based on factors like age, driving history, and vehicle type.

Which Car Insurance Company Has The Best Customer Service?

State Farm is often praised for its excellent customer service in Arkansas. They provide prompt claims processing, helpful agents, and extensive support resources.

Can I Get Discounts On Car Insurance In Arkansas?

Yes, many insurers in Arkansas offer discounts. These include safe driver, multi-policy, and good student discounts, which can help reduce premiums.

Conclusion

Finding the right car insurance in Arkansas is crucial. Geico, State Farm, Auto-Owners, USAA, and Shelter offer solid options. Each company provides competitive rates and excellent customer service. Discounts and digital tools enhance convenience and savings. Choose a policy that fits your needs and budget.

Visit Bankrate for detailed reviews. Drive safely with the best coverage.