To find a cheap auto insurance for young drivers is usually tough. Drivers aged 16 to 24 crash more often, so insurance costs more. For example, liability-only insurance costs about $196 a month. Male drivers might pay over $400 a month, based on their age.

Many new drivers feel lost when looking for affordable insurance. But, there are ways to find good deals. By comparing prices and looking for discounts, young drivers can find affordable options. These options still offer quality coverage. By reading this article you will able find top 10 cheap car insurance for new drivers under 21 in USA.

Table of Contents

ToggleKey Takeaways

- Considering the average liability-only cost at $196/month for young drivers.

- Identifying factors like age and gender that increase premium rates.

- Exploring providers that cater to affordable auto insurance for young drivers.

- Taking advantage of discounts for good students and safe driving.

- Understanding the importance of shopping around for the best deals.

Overview of Car Insurance Rates for Young Drivers

Car insurance for young drivers costs a lot more than for older drivers. This is because teens have less driving experience and are more likely to get into accidents. In fact, teens aged 16 to 19 are in nearly three times as many fatal crashes as adults.

Teenage boys are especially at risk, causing about two-thirds of these crashes. Many factors affect how much car insurance costs for inexperienced drivers. These include age, gender, where you live, and the car you drive.

For example, adding a teen to a parent’s policy can cost around $3,824 a year. If the teen drives their own older car, costs can range from $5,023 to $5,941 annually.

Where you live also plays a big role in insurance costs. In Hawaii, teen insurance can be as low as $126 a month. But in Connecticut, it’s $884 a month. These differences come from local laws, crash rates, and medical costs.

Here’s a table showing average costs for young drivers based on different factors:

| Insurance Type | Average Cost |

|---|---|

| Adding a teenager to parent’s policy | $3,824/year |

| Teen driving own older car | $5,023 – $5,941/year |

| Teen sharing family car | $5,239 – $6,535/year |

| Cost for two adults | $2,711/year |

| Adding teen to parent’s policy (monthly) | $278/month |

| Self-owned car insurance for young drivers (monthly) | $532/month |

Knowing these facts helps young drivers make better choices about their insurance. This can lead to safer driving and better financial management.

Factors Influencing Car Insurance Costs for New Drivers

New drivers face many challenges when figuring out their car insurance rates. Several factors influencing car insurance rates for young drivers play a big role. Age is a key factor; drivers under 25 often pay more because they have less driving experience.

They are also more likely to be in accidents, especially teenagers. This is why they pay more for insurance.

Gender also affects how much you pay for insurance. Young male drivers usually get higher quotes than young female drivers. This is because insurers think they are at higher risk based on past data.

Where you live also changes your insurance costs. People living in busy cities pay more because of theft, accidents, and vandalism. For example, Florida has very high rates at $3,945 a year. But Vermont is much lower at $1,353.

The type of car you drive matters too. Cars with safety features or good crash test ratings cost less to insure. Using a young driver car insurance premium calculator can help you choose wisely.

Credit history is also important. Drivers with bad credit pay about 69% more than those with good credit. Insurers see credit scores as a sign of responsibility, which affects their rates for new drivers.

Cheap Car Insurance for New Drivers Under 21

Finding cheap car insurance for new drivers under 21 can be tough. There are many options out there. It’s important to look around and find the best plan for you.

Importance of Shopping Around

Comparing quotes from different companies can save a lot of money. New drivers can find affordable rates by looking at different options. Here are some tips for shopping around:

- Gather quotes from at least three to five insurers.

- Consider both liability and full coverage options.

- Look for discounts tailored to young drivers, such as good student discounts.

- Review customer satisfaction ratings and reviews for each provider.

Age and Driving Experience Impact

Age and driving experience affect insurance costs. Younger drivers usually pay more because they are seen as riskier. It’s important to understand this when looking for auto insurance for new drivers.

The table below shows average annual premiums for different insurance providers. It shows how costs vary for young drivers:

| Insurance Provider | Average Annual Premium | WalletHub Editor Rating |

|---|---|---|

| Travelers | $1,249 | 4.2/5 |

| USAA | $1,289 | 3.5/5 |

| GEICO | $1,355 | 4.4/5 |

| State Farm | $1,500 | 4.1/5 |

| Mercury | $1,546 | 3.7/5 |

Doing your homework can help you find low-cost car insurance for new drivers. This way, you can drive responsibly while keeping costs down.

Average Car Insurance Costs for Teen Drivers

Teen drivers face big financial challenges with car insurance. A 16-year-old driver pays about $3,192 a year. This is much more than older drivers, like those 21 and up, who pay around $1,217.

Monthly, the average cost is about $315. Adding a teen to a parent’s policy can increase costs by $2,267 for a 16-year-old and $1,691 for a 17-year-old. Where you live also affects costs. For example, in Fort Lauderdale, prices can go up to $15,772, while Geico starts at $9,287.

Looking at insurance rates for teen drivers shows big differences in states. In Hawaii, teens pay just $493 a year. But in Louisiana, rates can hit $6,488. Many things affect these prices, like where you live, the car you drive, and your driving record.

| Age Group | Average Annual Cost | Average Monthly Cost |

|---|---|---|

| 16 Years Old | $3,192 | $266 |

| 17 Years Old | $3,000 | $250 |

| 21 Years Old | $1,217 | $101 |

| 45 Years Old | $671 | $56 |

The world of car insurance for drivers under 21 is tough but not impossible. Knowing these numbers helps young drivers and their families find good deals. They can get the best coverage without breaking the bank.

Top 10 Affordable Auto Insurance Providers

Finding the right car insurance for new drivers can be tough, especially for those under 21. There are many choices out there. Each one tries to meet the needs of young drivers. We’ll look at some of the best affordable options for under-21 drivers. We’ll compare rates for liability and full coverage, and also look at customer ratings.

Comparative Rates for Liability and Full Coverage

| Provider | Liability Coverage Average Rate | Full Coverage Average Rate |

|---|---|---|

| Progressive | $1,200 | $4,500 |

| GEICO | $1,150 | $4,300 |

| Allstate | $1,250 | $4,700 |

| State Farm | $1,300 | $4,600 |

| Nationwide | $1,100 | $4,000 |

| Auto-Owners | $1,050 | $4,200 |

Provider Ratings and Customer Satisfaction

Choosing the right car insurance for new drivers is important. Customer satisfaction is key. GEICO and Progressive are top choices because of their good prices and service. They also have tools that help policyholders.

A recent survey shows:

- Progressive scored 4.5 out of 5 for customer satisfaction.

- GEICO got 4.7 out of 5, making it a top pick for young drivers.

- Allstate scored 4.2, but is known for its wide range of coverage.

Discounts Available for Young Drivers

Insurance companies know it’s tough for young drivers to get affordable coverage. There are many insurance discounts for young drivers that can save a lot. Knowing about these discounts can help lower your premiums and still get good coverage.

Good Student Discounts

Many insurers give discounts to good students. If you keep a high GPA, you might get a discount of about 16%. This helps make car insurance more affordable for families.

Safe Driving Discounts

Young drivers who drive safely can get discounts. Taking a defensive driving course can save even more. Safe driving means fewer accidents, which helps keep your rates low.

How to Access Multi-Policy Discounts

Getting auto insurance with other types of coverage can save money. Multi-policy discounts are another way for young drivers to save. By getting auto insurance with home or renters insurance, you can save a lot. This way, you make sure you’re covered while saving money.

How to Save on Car Insurance for Young Drivers

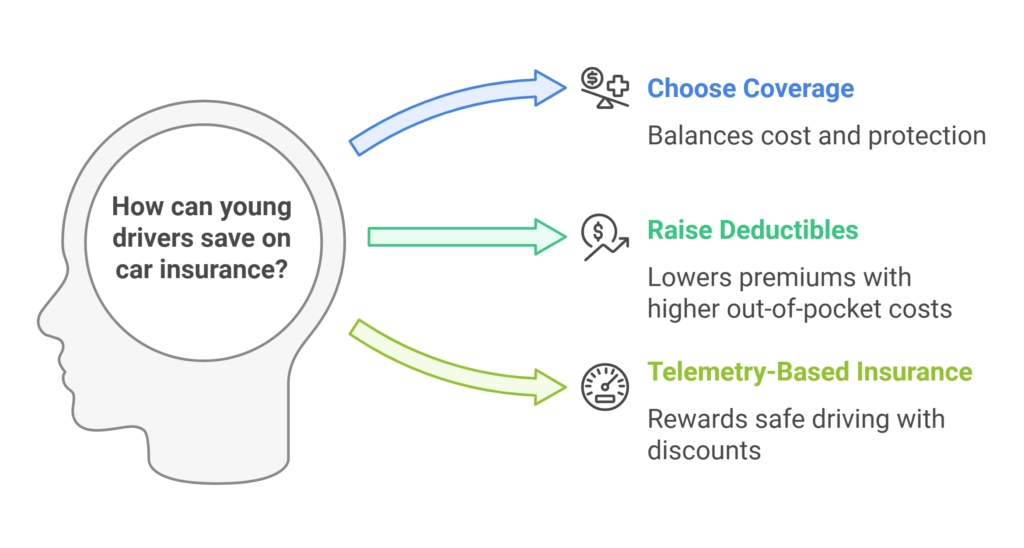

Young drivers can take several steps to lower their car insurance costs. It’s key to know about different coverage options. Choosing the right coverage helps manage costs and ensures safety on the road.

Young drivers can balance between minimum and full coverage. This lets them adjust their policies to fit their budget while staying protected.

Choosing the Right Coverage

Understanding the types of coverage is crucial for saving on car insurance. Full coverage is more expensive but offers better protection. Minimum coverage is cheaper but might not cover all costs after an accident.

Young drivers should compare quotes from different insurance providers. This helps find affordable auto insurance that meets their needs.

Raising Deductibles for Lower Premiums

Choosing a higher deductible can lower monthly premiums. This works for those who can afford to pay out-of-pocket costs after an accident. It’s important to consider personal finances and driving habits when picking a deductible.

Benefits of Telemetry-Based Insurance

Telemetry-based insurance offers new ways for young drivers to save. Companies like Allstate, Geico, and Progressive give discounts for safe driving. These programs reward safe behavior with savings, making them great for young drivers.

Using these strategies helps young drivers save on car insurance. Being proactive in choosing coverage and using discounts can lead to big savings.

Best Practices for Young Drivers to Manage Insurance Costs

Young drivers face special challenges with car insurance costs. Using smart strategies can lower premiums and make driving safer. Knowing the best ways to manage costs helps young drivers save money while driving safely.

Maintaining a Clean Driving Record

Keeping a clean driving record is key to getting good rates. Insurers like safe drivers and those who don’t get into accidents or break traffic laws. Car insurance for young drivers with a clean record shows this. Many insurers give discounts for good driving.

Following traffic rules and driving defensively helps keep insurance costs down.

Participating in Driver Education Programs

Going to driver education programs has big benefits. These programs improve driving skills and can get you discounts from insurers. Young drivers who do these courses show they care about safety.

Insurers often give them lower rates. Being part of these programs shows a commitment to safe driving and saving on insurance.

Understanding the Claims Process for New Drivers

New drivers need to know how to handle claims after an accident. It’s important to understand the process, whether it’s a small crash or a big one. Knowing what to do can make a big difference in your claims experience.

Steps to Take After an Accident

Here are the first steps to take after an accident:

- First, make sure you’re safe. Move to a safe spot if you can.

- Then, call emergency services and report the accident to the police if it’s needed.

- Next, take photos of the accident scene. Also, write down important details like the other driver’s info and any witnesses.

- After that, call your insurance right away to tell them about the accident.

- Finally, keep a record of all your talks about the claim.

Common Mistakes to Avoid in Claims

Here are some mistakes to avoid in the claims process:

- Don’t wait too long to report the accident. Delaying can hurt your claim.

- Be careful with recorded statements. Make sure you know your policy first.

- Don’t underestimate the damage. Report all costs you’ve had.

- Not getting all the evidence you can is a big mistake.

Insurance for Student Drivers Under 21

College students under 21 face special insurance challenges. Their car insurance costs more because they have less driving experience. Looking at different options can help find affordable coverage.

Exploring Options for College Students

Insurance for young drivers can change a lot. Staying on a parent’s policy can save a lot of money. This choice is often cheaper and offers more protection.

Some companies have special programs for students. These programs can make insurance even cheaper. The main benefits are:

- Lower overall premiums.

- Access to family discounts.

- Flexible payment plans tailored to students.

USAA and GEICO are known for their good rates for students.

Benefits of Staying on Parents’ Insurance Policy

Staying on parents’ policies can save money. Adding a student driver to an existing policy is often cheaper than getting your own. Other benefits include:

- Easier access to good student discounts for maintaining a B average or higher.

- Comprehensive coverage that includes liability and accidents.

- The simplicity of managing one policy rather than multiple.

Parents also want their young drivers to drive safely. This can lower insurance costs over time. It helps everyone stay safe on the road.

| Age | Average Monthly Cost | Annual Cost for Minimum Coverage | Annual Cost for Full Coverage |

|---|---|---|---|

| 16 | $175 – $231 | $2,101 – $2,500 | $5,200 – $7,000 |

| 17 | $175 – $202 | $2,101 – $2,420 | $5,000 – $6,500 |

| 18 | $135 – $194 | $1,621 – $2,333 | $4,000 – $5,500 |

| 19 | $120 – $176 | $1,445 – $2,114 | $3,500 – $5,000 |

| 20 | $106 – $151 | $1,269 – $1,808 | $3,000 – $4,500 |

How Driving Habits Influence Insurance Premiums

Young drivers’ habits greatly affect their insurance costs. Knowing how driving experience impacts rates shows that new drivers pay more. This is because they are seen as higher risk due to less experience.

Safe driving practices can lower this risk. They can also lead to insurance discounts.

Impact of Driving Experience on Rates

Insurance companies look at many factors to set rates. Driving experience is a big one. New drivers often face higher costs because they are more likely to have accidents.

For example, drivers under 17 pay about $2,472 a year. Drivers 18 to 24 can pay up to $3,985. This depends on their driving record and coverage choices.

Safe Driving Practices for New Drivers

Safe driving habits can lower insurance costs for new drivers. Taking defensive driving courses can teach important skills and save money on insurance. Other tips include:

- Keeping a clean driving record shows you’re responsible.

- Telematics programs can save 10% to 30% on renewal.

- Choosing older, safer cars can also lower rates.

By following these tips, young drivers can get cheaper insurance. They also help make the roads safer.

| Type of Coverage | USAA Annual Premium | Geico Annual Premium |

|---|---|---|

| State Minimum Coverage | $426 | $451 |

| Liability (50/100/50) | $523 | $572 |

| Full Coverage | $1,763 | $1,799 |

Comparing Full Coverage vs. Minimum Coverage for New Drivers

Young drivers need to know the difference between full coverage vs minimum coverage car insurance. Each choice has its own costs and protection levels. It’s important to think about your budget and how you drive.

Full coverage includes liability, collision, and comprehensive. It covers your car and damages to others. The cost of full coverage varies a lot between companies. For example:

| Provider | Full Coverage ($) | Minimum Coverage ($) |

|---|---|---|

| Allstate | 6,928 | 1,368 |

| American Family | 4,128 | 1,407 |

| Farmers | 7,928 | 2,612 |

| Geico | 3,640 | 948 |

| Nationwide | 6,044 | 2,084 |

| Progressive | 4,337 | 1,167 |

| State Farm | 5,149 | 1,313 |

| Travelers | 4,215 | 1,116 |

| USAA* | 3,192 | 815 |

Minimum coverage meets state laws but offers less protection. For young drivers, full coverage costs about $544 a month. Minimum coverage costs around $132. This big difference shows why picking wisely is key.

Young drivers should think about their money, how risky they are, and if they can save by bundling. Making a smart choice can protect you and save money.

Best Car Insurance Companies for New Drivers

Finding the right insurance as a young driver can be tough. Some companies offer affordable car insurance for young drivers. They have good rates and discounts for new drivers. Here’s a look at the top car insurance companies for young drivers.

Highlights of Each Recommended Insurer

| Insurance Company | Average Premium | WalletHub Rating | Notable Discounts |

|---|---|---|---|

| Geico | $1,355 | 4.4/5 | Good student, safety features |

| USAA | $1,289 | 3.5/5 | Family discount |

| State Farm | $1,500 | 4.1/5 | Good student, multi-policy |

| Travelers | $1,249 | 4.2/5 | Safe driving, multi-car |

| Mercury | $1,546 | 3.7/5 | Basic insurance for teens |

| Progressive | $1,670 | 3.9/5 | Bundle, safe driving discounts |

| Liberty Mutual | $2,560 | 3.2/5 | Good student |

| The Hartford | $2,007 | 3.1/5 | Driver training |

| AAA Insurance | $2,083 | 3.4/5 | AAA membership required |

| Esurance | $2,205 | 3.0/5 | Good student, driver training |

Conclusion

Finding affordable insurance for under-21 drivers can be tough. But, with the right strategy, young drivers can find good deals. Knowing what affects car insurance rates is key. This includes age, driving experience, and discounts.

The average cost for teen drivers is high. But, companies like USAA and GEICO have lower rates. They are great for those watching their budget.

Young drivers should always compare prices and look for discounts. Good grades or safe driving can lead to big savings. Adding a young driver to a parent’s policy can also cut costs.

Teen car insurance is often pricier because of the risks. But, knowing how to use discounts can help. Staying on a parent’s policy can save money too. It’s all about making smart choices.