Many young drivers in Florida face high car insurance rates. The average premium is about $245 per month, much higher than the national average. This can be very stressful for young drivers.

Finding affordable car insurance is crucial. Over 20% of Florida drivers are uninsured. This makes full-coverage policies key to protect against accidents. Luckily, finding cheap car insurance for young drivers in Florida is possible. I will show you the affordable and cheapest car insurance for young drivers in Florida. They offer competitive rates, helping first-time drivers get reliable coverage without spending too much.

Table of Contents

ToggleKey Takeaways

- The average car insurance cost for young drivers in Florida is significantly above the national average.

- State Farm is renowned for the lowest full-coverage rates available.

- Many drivers in Florida are uninsured, underlining the importance of full-coverage insurance.

- Understanding the range of options can help young drivers make informed decisions.

- Competitive providers like GEICO and Travelers offer attractive plans for young motorists.

Car Insurance for Young Drivers

Young drivers, aged 16 to 24, often face big challenges when getting car insurance. They pay more because they don’t have much driving experience. Many things affect these prices, like age, driving history, and what kind of car they drive.

For those looking for teen driver insurance savings Florida, it’s key to know how these factors play a role. This helps in making smart choices about insurance.

I can guide you through the different options. Many young drivers find it helpful to get young driver insurance quotes Florida from several companies. This way, we can compare prices, discounts, and what’s covered.

It’s also important to understand the types of coverage. Liability and comprehensive plans are key. They help meet Florida’s insurance rules and keep you safe on the road without breaking the bank.

Factors Affecting Car Insurance Rates for Young Drivers

In Florida, many things affect car insurance rates for young drivers. Age and driving experience are key. Young drivers pay more because they’re new to driving.

Accidents and traffic tickets make rates even higher. Insurance companies know young drivers are more likely to have accidents.

Credit history is also important. A good credit score means lower insurance costs. Young drivers with good credit can find cheaper insurance.

Gender also plays a part. Male drivers usually pay more than female drivers. This is because men have more accidents, insurers say.

Where you live affects your insurance too. Places with more crime, traffic, or natural disasters cost more to insure. Florida’s rates are about $2,560 a year, higher than the national average.

| Factor | Impact on Premiums |

|---|---|

| Driving Experience | Higher premiums for less experienced drivers |

| Claims History | At-fault accidents lead to significant premium increases |

| Credit Score | Better scores yield lower premiums |

| Gender | Male drivers often face higher rates |

| Location | High-risk areas cause increased costs |

| Vehicle Type | High-performance and theft-prone models incur higher rates |

| Coverage Level | More comprehensive coverage leads to higher premiums |

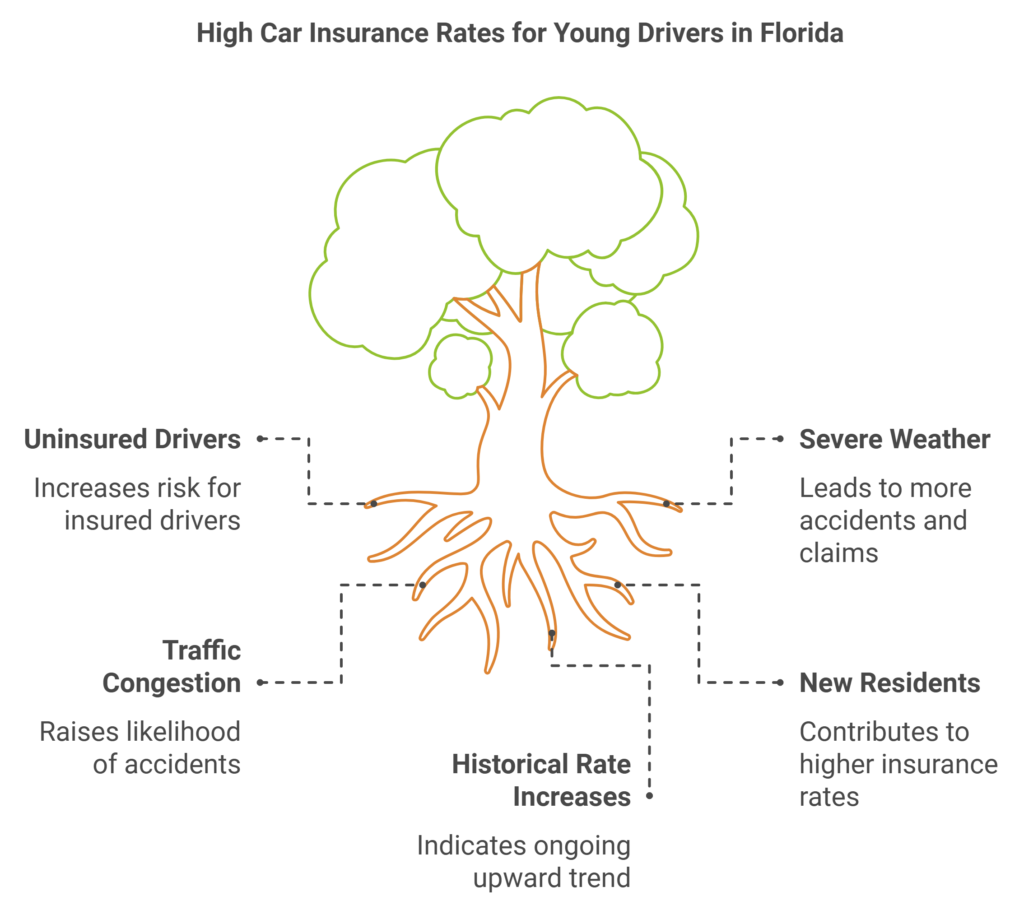

Why Florida Has High Car Insurance Premiums

Florida is a special place for car insurance, especially for Florida car insurance for teenage drivers. Many things make it the most expensive place for car insurance. People are now paying 24% more for car insurance than last year. The average cost for full coverage is close to $3,945, which is 55% more than the national average of $2,500.

One big reason for these high costs is the number of uninsured drivers. Florida has 20% of drivers without insurance, which is more than the national average of 12%. This makes it riskier for those who do have insurance and raises everyone’s rates. Florida also has a lot of severe weather, like hurricanes, which can cause more accidents and claims.

Looking at discounts, Florida car insurance discounts for young drivers can help lower costs. Things like traffic jams and new people moving in make it worse. For example, a driver with no tickets might pay more than someone with a lot of tickets. The 25% increase in auto insurance rates from 2015 to 2021 shows this trend is here to stay. It’s important for young drivers to know this to find affordable car insurance in Florida.

| Metric | Florida | National Average |

|---|---|---|

| Average Annual Cost of Full Coverage | $3,945 | $2,500 |

| Increase from Previous Year | 24% | – |

| Rate of Uninsured Drivers | 20% | 12% |

| Percentage of Income Spent on Healthcare | 14%+ | – |

Cheapest Car Insurance for Young Drivers in Florida

Finding cheap car insurance for new drivers in Florida can be tough. Many options are available for young Floridians looking for low rates. I’ll look at some of the most affordable providers for young drivers, helping them find cheap teen car insurance in Florida.

Geico: The Leader in Low Rates

Geico is a top choice for young drivers in Florida, with an average of $84 per month. It’s the cheapest car insurance for drivers with a clean record. Young drivers can save more with Geico’s discounts for good grades and safe driving.

State Farm: Affordable Full Coverage

State Farm offers full coverage at a competitive $130 per month. It’s a great choice for young drivers who want comprehensive protection without spending too much. State Farm is also known for reliable customer service, making it perfect for first-time car owners.

Travelers: Competitive for Young Motorists

Travelers is another good option, with an average rate of $150 per month. It’s a bit pricier than Geico and State Farm but offers many discounts for young drivers. These discounts can greatly reduce monthly payments over time.

Progressive: Competitive pricing with potential savings through various discounts

Progressive offers flexible pricing and many discounts for young drivers. They understand the challenges new drivers face and provide coverage that fits different budgets. This makes Progressive a strong contender for cheap teen car insurance in Florida.

| Insurance Provider | Average Monthly Cost | Coverage Type |

|---|---|---|

| Geico | $84 | Minimum Coverage |

| State Farm | $130 | Full Coverage |

| Travelers | $150 | Varied Coverage |

| Progressive | Varied | Flexible Coverage |

Looking at these options helps young drivers in Florida find affordable car insurance. By comparing rates and coverage, they can get the best deal. This makes it easier to drive while keeping costs down.

Comparative Analysis of Rates for Young Drivers

When looking at cheap car insurance for young drivers in FL, many things affect the rates. Knowing these helps young Floridians find the best coverage for them.

Rate Comparisons Based on Driving History

Your driving history is key in setting auto insurance rates. Young drivers with clean records get the best rates. Those with tickets or accidents pay more. For example, GEICO offers rates around $137 a month for young drivers.

Many parents add their young drivers to their policy. This can save about 7% compared to getting a separate policy.

Impact of Geography on Premiums

The place you live also affects car insurance rates. Cities in Florida have higher rates because of more traffic and accidents. But, rural areas have lower rates. This shows why it’s important to look at local driving conditions when choosing coverage.

| Insurance Provider | Average Monthly Rate | Discount Options |

|---|---|---|

| GEICO | $137 | Good student, multi-car |

| Progressive | $285 | Good student, multi-vehicle |

| State Farm | N/A | Good grades discount (up to 25%) |

How to Get the Best Rates for Young Driver Car Insurance

Finding the best rates for young driver car insurance can seem hard. But, with the right steps, I can save a lot. By looking at different quotes and offers, I find the best prices. This helps me get the best rates and save money.

Shopping Around for Quotes

I always compare quotes from at least three car insurance companies. This helps me find the cheapest options for young drivers in Florida. Each company has its own rates and discounts for young people. For example, Geico has the cheapest full coverage at about $179 a month.

By looking at many quotes, I can choose the best plan for me.

Utilizing Discounts for Young Drivers

Discounts are a big chance to save on car insurance in FL. I always look for discounts for young drivers. Good student discounts and driver education courses can lower my rates a lot.

These discounts can make my monthly payments much lower. It shows how important it is to use all savings options.

| Insurance Provider | Full Coverage Monthly Rate | Minimum Coverage Monthly Rate | Discount Opportunities |

|---|---|---|---|

| Geico | $179 | $89 | Good Student, Driver Education |

| State Farm | $163 | $176 (after speeding ticket) | Multiple Policies, Safe Driving |

| Progressive | $200 | $94 | Safe Driver Program, Bundling |

Affordable Auto Insurance for Young Drivers

Finding cheap car insurance for Florida teens is key because of high costs. Many insurance companies offer affordable plans for young drivers. Geico and State Farm have budget-friendly options for teens.

Teen drivers face high insurance rates due to their age and driving record. But, rates can drop as they get older and drive more safely. For example, good driving can lead to up to 22% off most insurance costs.

Programs like DriveEasy help lower insurance costs. It shows 75% of over 260,000 teen drivers got discounts. Young drivers can also get up to 15% off for good grades.

Companies like Mercury Insurance offer discounts for multiple policies and safe driving. Florida’s laws require basic insurance, so even cheap plans offer needed protection.

| Insurance Provider | Average Annual Premium | Good Student Discount | Good Driver Discount |

|---|---|---|---|

| Geico | $5,049 | 16% | Up to 22% |

| State Farm | $2,893 (female teen) | 15% | 22% |

| Travelers | $4,405 (female teen) | 15% | 20% |

| Mercury Insurance | Varies | Multiple discounts available | Specific to individual policies |

Young drivers in Florida have many affordable insurance options. These plans meet legal needs and offer practical features for teens.

Minimum Coverage Options for Young Drivers in Florida

Florida has rules for young driver car insurance Florida requirements. Every driver must have property damage liability and personal injury protection. This is key for new drivers who may not have much experience.

The cost of Florida minimum car insurance for young drivers has options for everyone. I found that minimum coverage can start at $39 a month with big names like Geico. Travelers’ minimum liability is about $657 a year, while Geico is $687. This helps those looking for inexpensive auto insurance for inexperienced drivers.

| Insurance Provider | Minimum Liability Coverage Cost (Annual) |

|---|---|

| Travelers | $657 |

| GEICO | $687 |

| Direct General Insurance | $1,490 |

Knowing the coverage rules and picking the right policy is crucial. Young drivers pay more because they’re new. But, by choosing wisely, they can follow state laws and keep costs down.

Discounted Car Insurance for Young Operators

Young drivers often pay a lot for insurance. But, there are discounts that can help. These discounts can make car insurance more affordable for new drivers.

Good Student Discounts

Insurance companies give discounts for good grades. If you get good grades, you might save up to 20%. This can really help lower the cost of car insurance in Florida.

Defensive Driving Course Discounts

Taking a defensive driving course can save you money too. Insurance companies like it when you learn to drive safely. This makes it easier to find affordable car insurance in Florida.

Incentives for Safe Driving in Florida

Keeping a clean driving record has many benefits for young drivers in Florida. It leads to financial rewards from insurance providers. These rewards help young drivers stay safe on the road.

State Farm is the cheapest for teen drivers in Florida. This shows that safe driving can save money. Progressive also offers personalized rates through its Snapshot program. This rewards safe driving with lower costs.

Many young driver insurance plans in Florida offer extra discounts. Progressive has accident forgiveness, keeping rates the same after small claims. Young Floridians can find cheap coverage while driving safely.

Check the table below to explore some of the key incentives available for young drivers in Florida:

| Insurance Provider | Incentive Description |

|---|---|

| State Farm | Affordable rates for teen drivers, especially for those with safe driving records. |

| Progressive | Snapshot program rewards safe drivers with personalized rate adjustments. |

| GEICO | Offers comprehensive roadside assistance, catering to responsible driving behaviors. |

| Allstate | Pay-per-mile feature for low-mileage teen drivers encourages responsible usage. |

| USAA | Excellent coverage options for military families, emphasizing safe driving habits. |

Responsible driving makes roads safer and saves money for young Floridians. These rewards show how important safe driving is for young drivers in Florida.

Insurance Requirements for Young Drivers in Florida

In Florida, young drivers must follow certain insurance rules. They need at least $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability. These rules help protect drivers and others on the road.

Florida has some of the lowest car insurance rules in the country. It doesn’t require Bodily Injury Liability insurance, except for those with DUIs.

Young drivers often see their insurance costs go up a lot. This can double because they are new to driving. Looking for cheap rates from different companies can help save money. For example, Farm Bureau Insurance gives discounts for good grades and having more than one car.

Progressive also offers discounts. Rates can drop by about 9% when a driver turns 19. Then, another 6% when they turn 21.

Not having insurance can lead to big legal problems if a young driver gets into an accident. Parents or guardians might have to pay for damages. It’s smart to add a young driver to a policy to avoid these issues.

Going to college far away without a car can also lower insurance costs. Telling the insurance company about this can help save money. Knowing how to get the best insurance deal in Florida is key for young drivers.

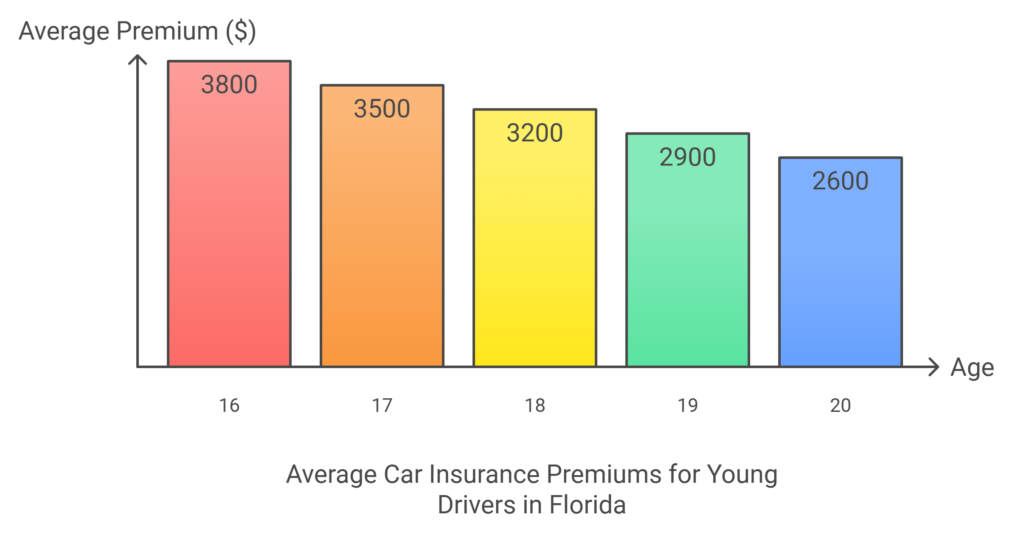

| Age | Average Premium ($) | Potential Discounts (%) |

|---|---|---|

| 16 | 3,800 | 0 |

| 17 | 3,500 | 10 (Good Student) |

| 18 | 3,200 | 10 (Good Student), 5 (Drivers Education) |

| 19 | 2,900 | 15 (Good Student), 10 (Educational Courses) |

| 20 | 2,600 | 15 (Good Student), 10 (Educational Courses) |

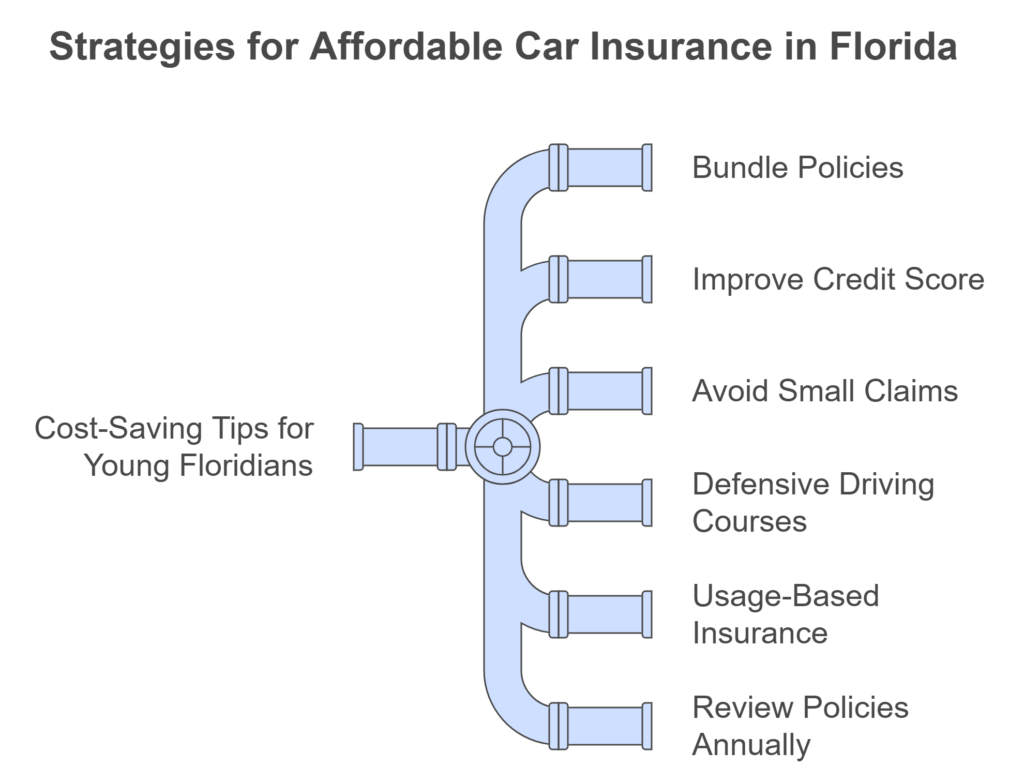

Cost-Saving Car Insurance Tips for Young Floridians

Young Floridians face unique challenges with car insurance. To tackle these, some cost-saving tips can help a lot. Being proactive in managing costs can make insurance more affordable.

First, bundling insurance policies can save a lot. For example, combining auto with renters or homeowners insurance can cut premiums by 7% to 9%. Also, a better credit score can lower insurance costs.

Not filing small claims can also save money. Filing minor claims can raise rates over time. Keeping a clean driving record and taking defensive driving courses can lead to discounts. These steps lower premiums and encourage safer driving.

Here’s a table with more tips for young Floridians to save on car insurance:

| Cost-Saving Tips | Description |

|---|---|

| Bundle Policies | Combine auto insurance with other policies for a discount. |

| Improve Credit Score | Enhancing your credit score can lower your premium amounts. |

| Avoid Small Claims | Frequent small claims may result in increased premiums. |

| Defensive Driving Courses | Completing these courses can yield significant discounts while promoting safety. |

| Usage-Based Insurance | Opt for telematics insurance; it rewards safe driving with lower costs. |

| Review Policies Annually | Regularly assess insurance needs, especially after life changes. |

Using these strategies, young drivers in Florida can get cheap auto coverage. This ensures they stay financially safe without spending too much. By being proactive, young Floridians can find affordable and effective car insurance.

Conclusion

In this guide I have covered most cheapest and affordable insurance provider for resident in in florida. From my above justification and analysis you can choose your best option which may fit you. The average cost price in florida around $3,451 a year, for this it’s important to choose it wisely. Knowing what affects prices helps young drivers save money and get good coverage.

Shopping for quotes shows that Geico and State Farm have low prices for young drivers. Their rates and discounts help young people stay within budget. As a young professional, staying updated and changing insurance plans can save a lot of money.

Improving driving skills and finding the right insurance are important. With careful planning, young drivers can get affordable coverage and stay safe on the road.