Life insurance is a crucial part of financial planning. It ensures peace of mind for you and your loved ones.

Open Care Life Insurance offers various policies catering to final expenses and more. In this blog post, we will explore Open Care Life Insurance in detail. You will learn about the benefits, drawbacks, and costs associated with their policies. Understanding these aspects will help you decide if Open Care Life Insurance meets your needs.

Stay with us as we break down the essential features and provide a comprehensive review. This way, you can make an informed decision about your life insurance options.

Table of Contents

ToggleIntroduction To Open Care Life Insurance

Open Care Life Insurance offers various policies to help cover final expenses. This Florida-based brokerage partners with national agencies to provide whole life, guaranteed life, term life, and burial insurance. Their goal is to ensure you have the right coverage for your needs.

What Is Open Care Life Insurance?

Open Care Life Insurance specializes in final expense insurance. They focus on providing easy-to-understand policies with straightforward terms. Their offerings include:

- Whole Life Insurance: Permanent coverage with fixed premiums and no medical exam required.

- Guaranteed Life Insurance: Guaranteed acceptance without a medical exam, though premiums are higher.

- Term Life Insurance: Coverage for a specific term (10, 20, or 30 years) with a required medical exam.

- Burial Insurance: Coverage for funeral and other end-of-life expenses.

This variety ensures that individuals can find a policy that fits their unique circumstances.

Purpose And Importance Of Life Insurance

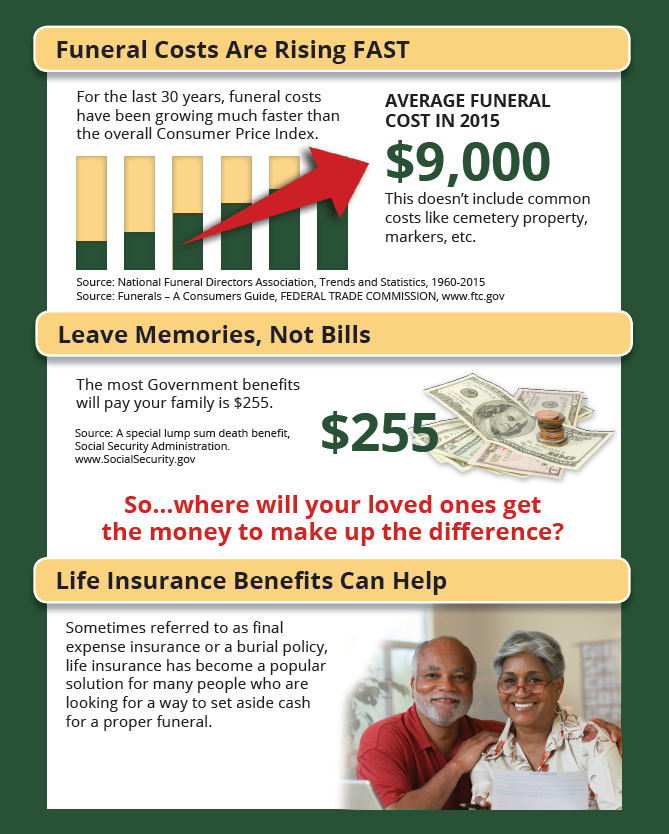

Life insurance is crucial for providing financial security to your loved ones after your passing. It helps cover:

- Funeral and burial costs

- Outstanding debts

- Living expenses for dependents

By having a life insurance policy, you ensure that your family is not burdened with financial worries during a difficult time.

Overview Of Open Care’s Offerings

Open Care Life Insurance provides several types of policies, each with its own benefits:

| Policy Type | Features | Benefits |

|---|---|---|

| Whole Life Insurance | Permanent coverage, fixed premium | No medical exam required, lifetime payout |

| Guaranteed Life Insurance | Guaranteed acceptance | No medical exam, higher premiums |

| Term Life Insurance | Specific term coverage | Lower initial premiums, medical exam required |

| Burial Insurance | Final expense coverage | Helps with funeral costs |

Open Care also offers same-day coverage for qualified applicants and an easy online application process. Monthly premiums start at $7.49 for a $2,000 death benefit for a healthy 50-year-old woman. Policy amounts range from $25,000 to $500,000.

Key Features Of Open Care Life Insurance

Open Care Life Insurance offers several key features that make it a popular choice for those seeking reliable coverage. Let’s explore some of the standout attributes that set this insurance provider apart.

Flexible Coverage Options

Open Care Life Insurance provides a variety of coverage options to meet different needs. These include:

- Whole Life Insurance: Permanent coverage with fixed premiums and a lifetime payout.

- Guaranteed Life Insurance: Guaranteed acceptance without a medical exam, but with higher premiums.

- Term Life Insurance: Coverage for a specific term (10, 20, or 30 years) that requires a medical exam.

- Burial Insurance: Final expense coverage for funeral and other end-of-life costs.

Hassle-free Application Process

Applying for Open Care Life Insurance is simple and straightforward. The online application process allows for easy access and quick completion. This user-friendly approach saves time and reduces stress for applicants.

No Medical Exam Required

For many of the policies offered by Open Care Life Insurance, no medical exam is needed. This feature is especially beneficial for those who may have health concerns or prefer to avoid the inconvenience of medical tests. Policies like Whole Life Insurance and Guaranteed Life Insurance offer this advantage.

Customizable Plans

Open Care Life Insurance allows for customizable plans to better match individual needs. Policyholders can choose from a range of coverage amounts, starting as low as $2,000 and going up to $500,000. Additionally, they can select the type of policy that best suits their situation, whether it’s whole life, term life, or burial insurance.

Here is a table summarizing the coverage options:

| Policy Type | Coverage Amount | Medical Exam |

|---|---|---|

| Whole Life Insurance | $25,000 to $500,000 | No |

| Guaranteed Life Insurance | $25,000 to $500,000 | No |

| Term Life Insurance | $25,000 to $500,000 | Yes |

| Burial Insurance | $2,000 to $25,000 | No |

Open Care Life Insurance ensures that there is a plan for everyone, making it a flexible and accessible choice for many.

Benefits Of Open Care Life Insurance

Open Care Life Insurance offers multiple benefits that make it a reliable choice for individuals seeking life insurance. Below, we highlight some key benefits that can help you understand its value.

Financial Security For Loved Ones

Open Care Life Insurance ensures financial security for your loved ones. It provides a lifetime payout that helps cover expenses such as funeral costs, debt, and daily living expenses. This financial safety net ensures your family is not burdened during difficult times.

Peace Of Mind For Policyholders

With Open Care Life Insurance, policyholders enjoy peace of mind knowing that their end-of-life expenses are covered. The same-day coverage option and guaranteed acceptance for certain policies mean you can secure your insurance quickly and without hassle. This reduces stress and provides comfort in knowing you are prepared.

Affordable Premiums

Open Care Life Insurance offers affordable premiums starting at just $7.49 per month for a $2,000 death benefit. This makes it accessible for many individuals. The variety of policy options allows you to choose coverage that fits your budget and needs.

Quick Approval Process

The company offers a quick approval process with an easy online application. Qualified applicants can receive first-day coverage, providing immediate protection. The online quote tool available 24/7 further simplifies the process, allowing you to get started at any time.

| Feature | Details |

|---|---|

| Whole Life Insurance | Permanent coverage with fixed premium, no medical exam required |

| Guaranteed Life Insurance | Guaranteed acceptance, higher premiums, no medical exam |

| Term Life Insurance | Coverage for a specific term, medical exam required |

| Burial Insurance | Final expense coverage for funeral costs |

Open Care Life Insurance provides a variety of options to suit different needs and budgets. With its financial security, peace of mind, affordable premiums, and quick approval process, it stands out as a viable choice for life insurance coverage.

Drawbacks Of Open Care Life Insurance

While Open Care Life Insurance offers many benefits, it also has some drawbacks. Understanding these can help in making an informed decision.

Limited Payout Options

The payout options with Open Care Life Insurance are limited. The policies range from $25,000 to $500,000, which might not be sufficient for everyone. This can be a significant limitation for those seeking higher coverage amounts.

Potential Higher Costs For Older Individuals

Older individuals might face higher premiums with Open Care Life Insurance. The cost of insurance generally increases with age. For instance, a healthy 50-year-old woman might pay a premium starting at $7.49 for a $2,000 death benefit. This cost can be higher for older individuals, making it less affordable.

Restrictions On Coverage Amounts

Open Care Life Insurance has restrictions on coverage amounts. The maximum coverage offered is $500,000. This might not meet the needs of those requiring substantial life insurance coverage. Additionally, the range of coverage options is limited compared to other providers.

Possible Exclusions And Limitations

There are possible exclusions and limitations in Open Care Life Insurance policies. The details of these exclusions are not always clear on their website. The strict underwriting process includes a four-year lookback period, which can result in exclusions based on past medical history. Also, the lack of detailed information about policy conditions can be a concern.

In summary, while Open Care Life Insurance offers various products, it also has notable drawbacks. These include limited payout options, potential higher costs for older individuals, restrictions on coverage amounts, and possible exclusions and limitations. Carefully considering these factors is essential before choosing a life insurance policy.

Pricing And Affordability

Open Care Life Insurance is known for offering various life insurance policies. Understanding the pricing and affordability of these plans is crucial. This section breaks down the costs, factors influencing premiums, and compares Open Care with other competitors. Learn how to budget effectively for life insurance.

Cost Breakdown Of Different Plans

Open Care offers several types of life insurance plans. Here is a breakdown of the costs:

- Whole Life Insurance: Permanent coverage with fixed premiums. No medical exam required. Premiums can be higher due to the guaranteed payout.

- Guaranteed Life Insurance: No medical exam required. Higher premiums because of guaranteed acceptance.

- Term Life Insurance: Coverage for a specific term (10, 20, or 30 years). Medical exam required. Premiums are lower compared to whole life insurance.

- Burial Insurance: Covers funeral and other end-of-life expenses. Premiums vary by age and gender.

For a healthy 50-year-old woman, monthly premiums start at $7.49 for a $2,000 death benefit. Policies range from $25,000 to $500,000.

Factors Influencing Premium Rates

Several factors influence the premium rates for Open Care Life Insurance:

- Age: Younger individuals generally pay lower premiums.

- Gender: Women often have lower premiums than men.

- Health: Healthier individuals receive lower rates. Certain health conditions can increase premiums.

- Smoking Status: Smokers typically face higher premiums due to health risks.

- Coverage Amount: Higher coverage amounts result in higher premiums.

Comparing Open Care With Competitors

To ensure you’re getting the best deal, compare Open Care with other life insurance providers:

| Provider | Monthly Premium (50-year-old woman) | Coverage Amount |

|---|---|---|

| Open Care | $7.49 | $2,000 |

| Competitor A | $8.00 | $2,000 |

| Competitor B | $6.50 | $2,000 |

Open Care offers competitive rates, but it’s essential to review all options.

Budgeting For Life Insurance

Budgeting for life insurance is vital. Here are a few tips:

- Assess your financial situation and determine how much coverage you need.

- Consider your monthly income and expenses to find a premium you can afford.

- Use online quote tools to compare different plans and find the best rate.

- Review your policy annually to ensure it still meets your needs.

Planning ahead ensures you can afford the protection your family needs.

Pros And Cons Based On Real-world Usage

Open Care Life Insurance has garnered mixed reviews from users. Analyzing real-world usage helps to understand the benefits and drawbacks of their policies. Here, we will break down the pros and cons based on customer experiences.

Customer Satisfaction And Testimonials

Many customers appreciate the same-day coverage option. It provides peace of mind knowing they are insured immediately. The online quote tool is another positive aspect, making it easy to get estimates without a lengthy process.

Testimonials often highlight the variety of life insurance products available. This flexibility allows individuals to choose a policy that fits their needs.

Below is a table summarizing key positive feedback:

| Feature | Customer Feedback |

|---|---|

| Same-Day Coverage | Immediate peace of mind |

| Online Quote Tool | Easy and quick estimates |

| Variety of Products | Flexibility in choosing policies |

Common Complaints And Issues

Despite the positives, some users find the lack of detailed information on the website frustrating. They feel the transparency is insufficient, especially regarding insurance providers.

Another common complaint is about the strict underwriting process. The four-year lookback period can be a significant hurdle for some applicants.

Here are some frequently mentioned drawbacks:

- Insufficient website information

- Strict underwriting process

- Potentially uncompetitive rates

Overall Value Proposition

Open Care Life Insurance offers various products, from whole life insurance to burial insurance. The easy online application and same-day coverage are significant advantages. However, the lack of transparency and strict underwriting can be off-putting for potential customers.

The value proposition lies in the convenience and variety of options, but careful consideration is necessary.

Comparing User Experiences

Comparing user experiences reveals a mixed bag of reviews. Some users praise the ease of application and range of products, while others criticize the lack of detailed information and strict underwriting criteria.

Here is a comparison of positive and negative user experiences:

| Positive Experiences | Negative Experiences |

|---|---|

| Quick and easy application | Lack of detailed information |

| Variety of policy options | Strict underwriting process |

| Same-day coverage for qualified applicants | Potentially higher rates |

Who Should Consider Open Care Life Insurance?

Choosing the right life insurance can be tough. Open Care Life Insurance offers various policies tailored to different needs. Understanding who should consider this insurance can help you make an informed decision.

Ideal Users And Scenarios

Open Care Life Insurance is suitable for a wide range of individuals. Whether you need permanent coverage, temporary protection, or specific final expense insurance, this provider has options. Here are some ideal users and scenarios:

- Individuals looking for no medical exam policies

- Those needing quick, same-day coverage

- People wanting a variety of coverage options

Young Families And New Parents

Young families and new parents often look for life insurance to secure their family’s future. Open Care’s term life insurance provides coverage for a set period. It helps cover mortgage payments, children’s education, and daily expenses. For parents, ensuring their children’s financial stability is crucial. Open Care offers affordable policies starting at $7.49 per month.

Retirees And Seniors

Open Care Life Insurance is also beneficial for retirees and seniors. As individuals age, final expense insurance becomes important. Open Care’s burial insurance covers funeral and end-of-life costs. This insurance relieves the financial burden on family members. With policies ranging up to $500,000, seniors can find peace of mind.

Individuals With Health Concerns

For those with health issues, finding life insurance can be challenging. Open Care’s guaranteed life insurance offers acceptance without a medical exam. This is ideal for individuals with pre-existing conditions. Although these policies have higher premiums, they provide essential coverage for those in need.

| Policy Type | Features |

|---|---|

| Whole Life Insurance | Permanent coverage, fixed premium, lifetime payout |

| Guaranteed Life Insurance | No medical exam, higher premiums |

| Term Life Insurance | Coverage for a specific term, requires medical exam |

| Burial Insurance | Final expense coverage for funeral costs |

Open Care Life Insurance offers various plans to meet different needs. Whether you are a young parent or a senior, there is a policy for you. Consider your situation and choose the best option to secure your loved ones’ future.

Credit: www.facebook.com

Credit: www.lhlic.com

Frequently Asked Questions

What Are The Benefits Of Open Care Life Insurance?

Open Care Life Insurance offers flexible coverage options and affordable premiums. It provides financial security for your loved ones. The policy includes additional riders like critical illness and accidental death benefits.

What Drawbacks Does Open Care Life Insurance Have?

Open Care Life Insurance may have higher premiums for older individuals. Some policies have limited coverage options. The application process can be lengthy and require medical examinations.

How Much Does Open Care Life Insurance Cost?

The cost of Open Care Life Insurance varies based on age, health, and coverage amount. Premiums start as low as $15 per month. Customized quotes are available for specific needs.

Is Open Care Life Insurance Worth It?

Open Care Life Insurance is worth it for those seeking affordable, flexible coverage. It offers peace of mind and financial security. Evaluate your needs and compare with other providers.

Conclusion

Choosing Open Care Life Insurance offers several benefits and some drawbacks. The variety of policies provides flexibility. Same-day coverage is a significant advantage. The online quote tool simplifies the process. However, lack of detailed information can be frustrating. Rates might not be the most competitive.

Consider your needs and research thoroughly. Visit their website for more details. Ensure you fully understand the terms before applying. Open Care Life Insurance can be a good option for some, but compare with other providers. Make an informed decision that best suits your needs.