Finding affordable car insurance in California is all about balancing coverage and cost. Compare quotes, prioritize liability insurance, and ask about discounts to get the protection you need without overspending.

As we gaze towards 2025, finding the best and cheap car insurance in California will top many motorists’ priority lists. With a landscape of changing regulations and varied options, it’s essential to stay informed. Car insurance in California doesn’t have to break the bank.

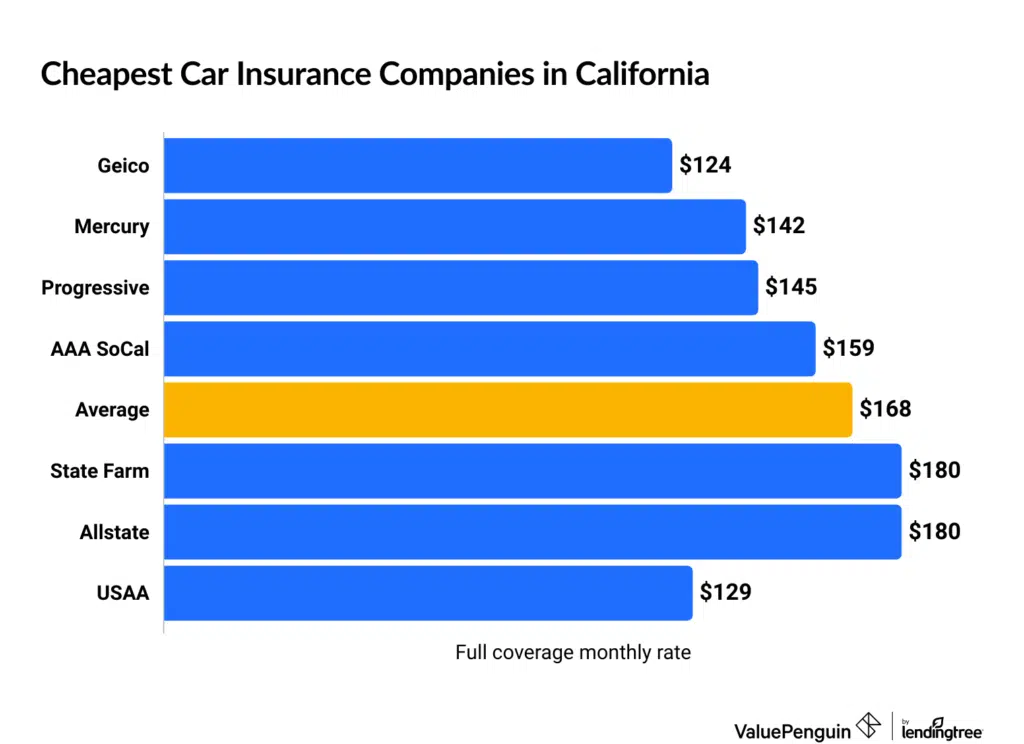

Recent analysis highlights affordable policies without compromising on quality. Providers like Geico and State Farm are leading the charge, offering plans that cater to diverse needs. With premiums averaging $3,066 for full coverage and just $760 for minimum, drivers can find a policy that fits their budget. Customer satisfaction is important, and these companies deliver, backed by impressive scores from the J. D. Power study. Notably, the market remains resilient, with insurers actively writing new policies despite economic fluctuations.

Progressive’s Name Your Price tool and Geico’s discounts help drivers stay within budget, while Mercury offers affordable rates for Californians. Progressive and Geico often have competitive prices, and State Farm adds value with its agent network and telematics programs. Though refund policies aren’t always clear, these insurers provide solid options for drivers.

Table of Contents

ToggleIntroduction To Car Insurance In California

California drivers face a unique car insurance landscape in 2025. With average annual premiums at $3,066 for full coverage and $760 for minimum coverage, finding affordable options is key. This guide spotlights the top cheap car insurance providers in California, focusing on Geico, State Farm, Progressive, and Mercury.

Understanding The California Car Insurance Landscape

The state mandates certain coverages, impacting rates. In 2025, California’s minimum coverage requirements rise, influencing premiums. Despite market fluctuations, providers like Geico, State Farm, Progressive, and Mercury continue offering new policies. They stand out for their balance of cost, coverage, and customer satisfaction.

- Minimum coverage requirements increase in 2025.

- Average premiums: $3,066 for full, $760 for minimum.

- Top providers: Geico, State Farm, Progressive, Mercury.

Why Cheap Car Insurance Is Sought After In California

California drivers seek affordable insurance for several reasons. Rising living costs, increased minimum coverage, and the desire for budget flexibility drive this need. Providers like Progressive offer tools like Name Your Price to help. Geico and Mercury focus on low premiums and discounts. State Farm combines agent network and telematics for savings.

| Provider | Full Coverage | Minimum Coverage |

|---|---|---|

| Progressive | $199/month | $583/year |

| Geico | $193/month | $442/year |

| State Farm | $256/month | $617/year |

| Mercury | $200/month | $745/year |

Choosing the right insurance requires understanding both the landscape and one’s personal needs. This guide aims to simplify that process, highlighting affordable options with strong coverage and satisfaction ratings.

Criteria For Choosing The Best Cheap Car Insurance

Finding affordable car insurance in California doesn’t mean you have to compromise on quality. Consider several factors to ensure you’re getting the best value for your money.

Evaluating Coverage Options

It’s essential to compare coverage levels. Look for policies that offer both full and minimum coverage to match your needs. In 2025, California’s minimum requirements will change, making it crucial to adjust your policy accordingly.

Assessing Customer Service And Claims Satisfaction

Insurers should provide excellent customer service. Check customer satisfaction scores, like those from J.D. Power, to gauge how well a company handles claims and inquiries.

Exploring Discounts And Rewards

Don’t miss out on potential savings. Look for insurers offering various discounts that can significantly lower your premiums. Rewards for safe driving or bundling services can add extra value.

Best And Cheap Car Insurance Providers In California For 2025

Finding affordable car insurance in California is crucial for drivers. With new laws in 2025, it’s important to stay covered without breaking the bank. Based on recent analysis, here are the top insurers offering the best value.

Overview Of Selected Insurers

- Geico: Known for low premiums and multiple discounts.

- State Farm: Offers a vast agent network and telematics programs.

- Progressive: Features Name Your Price tool for flexible budgeting.

- Mercury: Provides consistent coverage with a focus on affordability.

Comparative Analysis Of Coverage And Benefits

| Provider | Full Coverage Annual Premium | Minimum Coverage Annual Premium | Discounts and Tools | Customer Satisfaction |

|---|---|---|---|---|

| Progressive | $2,392 | $583 | Name Your Price, discounts | High |

| Geico | $2,312 | $442 | Various discounts, digital tools | High |

| State Farm | $3,069 | $617 | Agent network, telematics | High |

| Mercury | $2,397 | $745 | Consistent coverage, discounts | Good |

Each insurer has unique offerings. Geico excels in digital tools, while State Farm shines with agent support. Progressive‘s flexible pricing tool helps tailor costs, and Mercury stands out for budget-friendly options. Select the best fit for your needs.

Credit: www.usnews.com

Key Features Of The Top Picks

Choosing the right car insurance in California is crucial for drivers. The top picks for 2025 highlight insurers that stand out in affordability and quality. These companies offer innovative discounts, customizable plans, and digital tools for a seamless experience. Let’s dive into the key features that make these insurers the best choice for California drivers in 2025.

Innovative Discounts And Savings Opportunities

The leading car insurance providers in California for 2025 are known for their competitive pricing and diverse discounts. For example, Geico and Progressive offer substantial savings through various discount programs. Drivers can save money by maintaining a clean driving record, insuring multiple vehicles, and using telematics programs like State Farm’s Drive Safe & Save.

Customizable Coverage Plans

Flexibility in coverage is a key feature. Providers like Mercury and State Farm allow drivers to tailor their policies to fit their needs. Whether seeking full coverage or the legal minimum, there’s a plan for every budget. This customization ensures drivers only pay for what they need, making car insurance both affordable and practical.

Digital Tools And Mobile Apps For Policy Management

Today’s top insurers embrace technology, offering digital tools and mobile apps for convenient policy management. Geico and Progressive lead with intuitive apps that let drivers manage their policies, file claims, and even adjust coverage on-the-go. This digital approach simplifies insurance, saving time and enhancing customer experience.

| Provider | Full Coverage | Minimum Coverage | Discounts and Tools |

|---|---|---|---|

| Progressive | $2,392/year | $583/year | Name Your Price tool, Discounts |

| Geico | $2,312/year | $442/year | Mobile App, Multiple Discounts |

| State Farm | $3,069/year | $617/year | Drive Safe & Save, Agent Network |

| Mercury | $2,397/year | $745/year | Customizable Plans, Discounts |

These features make our top picks the best and cheapest car insurance options in California for 2025. Drivers benefit from lower rates, personalized coverage, and digital conveniences, ensuring peace of mind on the road.

Pricing And Affordability Breakdown

Understanding car insurance pricing is key for California drivers seeking value in 2025. This section breaks down affordability, highlighting the top 5 insurers.

Understanding The Factors Affecting Premiums

Several factors impact insurance costs. These include vehicle type, driving history, and coverage levels. In 2025, California sees new laws raising minimum coverage rates. This affects premiums.

- Vehicle type influences rates.

- Driving history matters.

- Coverage levels are crucial.

- New laws increase minimum coverage.

Comparative Cost Analysis Of The Top Insurers

The top insurers offer competitive rates for California drivers. See how they compare for both full and minimum coverage.

| Insurer | Full Coverage Annual Cost | Minimum Coverage Annual Cost |

|---|---|---|

| Progressive | $2,392 | $583 |

| Geico | $2,312 | $442 |

| State Farm | $3,069 | $617 |

| Mercury | $2,397 | $745 |

Each insurer offers unique benefits. Progressive shines with its Name Your Price tool. Geico is known for low premiums. State Farm provides a wide agent network. Mercury focuses on budget-friendly rates.

Credit: www.caranddriver.com

Real-world Pros And Cons

Discovering the best and cheap car insurance in California requires understanding the real-world pros and cons. This section delves into actual customer experiences and the strengths and weaknesses of top providers.

Customer Experiences And Testimonials

Customers rate their experiences based on service, value, and claims processing. Testimonials often highlight satisfaction or issues.

- Progressive users admire the flexible pricing tool.

- Geico’s digital tools are a hit with tech-savvy drivers.

- State Farm customers praise local agent networks.

- Mercury is favored for its budget-friendly rates.

Strengths And Weaknesses Of Each Provider

| Provider | Strengths | Weaknesses |

|---|---|---|

| Progressive | Price tool, discounts | Higher minimum coverage cost |

| Geico | Low premiums, digital tools | Limited agent network |

| State Farm | Agent network, telematics | Higher full coverage cost |

| Mercury | Consistent budget rates | Fewer digital options |

Recommendations For Specific Driver Profiles

Finding the right car insurance can be tough. Different drivers need different insurance. We looked at the best options in California for 2025. Let’s find the best fit for you.

Best Options For Young Drivers

Young drivers need affordable rates and good coverage. Geico and Progressive stand out. They offer competitive premiums and discounts for students and safe driving.

- Geico: $2,312/year full coverage

- Progressive: $2,392/year full coverage

These options help young drivers save money and stay protected on the road.

Top Picks For Families

Families look for reliability and multiple-car discounts. State Farm is a great choice. They have a strong agent network and offer discounts for safe driving and multiple vehicles.

- State Farm: $3,069/year full coverage

With State Farm, families benefit from personalized service and savings.

Ideal Choices For High-risk Drivers

High-risk drivers need insurers that understand their situation. Mercury offers consistent coverage and a focus on budget-friendly rates, which is crucial for high-risk profiles.

- Mercury: $2,397/year full coverage

Mercury’s policies provide the necessary support for drivers needing a second chance.

Credit: www.valuepenguin.com

Final Thoughts On Choosing The Right Car Insurance In California

Finding the best car insurance can be a challenge. Let’s explore how to balance cost and quality, alongside future trends for Californian drivers. Important factors like coverage, discounts, and customer satisfaction are key.

Balancing Cost And Quality

Quality car insurance doesn’t have to break the bank. Geico and Mercury offer competitive rates with essential coverage. State Farm and Progressive provide value through discounts and digital tools.

Seek policies that blend affordability with reliable protection. Look for insurers with strong customer satisfaction ratings. Bankrate helps by rating carriers on cost, coverage, and support.

Future Trends In Car Insurance For Californians

2025 brings changes with Senate Bill 1107, increasing minimum coverage requirements. Car insurance rates may change, but staying informed is key. Use tools like Bankrate’s updated reviews and scores.

Look for insurers adapting with the times, offering telematics and personalized pricing. Digital tools like Progressive’s Name Your Price can help tailor costs to your budget.

Frequently Asked Questions

What Determines Cheap Car Insurance In California?

Cheap car insurance in California depends on various factors, including the driver’s age, driving record, and the car’s make and model. Insurance companies also consider the coverage level chosen and any applicable discounts. Shopping around and comparing quotes is key to finding the best rate.

How Can I Lower My Car Insurance Rates In 2025?

To lower your car insurance rates in 2025, maintain a clean driving record, choose a car that’s cheap to insure, and increase your deductible. Also, take advantage of discounts for good drivers, multiple policies, and completing defensive driving courses. Regularly compare rates from different insurers.

Are There Specific Discounts For California Drivers?

Yes, California drivers can access specific discounts such as good driver, multi-car, and multi-policy discounts. Additionally, there are discounts for having safety features on your vehicle, completing a defensive driving course, and for students maintaining good grades. Check with insurers to see what discounts you qualify for.

What Coverage Is Mandatory For California Car Insurance?

California law requires drivers to have minimum liability coverage of $15,000 for injury/death to one person, $30,000 for injury/death to more than one person, and $5,000 for property damage. However, it’s wise to consider additional coverage for better protection.

Conclusion

Choosing the right car insurance in California doesn’t have to be tough. Our rundown of providers for 2025 simplifies your search. You’ve learned about affordable premiums, coverage variety, and customer satisfaction. Remember, prices may shift, but our reviews can guide you.

Check out the options, compare the benefits, and pick the one that fits. Drive with peace of mind, knowing you’ve made a smart choice for your wallet and your wheels. Safe travels and happy savings.