Looking for cheap Arizona car insurance in Arizona? With so many options, it can feel overwhelming, but finding an affordable plan is easier than you think.

In this guide, we will explore the best top 5 cheap Arizona car insurance providers for 2025. Our goal is to help you find the most cost-effective and reliable options tailored to your needs. We will consider key factors like customer satisfaction, coverage options, and pricing.

This way, you can make an informed decision without breaking the bank. Join us as we navigate through the best affordable car insurance options available to Arizona drivers in 2025.

Table of Contents

ToggleIntroduction To Affordable Car Insurance In Arizona For 2025

Finding affordable car insurance in Arizona for 2025 is crucial. Drivers need to balance cost with quality coverage. This guide will help you navigate the best options. Arizona has some top providers offering competitive rates without compromising on coverage.

Why Finding Affordable Car Insurance Is Essential

Affordable car insurance is vital for budget-conscious drivers. High premiums can strain finances. Lower rates provide peace of mind and financial security. Additionally, having adequate coverage protects you from unexpected expenses in accidents. Choosing the right policy saves money and ensures you are well-covered.

Overview Of The Arizona Car Insurance Market In 2025

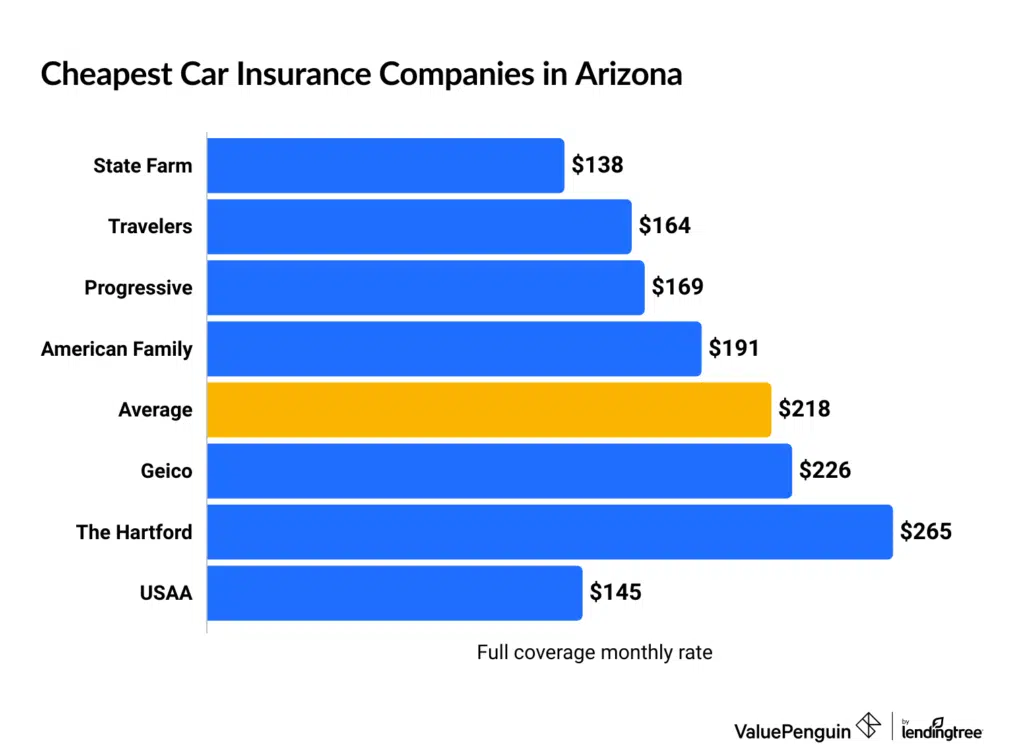

The Arizona car insurance market in 2025 remains competitive. Many providers offer various coverage options. Let’s look at some key players:

| Insurance Company | Full Coverage (Yearly) | Minimum Coverage (Yearly) |

|---|---|---|

| Progressive | $2,184 | $618 |

| Geico | $1,505 | $421 |

| State Farm | $2,947 | $1,042 |

| Travelers | $1,467 | $492 |

| Nationwide | $2,060 | $921 |

These figures reflect the average premiums for full and minimum coverage. Factors like customer satisfaction and claims handling also matter. Providers like Geico and Travelers offer competitive rates and excellent customer service. Progressive and Nationwide provide unique features, including telematics programs and discounts.

Understanding these options helps you make an informed choice. Comparing rates and coverage ensures you find the best fit for your needs.

Factors To Consider When Choosing Cheap Car Insurance

Finding affordable car insurance is crucial, but several factors should influence your decision. Below are key considerations to ensure you get the best value for your money.

Coverage Options

Not all car insurance policies are equal. Look for policies that offer comprehensive and collision coverage. Also, ensure liability limits meet state requirements. Some insurers provide additional benefits like roadside assistance or rental car reimbursement.

| Insurer | Full Coverage (Yearly) | Minimum Coverage (Yearly) |

|---|---|---|

| Progressive | $2,184 | $618 |

| Geico | $1,505 | $421 |

| State Farm | $2,947 | $1,042 |

| Travelers | $1,467 | $492 |

| Nationwide | $2,060 | $921 |

Customer Service And Support

Customer service is vital. You want an insurer that is responsive and helpful. Check customer satisfaction scores and read reviews. Look for companies with 24/7 support and easy claim filing processes.

Discounts And Savings Opportunities

Discounts can significantly reduce your premium. Many insurers offer discounts for safe driving, bundling policies, or installing anti-theft devices. Some even provide savings for paying your premium in full or setting up automatic payments.

- Safe Driver Discounts

- Multi-Policy Discounts

- Automatic Payment Discounts

Financial Stability Of The Insurer

An insurer’s financial stability is crucial. It ensures they can pay out claims. Check ratings from agencies like A.M. Best. A high rating means the company is financially sound and reliable.

By considering these factors, you can find cheap car insurance that provides excellent value and peace of mind.

Top 5 Cheap Arizona Car Insurance in Arizona For 2025

Finding affordable car insurance in Arizona can be challenging. But, we’ve done the homework for you. Here are the top 5 cheap car insurance options in Arizona for 2025. These companies offer competitive prices, excellent customer service, and various coverage options.

Company 1: Key Features And Benefits

Progressive offers a balance of affordability and coverage. Their full coverage costs $2,184/year, and minimum coverage is $618/year.

- Telematics programs for discounts

- High customer satisfaction scores

- Diverse coverage options

Company 2: Key Features And Benefits

Geico stands out with some of the lowest rates. Full coverage is priced at $1,505/year, while minimum coverage is $421/year.

- Low premiums for both full and minimum coverage

- Excellent claims handling

- Various discount opportunities

Company 3: Key Features And Benefits

State Farm provides comprehensive coverage with full coverage at $2,947/year and minimum coverage at $1,042/year.

- Personalized quotes based on individual needs

- Strong customer satisfaction

- Wide range of endorsements

Company 4: Key Features And Benefits

Travelers offers competitive rates with full coverage at $1,467/year and minimum coverage at $492/year.

- Affordable premiums for full and minimum coverage

- Comprehensive telematics programs

- High customer satisfaction

Company 5: Key Features And Benefits

Nationwide delivers a mix of coverage options with full coverage at $2,060/year and minimum coverage at $921/year.

- Diverse coverage options and endorsements

- Personalized quotes

- Good customer service

These companies provide a variety of options for cheap car insurance in Arizona. Choose the one that meets your needs and budget.

Comparative Analysis Of The Top 5 Options

Choosing the best car insurance in Arizona for 2025 can be challenging. Here, we provide a comparative analysis of the top 5 cheap options. This will help you make an informed decision based on coverage, pricing, customer satisfaction, and unique features.

Coverage Comparison

Coverage is a key factor in choosing car insurance. Here’s a comparison of the coverage options offered by each provider:

| Provider | Full Coverage | Minimum Coverage |

|---|---|---|

| Progressive | Comprehensive, collision, liability, uninsured motorist | Liability only |

| Geico | Comprehensive, collision, liability, medical payments | Liability only |

| State Farm | Comprehensive, collision, liability, rental reimbursement | Liability only |

| Travelers | Comprehensive, collision, liability, new car replacement | Liability only |

| Nationwide | Comprehensive, collision, liability, accident forgiveness | Liability only |

Pricing And Affordability Breakdown

Pricing is crucial for many drivers. Here’s a breakdown of the costs for full and minimum coverage:

| Provider | Full Coverage (Yearly) | Minimum Coverage (Yearly) |

|---|---|---|

| Progressive | $2,184 | $618 |

| Geico | $1,505 | $421 |

| State Farm | $2,947 | $1,042 |

| Travelers | $1,467 | $492 |

| Nationwide | $2,060 | $921 |

Customer Satisfaction And Reviews

Customer satisfaction is a good indicator of service quality. Below are insights into customer reviews:

- Progressive: High ratings for claims processing and customer service.

- Geico: Known for affordable rates and easy-to-navigate online tools.

- State Farm: Positive feedback for local agents and comprehensive coverage.

- Travelers: Customers appreciate the variety of coverage options.

- Nationwide: Good reviews for accident forgiveness and customer support.

Unique Selling Points Of Each Provider

Each provider offers unique features that can be a deciding factor:

- Progressive: Offers a wide range of discounts and telematics programs.

- Geico: Provides robust mobile app features and military discounts.

- State Farm: Strong network of local agents and personalized service.

- Travelers: Innovative coverage options like new car replacement.

- Nationwide: Unique features such as accident forgiveness and vanishing deductible.

Pros And Cons Of Each Insurance Provider

When choosing the best car insurance provider in Arizona for 2025, it’s important to weigh the pros and cons of each option. Here’s a detailed look at the top five providers to help you make an informed decision.

Company 1: Pros And Cons

| Pros | Cons |

|---|---|

|

|

Company 2: Pros And Cons

| Pros | Cons |

|---|---|

|

|

Company 3: Pros And Cons

| Pros | Cons |

|---|---|

|

|

Company 4: Pros And Cons

| Pros | Cons |

|---|---|

|

|

Company 5: Pros And Cons

| Pros | Cons |

|---|---|

|

|

Specific Recommendations For Different User Scenarios

Finding the right car insurance can be challenging. Different drivers have different needs. Below are specific recommendations for the best cheap car insurance in Arizona for 2025. Each category addresses unique user scenarios, helping you find the best fit for your situation.

Best For Young Drivers

Young drivers often face high premiums due to their inexperience. Geico offers competitive rates for young drivers in Arizona, with a minimum coverage cost of $421/year. Their telematics program can also help young drivers reduce their premiums by monitoring safe driving habits.

Best For Families

Families need comprehensive coverage at affordable rates. Travelers provides excellent options for families, with full coverage costing $1,467/year. They offer various discounts for bundling multiple policies, making it a cost-effective choice for family insurance needs.

Best For High-risk Drivers

High-risk drivers often struggle to find affordable insurance. Progressive is a suitable option, with full coverage at $2,184/year. They offer programs that can help reduce premiums over time, even for those considered high-risk.

Best For Low Mileage Drivers

Drivers who don’t drive much can benefit from pay-per-mile insurance. Nationwide offers this option, with a full coverage cost of $2,060/year. Their telematics program tracks mileage and adjusts premiums accordingly, which can be very cost-effective for low mileage drivers.

Best For Comprehensive Coverage Seekers

For those seeking extensive coverage, State Farm offers robust options. Though their full coverage is higher at $2,947/year, they provide extensive coverage options and excellent customer service. This makes them an ideal choice for those who want comprehensive protection.

| Insurance Provider | Full Coverage (Yearly) | Minimum Coverage (Yearly) |

|---|---|---|

| Progressive | $2,184 | $618 |

| Geico | $1,505 | $421 |

| State Farm | $2,947 | $1,042 |

| Travelers | $1,467 | $492 |

| Nationwide | $2,060 | $921 |

Frequently Asked Questions

What Is The Cheapest Car Insurance In Arizona For 2025?

The cheapest car insurance in Arizona for 2025 varies. Companies like Geico, State Farm, and Progressive often offer competitive rates.

How Can I Find Affordable Car Insurance In Arizona?

To find affordable car insurance in Arizona, compare quotes from multiple providers. Look for discounts and consider higher deductibles.

Are There Discounts For Car Insurance In Arizona?

Yes, many insurers offer discounts for good driving records, bundling policies, and having safety features in your car.

Is Minimum Coverage Enough For Arizona Car Insurance?

Minimum coverage meets legal requirements but may not cover all damages. Consider higher coverage for better protection.

Conclusion

Choosing the right car insurance isn’t just about saving money—it’s about peace of mind, too. The options we’ve listed offer affordable coverage tailored for Arizona drivers. Take the time to compare prices, check customer reviews, and review coverage details to find the best fit for your needs. Visit [website] to explore your options and make a smart, well-informed choice for 2025. Drive safe, stay protected, and enjoy the road ahead!