As a pet owner, it’s tough to keep your furry friend healthy, especially with chronic conditions. The cost of long-term vet care can worry you. You might ask, “How can I afford my pet’s care without financial stress?”

Pet insurance for chronic conditions is a great solution. This article will show you the best pet insurance for chronic illnesses. We’ll look at top providers and their plans. You’ll learn about reimbursement rates and coverage options to choose the right plan for your pet.

Table of Contents

ToggleKey Takeaways

- Explore top-rated pet insurance providers renowned for chronic condition coverage.

- Understand reimbursement rates and various deductible options.

- Learn the importance of comprehensive coverage for ongoing health challenges.

- Evaluate sample rates for different pets’ age groups.

- Customize plans according to your pet’s unique health needs.

Pet Insurance for Chronic Conditions

Chronic conditions in pets need ongoing care. This makes pet insurance coverage very important for pet owners. Conditions like diabetes, arthritis, and chronic respiratory issues can really hurt a pet’s health if not managed right.

It’s key to know the different plans out there. Each plan offers different levels of coverage for chronic conditions in pet insurance.

Many pet insurance companies don’t cover pre-existing conditions. This is a big problem for pets with chronic illnesses. A lot of claims are for pre-existing conditions, showing a big gap for pet owners to deal with.

If a condition showed symptoms before the policy started, coverage might be limited or not available. This is something pet owners need to understand.

Pet insurance plans for chronic conditions usually cost more. But, they can save a lot of money on unexpected vet bills. A recent study showed different companies have different market shares for chronic condition coverage. This means pet owners should compare to find the best plan.

Also, many pet owners get insurance when their pets are young. They know it’s a smart move to save money on long-term care. This way, they can protect their finances better against the high costs of chronic conditions.

Importance of Chronic Condition Coverage in Pet Insurance

Pet ownership brings joy and companionship. But, it can also come with unexpected challenges. Chronic conditions can lead to big vet bills over time. For many, pet insurance for chronic conditions is a must, not just a luxury.

It helps cover the cost of ongoing treatments and meds. This lets me focus on my pet’s health without worrying about vet bills.

Chronic ailments like allergies, arthritis, diabetes, and obesity need regular vet visits. Arthritis can make it hard for pets to move. Diabetes means they drink and pee more, needing constant care.

With good pet insurance, I can give my pet the care they need. This means no stress about the cost of their treatments.

Companies like Figo Pet Insurance offer plans for chronic conditions. These plans start covering costs from the first vet visit. They’re also customizable, fitting my pet’s health needs.

Today, pet insurance for chronic conditions is more comprehensive. It covers medical needs, alternative therapies, and more. This flexibility helps me manage my pet’s health without breaking the bank.

Pet insurance for chronic conditions is key for responsible pet ownership. It helps with regular check-ups and care. This is especially important as pets get older.

Knowing I have coverage gives me peace of mind. It helps me handle unexpected vet bills. This ensures my pets get the care they need, no matter what.

Top Providers Offering Pet Insurance for Chronic Conditions

Looking for the best pet insurance for ongoing conditions means checking out different providers. With vet bills going up, picking the right plan is key. This is especially true for pets with chronic diseases. Here are some top choices in pet insurance:

ASPCA: Best for Broad Coverage

ASPCA offers a wide range of pet insurance plans. They cover accidents, illnesses, and even behavioral issues. Their flexible plans are great for pets needing ongoing care.

Embrace: Best Flexible Wellness Plan

Embrace is known for its customizable wellness plan. You can add preventive care and chronic disease coverage. However, pets must be symptom-free for 12 months before coverage for curable conditions starts. This makes Embrace a good fit for pets with chronic diseases.

Hartville: Best for Straightforward Waiting Periods

Hartville makes insurance easy with clear waiting periods. They offer simple plans that clearly state what’s covered for chronic conditions. This makes Hartville a good choice for those wanting straightforward care for their pets.

Features to Look for in Pet Insurance Coverage

When looking at pet insurance, some features are key. These include wide coverage, how much you get back, and what you pay upfront. These parts help ensure my pet gets the care they need, especially for ongoing health issues.

Comprehensive Coverage Options

It’s important to have a plan that covers a lot. This means accidents, illnesses, and long-term conditions like diabetes and arthritis. For example, ASPCA® Pet Health Insurance covers many illnesses and even alternative treatments like acupuncture.

Reimbursement Rate Policies

Reimbursement rates vary from 70% to 90%. This affects how much I pay for vet bills, especially for serious health problems. Choosing a plan with a higher rate means I get more back, which is key for ongoing care.

Annual Deductibles and Limits

Deductibles and limits are big factors in cost. Deductibles vary, so it’s crucial to match them with what I can afford and my pet’s needs. Also, knowing if there’s a cap on claims helps avoid unexpected costs during long treatments.

| Feature | Details |

|---|---|

| Comprehensive Coverage | Covers accidents, illnesses, chronic conditions, and alternative therapies |

| Reimbursement Rates | Typically between 70% – 90% |

| Annual Deductibles | Varies per policy; average amounts differ |

| Policy Limits | Annual or lifetime limits may apply |

Best Pet Insurance for Chronic Conditions in Dogs

Dogs with chronic conditions like diabetes and arthritis need special care. It’s important to find pet insurance that covers their ongoing medical needs. This includes treatments and medications.

Coverage for Conditions Like Diabetes and Arthritis

For chronic health issues, getting the right coverage is key. Look for plans that cover diabetes, arthritis, and more. They should include:

- Emergency vet visits

- Diagnostic tests like X-rays and MRIs

- Prescription meds

- Specialist vet visits

- Long-term care for chronic conditions

AKC Pet Insurance is great for pets with chronic conditions. They cover pre-existing conditions after 365 days of coverage. Their plans are perfect for pets needing long-term care.

Top Providers for Dogs with Long-term Health Issues

Here’s a look at top providers for pet insurance for dogs with chronic conditions:

| Provider | Chronic Condition Coverage | Customization Options | No Per-condition Limits |

|---|---|---|---|

| AKC Pet Insurance | Joint deterioration, hip dysplasia, arthritis | Wellness options, hereditary condition coverage | Yes |

| ASPCA | Some chronic conditions | Basic wellness plan available | No |

| Trupanion | Injury and illness, specific exclusions apply | Limited customization available | No |

| HealthyPaws | Illnesses including cancer, some exclusions | Basic vet visits and treatments | No |

| PetPlan | Comprehensive coverage with exclusions | Annual limit options | No |

AKC’s approach to covering chronic conditions is unique. They don’t have per-condition limits. This makes them the best choice for pet insurance for dogs with chronic conditions.

Best Pet Insurance for Chronic Conditions in Cats

Chronic health issues in cats can be tough for owners. Good pet insurance helps with the costs and gives needed care. Many plans are made for cats with ongoing health problems, offering full care.

Popular Plans for Cats with Chronic Health Issues

I looked at many pet insurance plans for cats with chronic health. Here are some top picks:

| Provider | Coverage Options | Reimbursement Rate | Waiting Period for Pre-existing Conditions |

|---|---|---|---|

| ASPCA | Strong coverage for hereditary and chronic conditions | Up to 90% | 12 months symptom-free for curable conditions |

| Embrace | Flexible wellness plans with add-ons | 90% | Reevaluates after one year of being symptom-free |

| Hartville | Affordable plans with essential chronic illness coverage | 80% | Excludes bilateral conditions already affected |

Specific Treatments and Coverages Offered

Many policies cover important treatments for chronic cat conditions. These include:

- Regular vet check-ups

- Medications for conditions like diabetes or kidney disease

- Special diets for health management

- Diagnostic testing and imaging

- Emergency care for chronic conditions

Choosing the right pet insurance for cats with chronic health can ease financial worries. It helps keep cats healthy and happy.

Affordable Pet Insurance Options for Chronic Health Issues

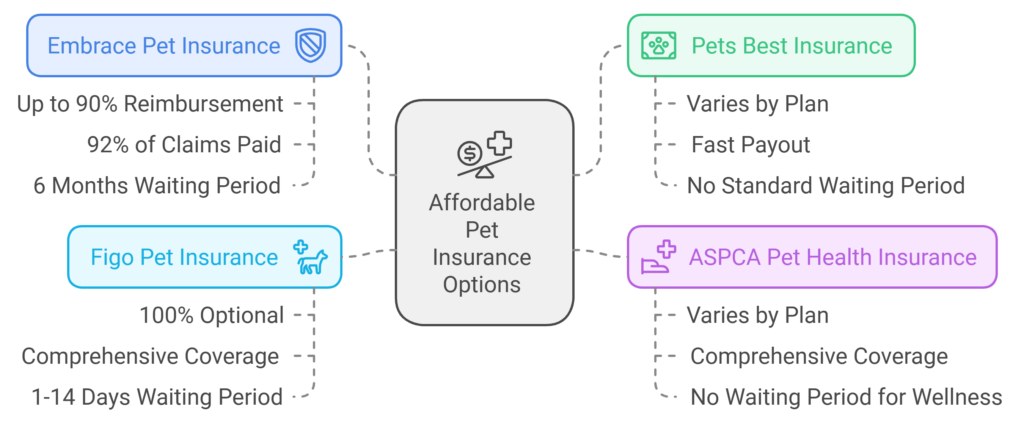

Cost is a big deal when looking at pet insurance. I found that affordable pet insurance for chronic health issues is out there. It offers good coverage without breaking the bank. Many pets need ongoing care for chronic conditions.

For example, treating kidney disease in cats can cost $649. Diabetes in cats can cost $889. Dogs with arthritis can face $400 in treatment costs.

Looking for budget-friendly pet insurance plans is key. This ensures pets get the care they need without hurting your wallet. Many companies offer plans that are both affordable and beneficial.

For instance, Embrace Pet Insurance paid out 92% of claims in 2021. This makes it a solid choice for those looking for good reimbursement rates. Pets Best Insurance is also known for quick payouts, helping you cover vet costs fast.

ASPCA Pet Health Insurance has a Complete Coverage plan. It covers accidents, illnesses, and routine care. Figo Pet Insurance even offers a 100% reimbursement option after you meet the deductible.

It’s important to compare different plans. This helps find the best balance between cost and coverage. Here’s a table comparing some affordable pet insurance options:

| Provider | Reimbursement Rate | Average Claim Payout | Waiting Period |

|---|---|---|---|

| Embrace Pet Insurance | Up to 90% | 92% of claims | 6 months |

| Pets Best Insurance | Varies by plan | Fast payout ( | No standard waiting period |

| ASPCA Pet Health Insurance | Varies by plan | Comprehensive coverage | No waiting period for wellness |

| Figo Pet Insurance | 100% optional | Comprehensive coverage | 1-14 days |

How to Compare Pet Insurance Quotes Effectively

When I look to compare pet insurance quotes, I find it essential to consider various factors. These factors include specific coverage details, price points, and customer satisfaction ratings. With this information, I can determine the best options for how to get pet insurance for chronic conditions.

Factors to Consider When Comparing Plans

Several key elements come into play when evaluating pet insurance policies:

- Annual Deductibles: Typically range from $100 to $1,000 per year, impacting overall costs.

- Reimbursement Limits: Many insurers have specific reimbursement amounts that can differ for various treatments.

- Reimbursement Percentage: Coverage levels generally fall between 70% to 90%, with some policies offering full (100%) coverage.

- Waiting Periods: Commonly last from 10 to 30 days, depending on the policy.

- Premium Variations: Premiums usually vary based on a pet’s breed, age, and size; older and larger breeds often incur higher costs.

Using Online Comparison Tools

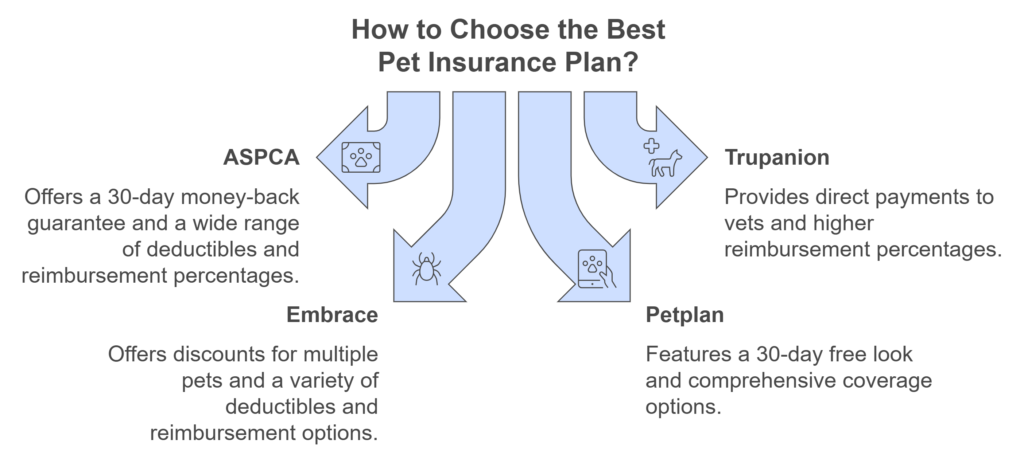

Online comparison tools provide an efficient way for me to evaluate multiple pet insurance providers concurrently. These platforms allow me to enter my pet’s details, view different policies, and easily compare coverage side by side. For chronic conditions, I pay close attention to how specific companies like ASPCA or Trupanion address pre-existing conditions and waiting periods.

Utilizing these resources can significantly simplify the process of finding the right coverage. Whether it be for a new puppy, an older cat, or a pet with special health needs. By carefully weighing these factors, I can ensure that I receive the best value for my pet’s insurance.

| Insurance Provider | Annual Deductible | Reimbursement Percentage | Special Features |

|---|---|---|---|

| ASPCA | $100 – $1,000 | 70% – 90% | 30-day money-back guarantee |

| Trupanion | $0 – $1,000 | 90% | Direct payments to vets |

| Embrace | $100 – $1,000 | 70% – 90% | Discounts for multiple pets |

| Petplan | $250 – $1,000 | 80% – 100% | 30-day free look |

| Healthy Paws | $100 – $500 | 70% – 90% | Sick exam fee coverage |

Pet Insurance for Senior Pets with Chronic Conditions

Senior pets need special care for their chronic conditions. As they get older, they may face health issues like arthritis and diabetes. Pet insurance for senior pets with chronic conditions is very important.

Many insurance plans are made for older pets. They help with the ongoing care needed for these pets.

Pet insurance providers know that age affects health and costs. Small dogs can be seniors at 11, while big dogs may be seniors at 6. This means policies can vary a lot.

Some policies have age limits for new pets. This can limit options for senior pets.

Older pets often have policies with exclusions for pre-existing conditions. Premiums also go up with age. This is because older pets need more medical care.

Companies like Embrace offer accident-only coverage for pets over 15. MetLife has no age limit for new pets. Knowing these differences helps manage costs and ensure care is available.

When looking for insurance, consider flexible policies. These allow you to customize coverage to fit your pet’s needs. Companies like Pets Best and Spot offer coverage for all ages, which is great for senior pets.

Planning for your senior pet’s future health is important. You can use CareCredit or charitable organizations to help with costs. Taking proactive steps helps ensure your pet’s quality of life.

| Insurance Provider | Age Limit | Policy Type | Notable Features |

|---|---|---|---|

| Embrace Pet Insurance | None for comprehensive (under 14), Accident-only up to 15 | Accident-only and Comprehensive | Flexible options with accident-only policy |

| MetLife Pet Insurance | No age limit | Comprehensive | Broad coverage for all ages |

| Pets Best Pet Insurance | No upper age limit | Customizable coverage | Focused on senior pet needs |

| Spot Pet Insurance | No upper age limit | Comprehensive | Specialized for seniors |

Pet insurance can be complex, especially for older pets. It’s important to review options carefully. This ensures your pet gets the best care for their needs.

Understanding Coverage for Pre-existing Chronic Conditions

Pet insurance for pre-existing chronic conditions is a big deal for many pet owners. Most policies don’t cover conditions diagnosed before you sign up. This makes many wonder: does pet insurance cover chronic conditions? While some conditions like arthritis and diabetes might not be covered, some companies might offer coverage under certain conditions.

Some conditions, like broken bones or ear infections, might be covered if they’re curable. Insurers check medical records to see if a condition existed before you got insurance. If there were symptoms before you signed up, it could affect if you’re covered.

But, conditions like allergies, cancer, or issues specific to certain breeds are usually not covered. If a condition affects both sides of the body and was diagnosed before you got insurance, it’s not covered. It’s key to keep all vet records up to date. Companies like ASPCA, Embrace, and Hartville have different rules for curable conditions, so it’s good to check each one out.

Some pet owners might not get insurance because they’re unsure about pre-existing conditions. But, getting a policy can really help with other health issues or accidents. With over two million pets insured in the U.S. and Canada, more people are realizing how important it is to protect their pets’ health.

Pet Insurance Plans for Long-term Medication Needs

Pets with long-term health issues need ongoing medication. I’ll look at pet insurance plans for these needs. The right plan can give pet owners peace of mind, especially for expensive treatments.

Many providers offer pet insurance for chronic illnesses with lifetime coverage. ASPCA Pet Health Insurance has a Complete CoverageSM plan. It covers prescription medication and more. Embrace also offers a Wellness Rewards add-on for important care.

Figo covers many prescription medications and chronic conditions. Healthy Paws and Lemonade have limited exclusions but cover big costs. Healthy Paws doesn’t cover prescription pet foods, but Lemonade does.

ManyPets and MetLife Pet Insurance have good options, but don’t cover pet foods. Nationwide and Pets Best focus on medication. Spot Pet Insurance and Trupanion cover both medications and foods but have limits.

It’s important to know the differences in coverage and costs. Plans start at $13 a month. Deductibles range from $250 to $1,000. Reimbursement percentages can be adjusted. But, some conditions and expenses are not covered.

| Provider | Prescription Medication | Chronic Medication | Prescription Pet Foods |

|---|---|---|---|

| ASPCA | Yes | Yes | Yes |

| Embrace | Yes | Yes | Yes |

| Figo | Yes | Yes | Yes |

| Healthy Paws | Yes | Yes | No |

| Lemonade | Yes | Yes | No |

| ManyPets | Yes | Yes | No |

| MetLife | Yes | Yes | Yes |

| Nationwide | Yes | Yes | Conditional |

| Pets Best | Yes | Yes | No |

| Spot Pet Insurance | Yes | Yes | Yes |

| Trupanion | Yes | Yes | Conditional |

Choosing the right pet insurance for long-term medication needs is key. I’ve shared important options and details to help you make the best choice for your pet.

Conclusion

Having good insurance for chronic conditions is key for my pet’s health. I’ve looked at many providers and plans. Each one has its own benefits for pets with chronic health problems.

When I look at pet insurance plans, I consider many things. This includes coverage, deductibles, and what’s not covered. This helps me make sure my pet gets the care they need without surprise costs.

Getting pet insurance is more than just saving money. It’s about making sure my pet stays healthy and happy. By choosing wisely, I can find a plan that fits my budget and meets my pet’s needs.