Finding the right auto insurance for young drivers is tough. Young drivers often pay a lot for insurance, around $6,517 for an 18-year-old’s policy. It’s important to find a good deal.

As a young adult, it’s hard to feel financially squeezed. But, many top insurance companies have plans just for young people. These plans can help ease the financial burden.

In this article, I’ll show you the top five best auto insurance for drivers under 25. They offer great rates and coverage for young drivers.

Table of Contents

ToggleKey Takeaways

- Younger drivers face significantly higher average premiums.

- Policies offered by major insurance providers can substantially lower costs.

- Discounts for students can provide critical savings.

- Exploring multiple providers can yield better rates and coverage.

- Understanding policy options is essential for making informed decisions.

Auto Insurance for Young Drivers

Auto insurance for young drivers can be tough to understand. It’s key to know the basics, like the different types of coverage. Learning about liability, collision, and comprehensive coverage helps pick the right policy.

Liability coverage pays for damages or injuries I cause in an accident. It’s needed by law in most places. Collision coverage fixes my car if it crashes. Comprehensive coverage covers theft or natural disasters. Each has its own benefits, helping me choose wisely.

Young drivers face a big challenge because they’re more likely to be in accidents. Crash deaths among drivers aged 20 to 24 show the risk. Insurance costs more for young drivers, with 18-year-olds paying $7,396 a year. For a 25-year-old, it’s $3,348.

Adding safety features and good driving habits can lower my rates. Knowing these tips can save a lot on insurance costs.

Why Young Drivers Pay Higher Premiums

Young drivers often face higher car insurance premiums. This is because they are seen as a higher risk. Car insurance stats show that drivers under 25 can pay double what average drivers do.

Drivers aged 15 to 19 are in 16% of fatal accidents caused by distraction. This shows they are more likely to drive distracted. Young drivers are also three times more likely to be in a road crash. Speeding is a big part of these crashes, happening in nearly 30% of fatal incidents.

Insurance companies see young people as high-risk. This is because they have less credit history. Young men, especially between 16-20, pay 9% to 11% more for full coverage than women. But, after 30, the difference in cost based on gender gets smaller.

Young drivers can lower their insurance costs. They can get discounts for safe driving and good grades. Adding security features like alarms can save 5% to 15% on premiums.

Best Auto Insurance for Drivers Under 25

Finding the right auto insurance can be tough, especially for young drivers. Knowing what features and coverage options are best helps find good rates. I’ve listed key features and coverage types to look at when choosing insurance.

Key Features to Look For

When looking for auto insurance, focus on these features:

- Premium Costs: Compare quotes to find the best rates.

- Customer Service Quality: Choose insurers with good customer support and claims handling.

- Discount Opportunities: Look for discounts for safe driving, good grades, or bundling policies.

- Tailored Policy Features: Make sure the policy fits your driving habits and needs.

Important Coverage Options

Young drivers often miss important coverage options:

- Uninsured/Underinsured Motorist Coverage: This is key for protection against drivers without insurance.

- Rental Reimbursement: Helps with car rental costs if your vehicle is in the shop.

- Roadside Assistance: Important for help during breakdowns or emergencies.

Choosing the right mix of features and coverages can help get the best rates for young drivers. Here’s a comparison of some providers’ premiums for young drivers in California:

| Insurance Provider | Average Monthly Premium | WalletHub Editors’ Rating |

|---|---|---|

| Geico | $81 | 4.4/5 |

| Progressive | $107 | 3.9/5 |

| Travelers | $85 | 4.2/5 |

| State Farm | $101 | 4.1/5 |

| Mercury | $104 | 3.7/5 |

By carefully considering these features and coverage options, young drivers can find the right insurance. This helps them get policies that fit their needs and budget.

Top Providers for Auto Insurance Under 25

Choosing the right auto insurance can be tough for young drivers. There are many options, so it’s key to know which ones are best. I’ll show you some top auto insurance companies for young drivers. They offer great deals and services.

Overview of Recommended Companies

Many top auto insurance companies focus on young drivers. Brands like Geico, Progressive, State Farm, and USAA are among the best. They have good rates, special discounts, and great customer service.

- Geico: Known for being affordable, Geico costs about $81 a month for drivers under 25. They offer accident forgiveness and discounts for more than one car.

- Progressive: With a monthly cost of $107, Progressive is good for those watching their budget. They have many insurance options.

- State Farm: State Farm focuses on making customers happy. They charge about $101 a month for young drivers. They also have many discounts for safe driving.

- USAA: Only for military families, USAA is the cheapest and best service. They offer special deals that can save a lot of money.

- Allstate: Allstate offers several discount opportunities, including a “Drivewise” program that tracks driving behavior and rewards safe driving with lower rates. They also offer a “TeenSMART” program for drivers under 25 to help improve their driving skills and earn discounts.

Evaluation Criteria for Selection

I looked at several important things when picking the best auto insurance companies:

- Pricing: I checked how affordable the premiums were. I compared them to state averages to find the best deals.

- Customer Service Ratings: A good reputation is key. I looked at what customers say about each company. I wanted to see if they were reliable and helpful.

- Discounts Offered: Discounts are important for saving money. I checked what discounts each company offers. This includes good student discounts or deals for bundling policies.

- Coverage Options: Having many coverage options is important. I looked for companies with flexible and comprehensive plans. This is important for different driving situations.

Affordable Auto Insurance for Young Drivers

Finding cheap car insurance for young drivers can be tough. But, with some research, you can find good deals. Over 2.4 million quotes from 607 companies show many ways to save. For example, Idaho has the cheapest average premium at $689 a year. Louisiana has the highest at $3,137.

Maine has the best rates for 21-25 year olds at $660 a year. New drivers pay a lot, about $3,131 for full coverage. But, a good driving record can lower your monthly payments a lot.

Companies like USAA, Nationwide, and GEICO offer great rates for young drivers. USAA charges $1,497 a year to add a teen driver. This is much cheaper than others. Discounts for good students show the value of looking for deals.

Young drivers should also compare quotes from different insurers. This can help find the cheapest insurance. Making smart choices can save a lot of money.

Average Cost of Car Insurance for Drivers Under 25

It’s key for young drivers to know the average cost of car insurance for drivers under 25. The yearly costs vary a lot, from about $3,842 to $8,348. Auto-Owners has the lowest yearly premium at $3,842, which is good for new drivers.

Monthly Premium Averages

Monthly costs for young drivers change based on many things. On average, 20-year-olds might pay around $315 a month. But, this can change a lot depending on the insurance company.

Geico and Travelers offer lower rates, at about $5,049 and $4,834 a year, respectively. In Michigan, costs can go up to $7,576 a year. But in Hawaii, it can be as low as $1,022 a year.

Factors Influencing Premiums

Many factors affecting rates include age, gender, driving experience, and where you live. Younger drivers, especially 16-year-olds, often pay more. But, rates tend to go down as they get older, peaking at about $1,402 for 25-year-olds.

Also, male drivers usually pay more than female drivers. This is true in states that consider gender when setting rates. Other things that can affect rates include your driving history, the type of car you drive, and any discounts you might get.

Discounts Available for Young Drivers

Finding cheap car insurance is hard for young drivers. But, there are many car insurance discounts for young drivers to help. Knowing about these can help get the best rates. I’ll talk about good student discounts and the perks of bundling insurance.

Good Student Discounts

Insurance companies see good grades as a sign of safety. They offer a good student discount for students with a 3.0 GPA or higher. Companies like Progressive and GEICO give these discounts to encourage good grades.

This discount helps keep costs down. It’s a big plus when combined with other savings.

Add-On Features and Bundling Savings

Getting more than one insurance policy can save a lot of money. For example, combining auto insurance with renters or homeowners insurance can lower your total cost. Adding more cars to one policy also saves money.

It’s not just about saving money. It also makes managing your insurance easier. You can get more discounts by combining policies.

| Insurance Provider | Good Student Discount | Multi-Car Discount | Additional Program |

|---|---|---|---|

| Progressive | Up to 10% | Available | Snapshot® program |

| GEICO | Up to 15% | Available | DriveEasy program |

Using these discounts can make car insurance more affordable for young drivers. It’s smart to compare different insurers to find the best savings.

Best Insurance Policies for First-Time Drivers

Choosing insurance can be tough for new drivers under 25. It’s key to find the best policies for them. Many companies offer special coverage for new drivers. This coverage addresses common concerns and needs.

The cost of car insurance for first-time drivers varies a lot. It can be around $3,192 for 16-year-olds and about $952 yearly for 24-year-olds. This shows why it’s important to compare options to find the best policy.

State Farm charges an average of $1,573 annually for first-time driver insurance. USAA and Geico offer good deals, costing $1,384 and $1,484 per year, respectively. Travelers and Mercury Insurance also have competitive prices, at $1,325 and $1,648 per year. These prices show how different insurers can affect the cost.

It’s important to know about coverage types when picking insurance for first-time drivers. Look for:

- Collision insurance: Covers vehicle repair costs after accidents.

- Comprehensive insurance: Protects against non-collision related damages.

- Roadside assistance: Useful for emergencies on the road.

- Accident forgiveness: Prevents premium increases after a first accident.

- Rental reimbursement: Covers rental costs while your vehicle is in the shop.

First-time drivers should also think about good student discounts. These discounts can lower premiums for those with a “B” average or better. Insurance costs often drop by 12% to 20% when drivers turn 25. This means big savings as driving experience grows. It’s vital to compare different options to find the best policy for your needs.

| Insurance Provider | Average Annual Cost |

|---|---|

| State Farm | $1,573 |

| USAA | $1,384 |

| Geico | $1,484 |

| Travelers | $1,325 |

| Mercury Insurance | $1,648 |

In conclusion, picking the right insurance policy as a first-time driver is about looking at costs, coverage options, and discounts. By exploring these, you can get a solid insurance plan made just for new drivers.

High-Quality Car Coverage for Young Adults

Young adults need good car insurance. It protects them from unexpected events and keeps their finances safe in accidents. Comprehensive insurance adds extra safety, covering many possible incidents.

The Importance of Comprehensive Coverage

Comprehensive coverage is key for young drivers. It guards against theft, vandalism, and natural disasters. With full coverage costs rising, especially for the young, it helps save money.

Liability vs. Full Coverage Explained

It’s important for young drivers to know the difference between liability and full coverage. Liability insurance covers damages to others in an accident. Full coverage includes liability and comprehensive, covering your own vehicle too. For young drivers, choosing the right coverage can save money while still offering good protection.

Top Insurance Options for Young Drivers

Finding the right auto insurance for young drivers can be tough. There are many providers with different options. I suggest looking at the top ones like State Farm, Geico, Nationwide, Travelers, and Progressive. They are known for good prices and service.

Comparing the monthly costs and ratings shows big differences. Here’s a quick look:

| Insurance Provider | Monthly Premium | Rating (out of 5) |

|---|---|---|

| GEICO | $137 | 4.65 |

| Erie | $150 | 4.75 |

| State Farm | $172 | 4.90 |

| American Family | $183 | 4.98 |

| Progressive | $285 | 4.73 |

Auto-Owners is the cheapest, with an annual cost of $3,842. But it’s only in 26 states. Adding a young driver to a parent’s policy can save a lot of money.

Looking at costs and coverage is key. State Farm gives discounts for good grades, up to 25%. A clean driving record and higher deductibles can also save money.

In short, checking out these top insurance companies helps young drivers choose wisely. By looking at both prices and coverage, they can find the right insurance for them.

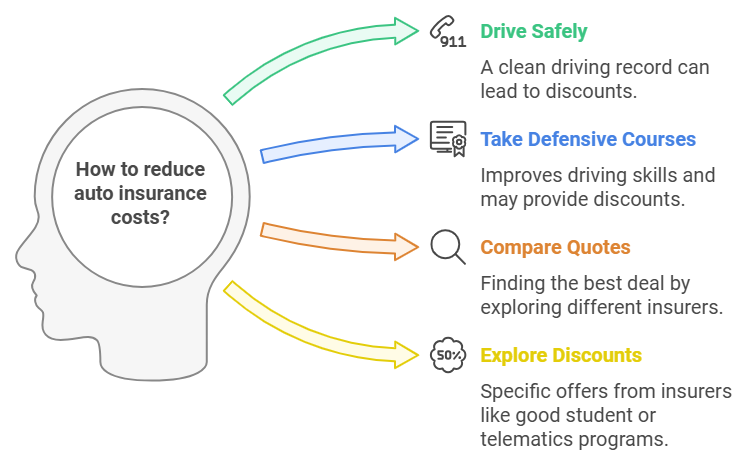

How to Reduce Car Insurance Premiums Under 25

Getting cheap auto insurance under 25 can seem tough. But, there are ways to lower your premiums. One key is to drive well. A clean driving record can get you discounts.

Also, taking defensive driving courses helps. These courses improve your driving and might get you discounts. Check with your insurer to see what’s available.

Don’t forget to shop around. Getting quotes from different companies lets you compare prices. Companies like Geico and Nationwide offer discounts for good grades and driving records. Progressive even rewards safe driving with telematics programs. This research can save you a lot of money.

Here’s a brief overview of how various companies support young drivers in finding ways to cut insurance costs:

| Insurance Provider | Discounts Available | Additional Notes |

|---|---|---|

| Auto-Owners | Discounts for teen drivers | Available in 26 states |

| Geico | Good student, away-at-school | Discounts for driver’s training |

| Nationwide | Good student, distant student | Educational programs available |

| Progressive | Telematics program (Snapshot) | Monitors driving habits |

| State Farm | Steer Clear program | On-the-road training and mentoring |

Using these tips can really cut down your costs. It makes owning a car more affordable. Knowing your options helps you manage your insurance better.

Insider Tips for Navigating Auto Insurance

Auto insurance can be tough to understand, especially for young drivers. I’ve gathered insider tips to help you make smart choices. Knowing how to shop for quotes and use online resources can save you money.

Shopping Around for Quotes

Getting competitive rates starts with shopping for quotes from different insurers. Compare the premium, deductibles, and coverage options. Your driving record, age, and vehicle type affect the quotes.

By getting multiple quotes, you can find the best deal. This way, you get great coverage at a good price.

- Reports show combining property and vehicle insurance can save 5% to 15%.

- Raising your deductible can cut your premium by 5% to 10%.

- Multi-vehicle policies can save 10% to 20% if you insure more cars with the same company.

- Drivers in usage-based programs might get discounts up to 25%.

- Paying annually instead of monthly can lower costs.

Utilizing Online Resources for Savings

Online tools are key for young drivers to understand their options. Use comparison tools and calculators to see different scenarios. These tools save time and help you find the best quotes.

Also, keep your driving record and credit score clean. This makes you more attractive to insurers and can get you discounts.

Remember to track renewal reminders from your insurer. These reminders come six weeks before your policy ends. This gives you time to compare rates and find the best deal.

| Insurance Company | JD Power Rating | AM Best Rating |

|---|---|---|

| Erie Insurance | 893 | A+ |

| USAA | 871 | A++ |

| Nationwide | 794 | A+ |

| GEICO | 824 | A++ |

| State Farm | 817 | A++ |

Conclusion

Auto insurance for young drivers can be tricky. But knowing your options is key. This article has covered the main insurance choices for drivers under 25. It also talked about the important coverage types you need to know.

The cost of insuring a young driver can be very high, often over $5,000. It’s important to look for discounts and compare policies. I suggest you think about what you really need and what you can afford.

Young drivers should take control of their insurance. Being informed and proactive helps you find the best rates. This makes driving more affordable and secure.